41 rental property expenses worksheet

Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Topic No. 414 Rental Income and Expenses | Internal Revenue ... Oct 04, 2022 · If you don't use the rental property as a home and you're renting to make a profit, your deductible rental expenses can be more than your gross rental income, subject to certain limits. For information on these limitations, refer to Publication 925, Passive Activity and At-Risk Rules and Topic No. 425. Net Investment Income Tax

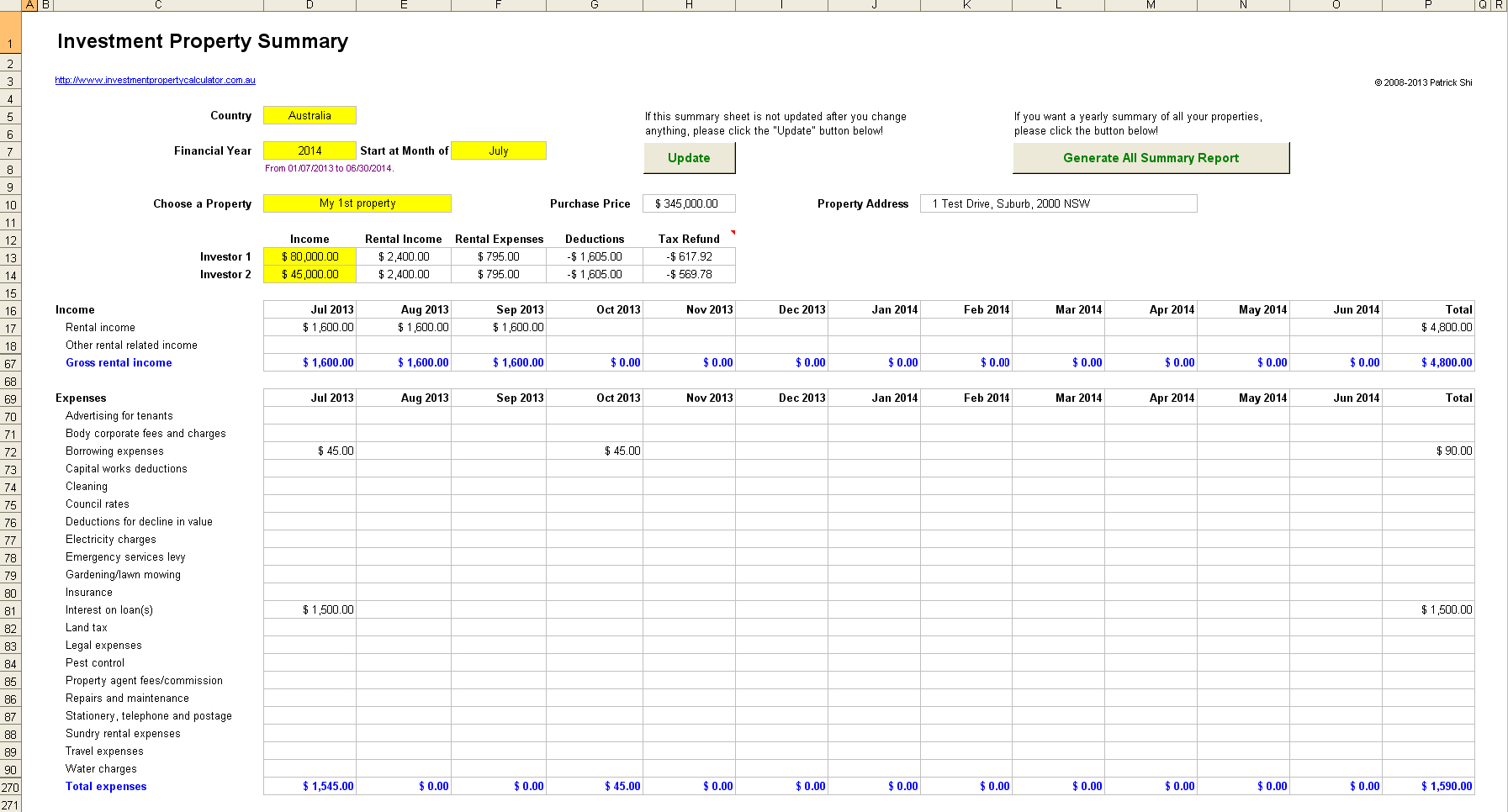

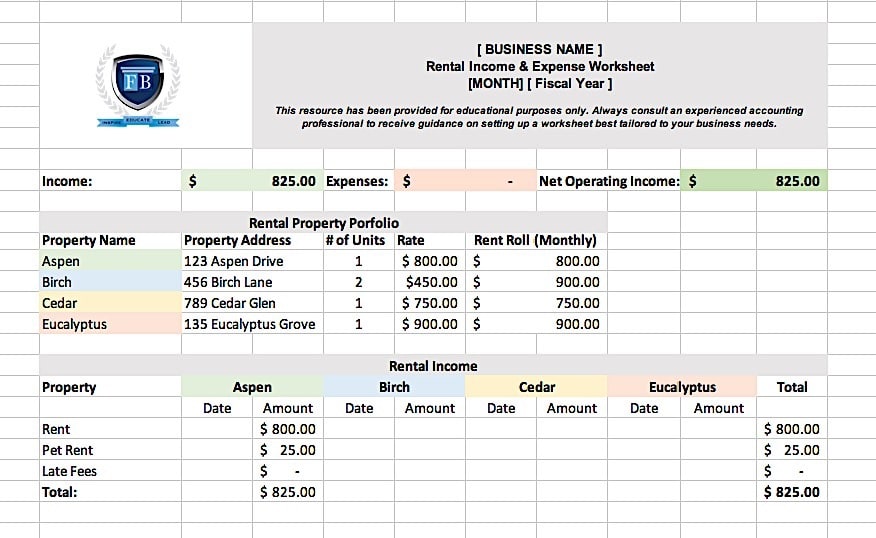

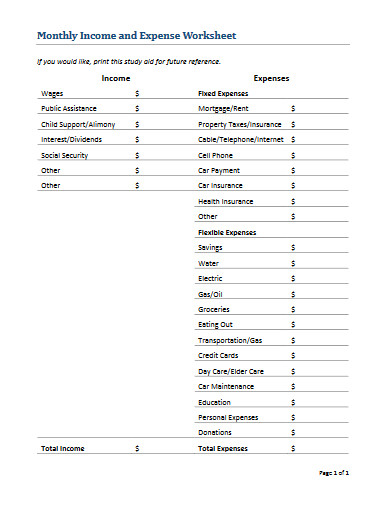

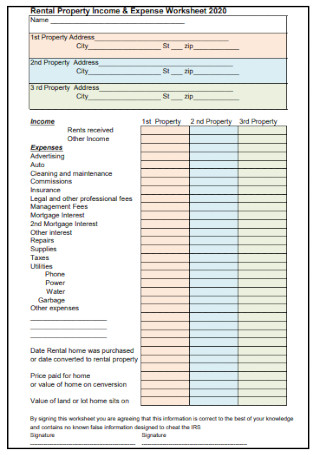

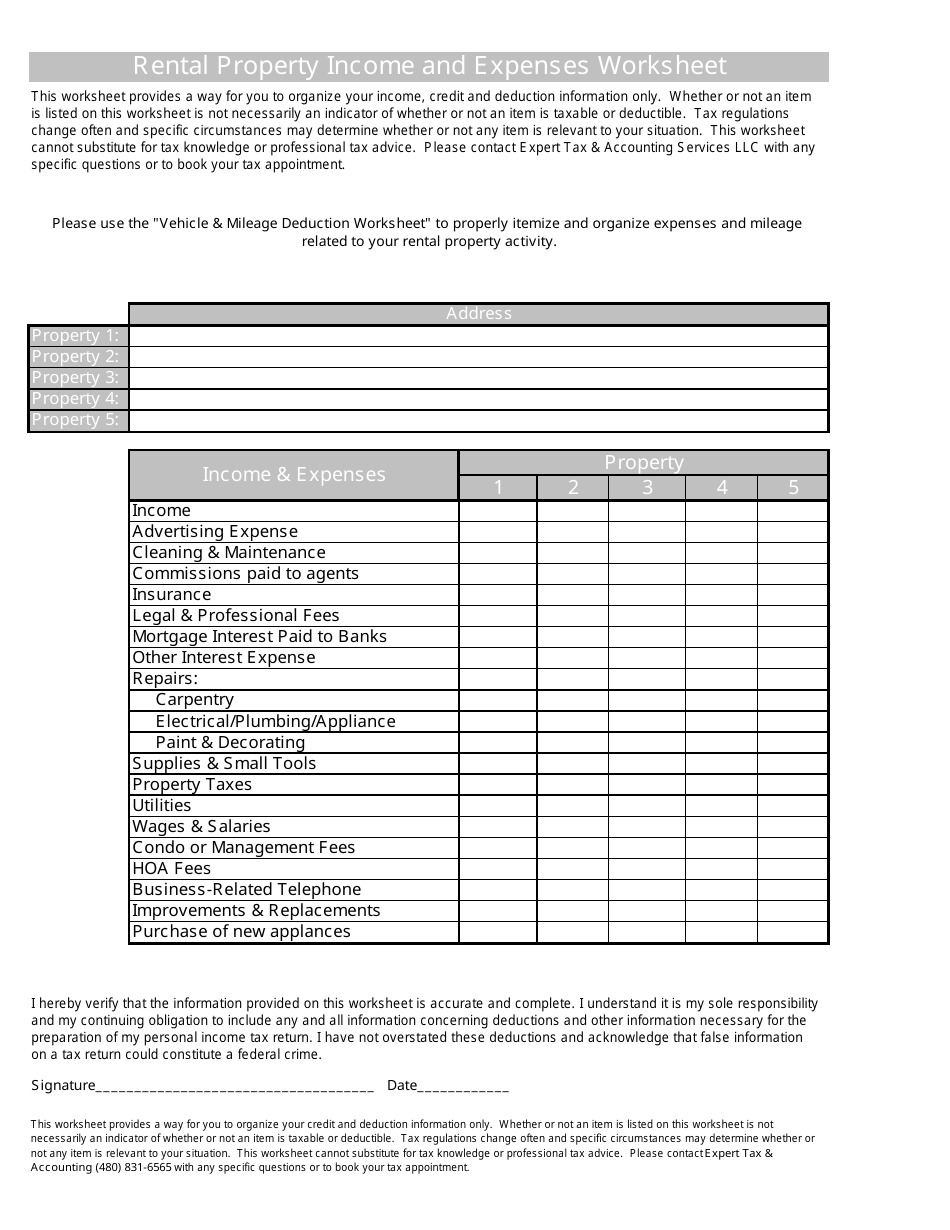

Rental Income and Expense Worksheet - PropertyManagement.com 1 Income and expenses are an essential part of effectively managing your rental. 2 Personalize your expenses with this worksheet. 3 Totals are automatically calculated as you enter data. 4 This sheet will also track late fees and any maintenance costs.

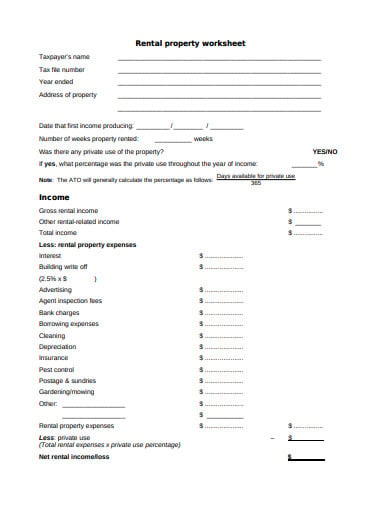

Rental property expenses worksheet

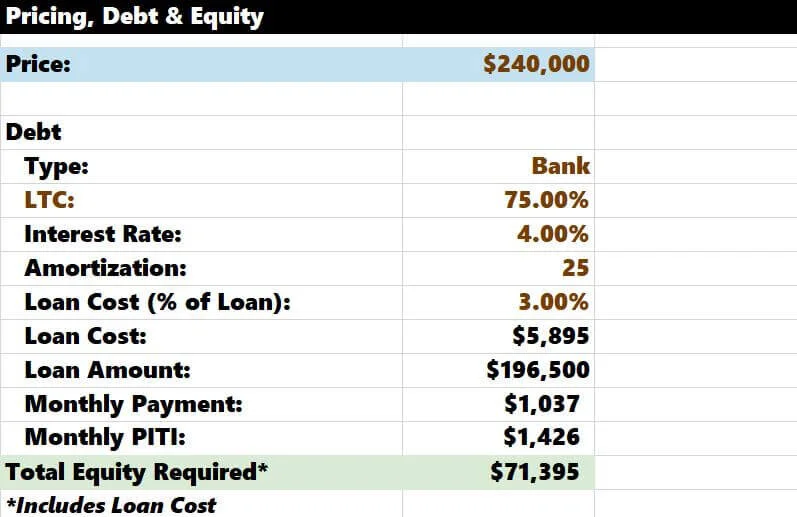

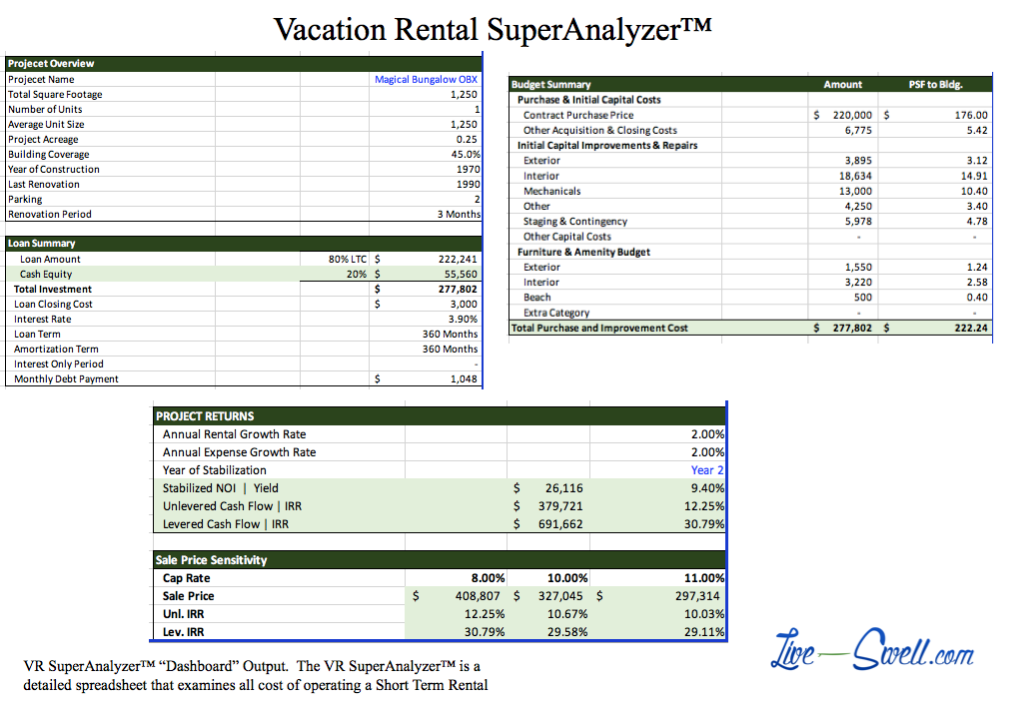

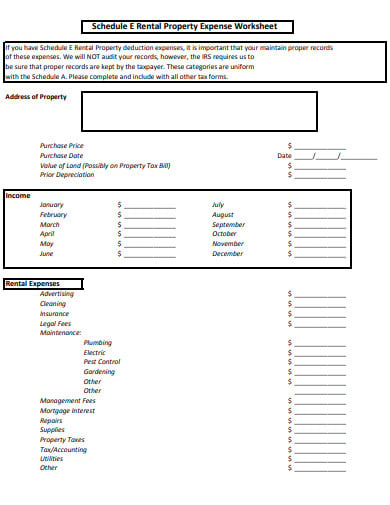

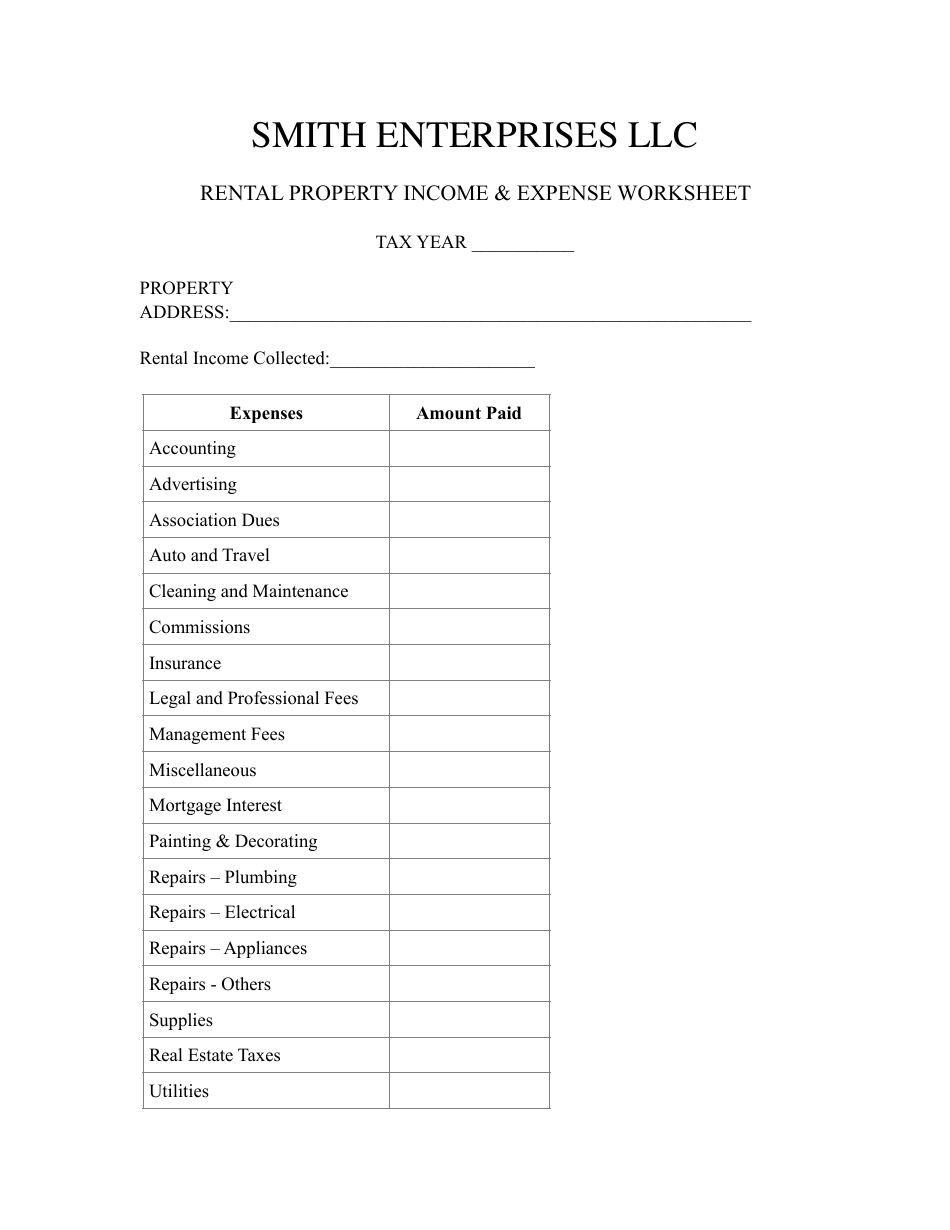

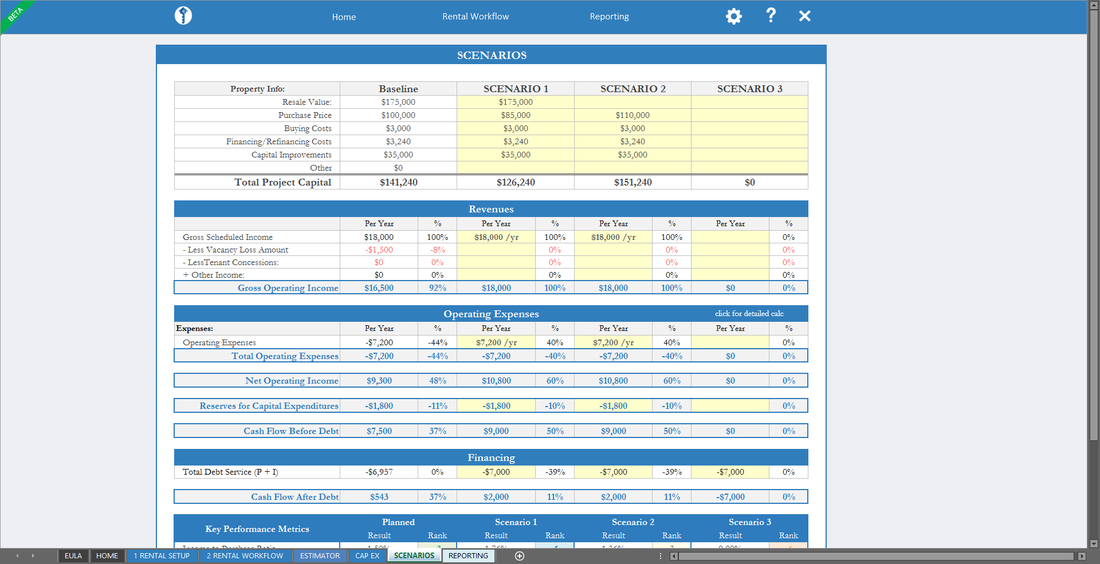

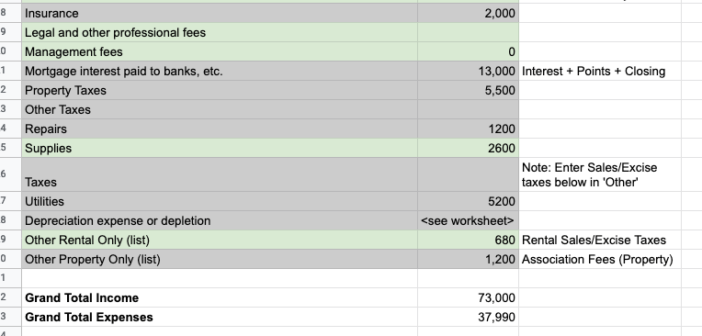

18+ Rental Property Worksheet Templates in PDF | Free ... The rental property deduction worksheet is the worksheet that only includes the particulars that are to be deducted or expenses are made on the property are included in this worksheet. The deductions made are the utility bills and the travel expenses etc and when you will to calculate all your deduction then need to take the help of the ... 5+ Free Rental Property Expenses Spreadsheets - Excel TMP Oct 08, 2019 · All expenses and income: At the last stage of the example, you can track all of your income and related property expanses. This is also done with the free rental income and expense worksheet. You should also check the home inspection checklist template. Rental Property Excel Spreadsheet Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Rental property expenses worksheet. Interest expenses - Canada.ca You can also deduct interest charges you paid to tenants on rental deposits. If you are claiming interest as a rental expense on Form T776, do not include it as a carrying charge on Form 5000-D1, Federal Worksheet (for all except non-residents). Do not deduct in full for the year any lump-sum amounts paid for interest or a fee paid to reduce ... Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. 5+ Free Rental Property Expenses Spreadsheets - Excel TMP Oct 08, 2019 · All expenses and income: At the last stage of the example, you can track all of your income and related property expanses. This is also done with the free rental income and expense worksheet. You should also check the home inspection checklist template. Rental Property Excel Spreadsheet 18+ Rental Property Worksheet Templates in PDF | Free ... The rental property deduction worksheet is the worksheet that only includes the particulars that are to be deducted or expenses are made on the property are included in this worksheet. The deductions made are the utility bills and the travel expenses etc and when you will to calculate all your deduction then need to take the help of the ...

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "41 rental property expenses worksheet"

Post a Comment