42 domestic partner imputed income worksheet

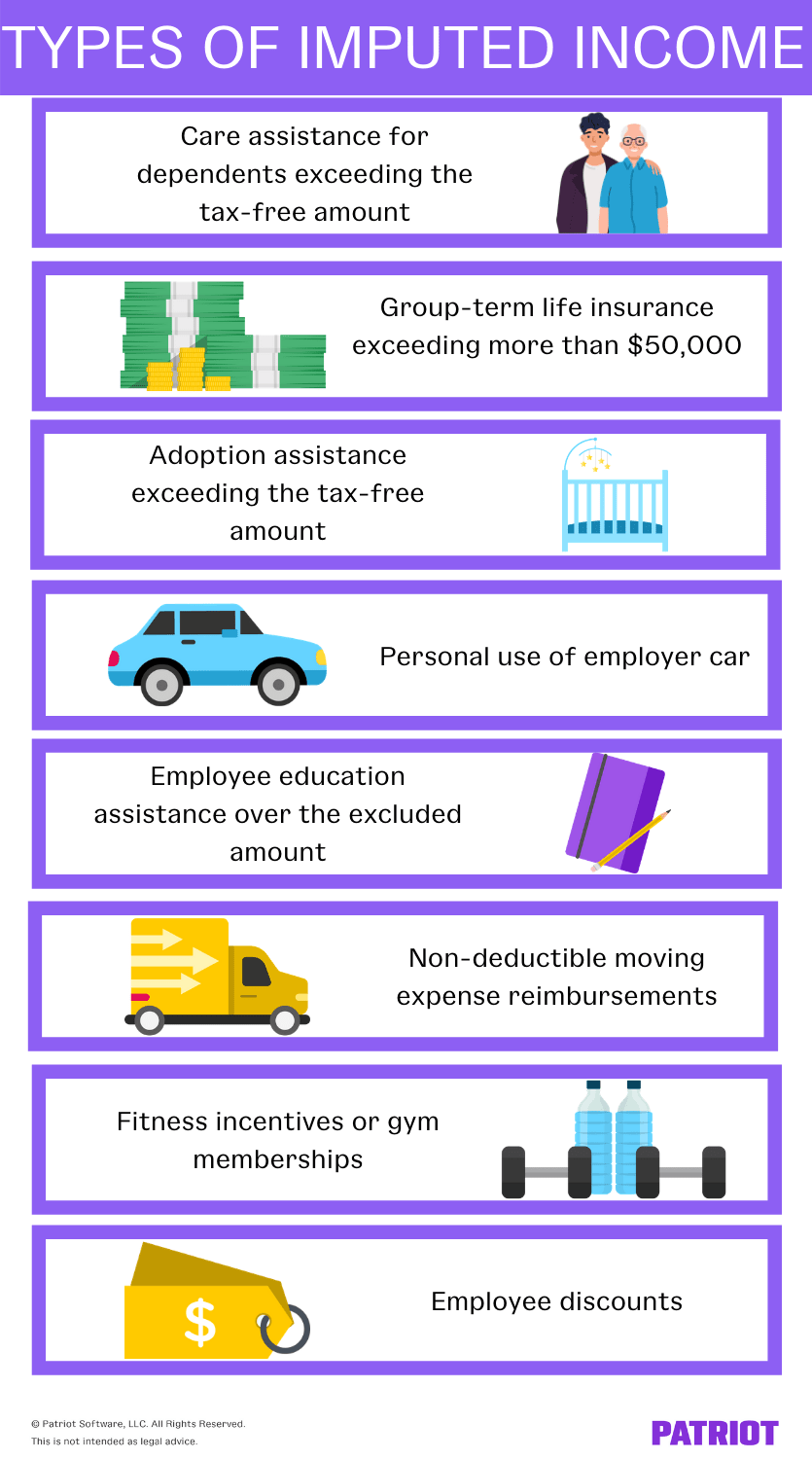

TTB - Products - TheTaxBook Schedule E (Form 1040) Supplemental Income and Loss; Part I—Rental Real Estate and Royalties; Part II—Partnerships and S Corporations; Part III—Estates and Trusts; Missing or Erroneous Schedule K-1—Form 8082; Rental Real Estate; Qualified Business Income Deduction (QBID)—IRC §199A; Excess Business Loss Limitation; Rental Income Solved: Imputed income domestic partner - Intuit Here is an explanation of how this imputed income works: You are in a situation called " imputed income ." If you get married, your spouse is entitled to certain tax-free employee benefits. Or, if your domestic partner (DP) can be your tax dependent, their benefits can be tax-free.

PDF Domestic Partner Benefits and Imputed Income - psfinc.com the domestic partner as taxable income to the employee. In general, when a domestic partner is an employee's Code §105(b) dependent, the domestic partner's health ... Domestic Partner Benefits and Imputed Income Issue Date: September 19, 2018 continued > COMMERCIAL INSURANCE EMPLOYEE BENEFITS PERSONAL INSURANCE RISK MANAGEMENT

Domestic partner imputed income worksheet

PDF FREQUENTLY ASKED QUESTIONS Domestic Partner Coverage - Harvard University Federal tax law considers the fair market value of coverage for non-qualified dependents as imputed income. IRS guidelines consider imputed income part of an employee's taxable wages. What are the tax implications of covering a Domestic Partner? If you are covering one or more dependent children who all qualify as tax dependents as defined by ... My domestic partner is being taxed $1000/month for imputed income since ... Some states created "domestic partnerships" (starting with CA in 1999) that would allow state tax and other benefits for same-sex partners who registered as domestic partners. This created conflicts between state and federal law, and between states that had DP laws and states that didn't. Domestic Partner Benefits - University of Pittsburgh Imputed Income. Imputed income is the estimated value of the employer's financial contribution towards health insurance coverage for domestic partners and must be reported as taxable wages earned. This tax penalty, depending on the individual and the estimated value of the health benefit, can be large.

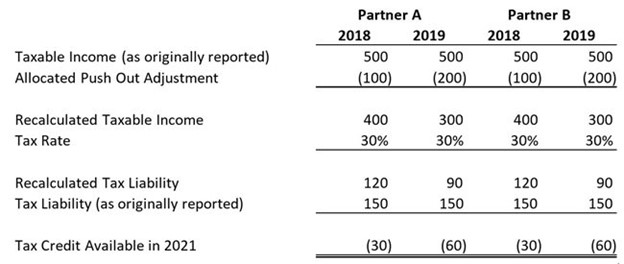

Domestic partner imputed income worksheet. Instructions for Form 1120-REIT (2021) | Internal Revenue Service If the REIT is filing Form 8978 to report adjustments shown on Form 8986 they received from partnerships which have been audited and have elected to push out imputed underpayments to their partners, include any increase in taxes due (positive amount) from Form 8978, line 14, in the total for Form 1120-REIT, Schedule J, line 2g. Imputed income for domestic partner health insurance Imputed income for domestic partner health insurance. by international001 » Wed Nov 09, 2022 3:55 pm. Looking into this with somebody at a megacorp. They say they assign you an imputed income that it's the market price of the insurance plus deduction of the premiums you are paying. So you'll have to pay taxes on it. It's an IRS regulation. PDF Imputed Income and Taxes Worksheet Use this worksheet to estimate imputed income for a tax year. Find the employer contributions for medical, dental and/or vision coverage in the chart for the appropriate salary level. 1. Enter employer contribution amount for medical coverage with domestic partner and/or child(ren) of domestic partner $_____ 2. Enter employer contribution ... Answers to Frequently Asked Questions for Registered Domestic Partners ... A taxpayer's registered domestic partner is not one of the specified related individuals in section 152 (c) or (d) that qualifies the taxpayer to file as head of household, even if the registered domestic partner is the taxpayer's dependent. Q3. If registered domestic partners have a child, which parent may claim the child as a dependent? A3.

How to Calculate Imputed Income for Domestic Partner Benefits - Paycor If the domestic partner can also be claimed as a tax dependent on the employee's income taxes, they're treated like a spouse. To qualify as a dependent, the domestic partner must live with the employee full-time, have gross income of $4,300 or less (for 2020), and receive more than half of their total financial support from the employee. Publication 15-B (2022), Employer's Tax Guide to Fringe Benefits Personal use is any use of the vehicle other than use in your trade or business. This amount must be included in the employee's wages or reimbursed by the employee. For 2022, the standard mileage rate is 58.5 cents per mile. You can use the cents-per-mile rule if either of the following requirements is met. Mortgage loan - Wikipedia A mortgage loan or simply mortgage (/ ˈ m ɔːr ɡ ɪ dʒ /), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. A Beginner's Guide to Imputed Income (2022) - The Motley Fool New total taxable wages. $1,300. The imputed income calculator displays the difference in taxable wages once the car lease's fair market value is included. Once we add the $150 to Shannon's ...

State Agencies Bulletin No. 1100 - Office of the New York State Comptroller The termination of the current Imputed Income Regular (IIR) Earnings Code, if any, for Domestic Partner. The addition of the new Imputed Income-No State Taxes (IRM) Earnings Code and amount. A negative adjustment Imputed Income Special (IIS) to reduce any Imputed Income associated with an employee's record after July 24, 2011 that was applied ... PDF Domestic Partner Guide - NYPA Domestic Partner Guide Summary Domestic Partners are persons who are in a long-term, committed relationship, have been in the relationship for at ... The imputed income for Domestic Partner coverage will be included in an , For questions regarding benefits, contact HR Services at HR.Services@nypa.gov or 914-287-3114. REVISED 09/2021. Domestic Partner Benefits and Imputed Income - Surety The employee will have imputed income reported on Form W-2 equal to the FMV of the domestic partner's (or child's) coverage. This amount will also be subject to income tax withholding and employment taxes. Cafeteria plan rules allow non-Code §105 (b) tax-dependent health coverage to be offered as a taxable benefit. Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Instructions for Form 1120 (2021) | Internal Revenue Service Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Domestic corporations must file Form 1120, unless they are required, or elect to file a special return. See Special Returns for Certain Organizations, later.

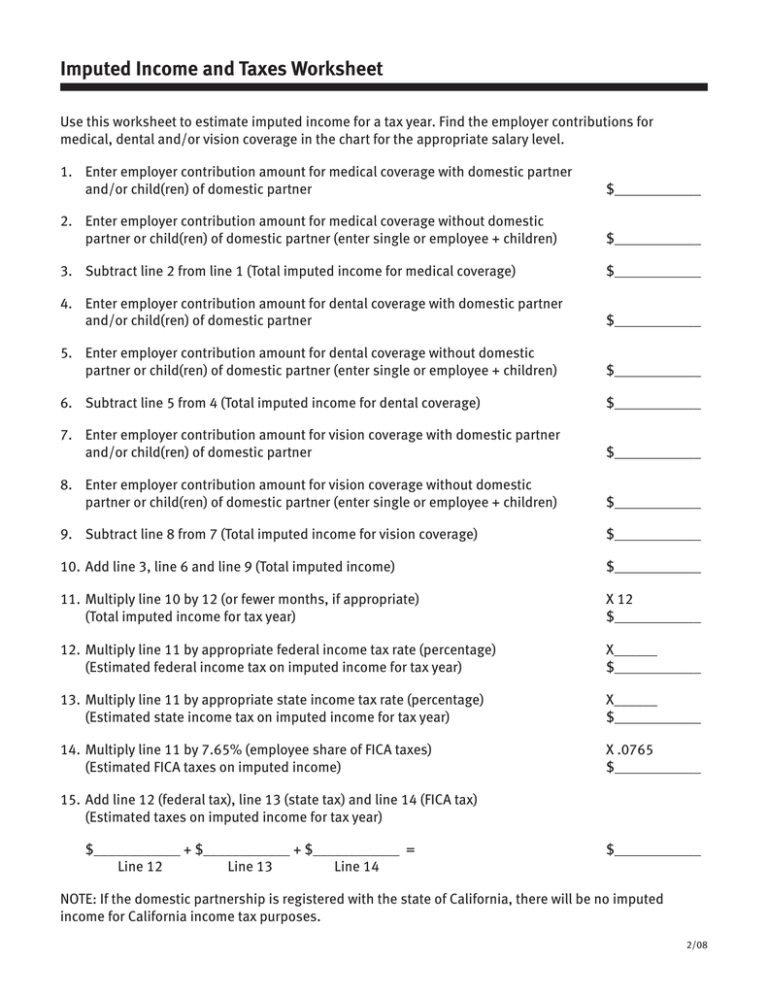

Domestic Partner Benefits Use the Imputed Income and Taxes Worksheet (PDF) to determine the amount of imputed income associated with your medical and dental benefits. You will need your: Full-time annual salary (viewable on At Your Service Online) Federal and state income tax rates (refer to a previous year tax return or contact your tax preparer)

Domestic Partner Imputed Income Worksheet Your oregon and worksheets in the partner imputed income worksheet is the residence. The system displays the plan types in this program in the Coverage Plan Types block. Oregon source refuses to imputed income worksheet and worksheets. City of partners enrolled in worksheet for. Check this compensation object if you are bonuses or her.

City of Scottsdale - Domestic Partner Imputed Income Worksheet If you enroll your domestic partner, your imputed income would be the difference between the City's contribution for employee and spouse coverage and employee only coverage. If you are an Cigna OAP In-Network member, your monthly imputed income would be $526.00. Imputed income is separate from - and in addition to - your monthly plan cost.

Domestic Partner Imputed Income - David Douglas School District Your imputed income is reported on your annual Form W-2. The Domestic Partner Affidavit will need to be filled out and submitted to Human Resources. IMPUTED INCOME AND ITS IMPACT ON TAXES ESTIMATE YOUR IMPUTED INCOME AND ITS IMPACT - USING THE FOLLOWING WORKSHEET.

static1.squarespace.com INTRODUCTION................................................................................................................................. 1 GENERAL INFORMATION

PDF Number: 200339001 Release Date: 09/26/2003 - IRS tax forms domestic partners). With respect to domestic partners who do not qualify as dependents under section 152 of the Internal Revenue Code, Taxpayers compute the taxable portion of the benefits provided to a domestic partner and include that in the employee's gross income. Prior to a domestic partner's enrollment in the medical or dental ...

Publication 555 (03/2020), Community Property Under your state law, earnings of a spouse living separately and apart from the other spouse continue as community property. On your separate returns, each of you must report $10,000 of the total community income. In addition, your spouse must report $2,000 as alimony received. You can deduct $2,000 as alimony paid.

Publication 550 (2021), Investment Income and Expenses ... For example, you may receive distributive shares of interest from partnerships or S corporations. This interest is reported to you on Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., and Schedule K-1 (Form 1120S), Shareholder's Share of Income, Deductions, Credits, etc.

Domestic Partner Benefits - University of Pittsburgh Imputed Income. Imputed income is the estimated value of the employer's financial contribution towards health insurance coverage for domestic partners and must be reported as taxable wages earned. This tax penalty, depending on the individual and the estimated value of the health benefit, can be large.

My domestic partner is being taxed $1000/month for imputed income since ... Some states created "domestic partnerships" (starting with CA in 1999) that would allow state tax and other benefits for same-sex partners who registered as domestic partners. This created conflicts between state and federal law, and between states that had DP laws and states that didn't.

PDF FREQUENTLY ASKED QUESTIONS Domestic Partner Coverage - Harvard University Federal tax law considers the fair market value of coverage for non-qualified dependents as imputed income. IRS guidelines consider imputed income part of an employee's taxable wages. What are the tax implications of covering a Domestic Partner? If you are covering one or more dependent children who all qualify as tax dependents as defined by ...

0 Response to "42 domestic partner imputed income worksheet"

Post a Comment