44 1120s other deductions worksheet

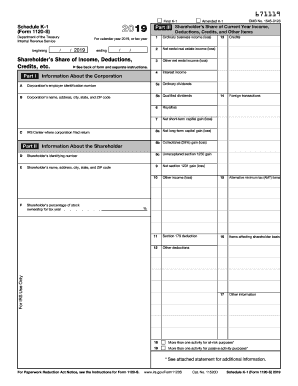

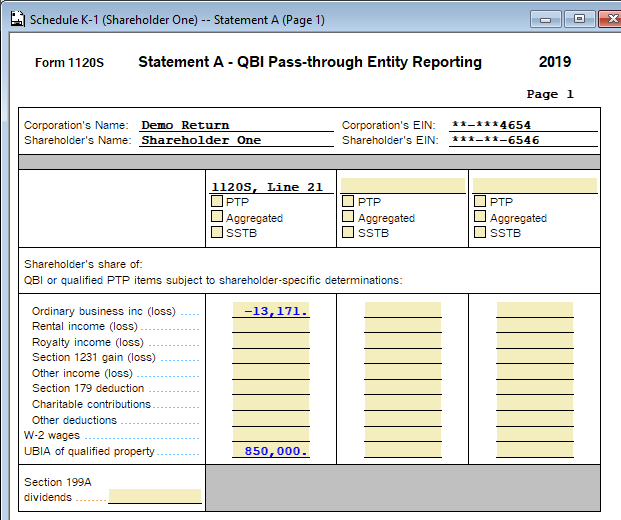

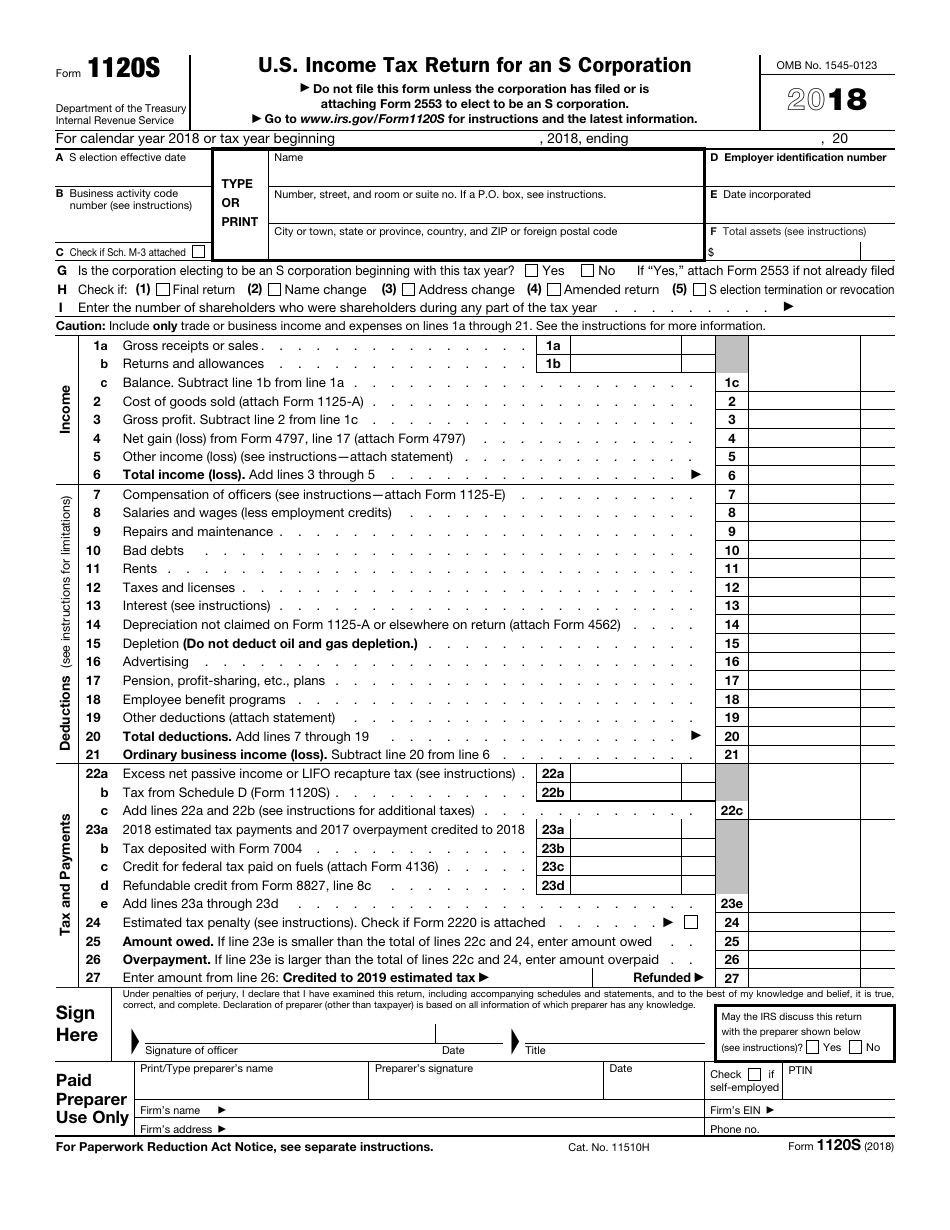

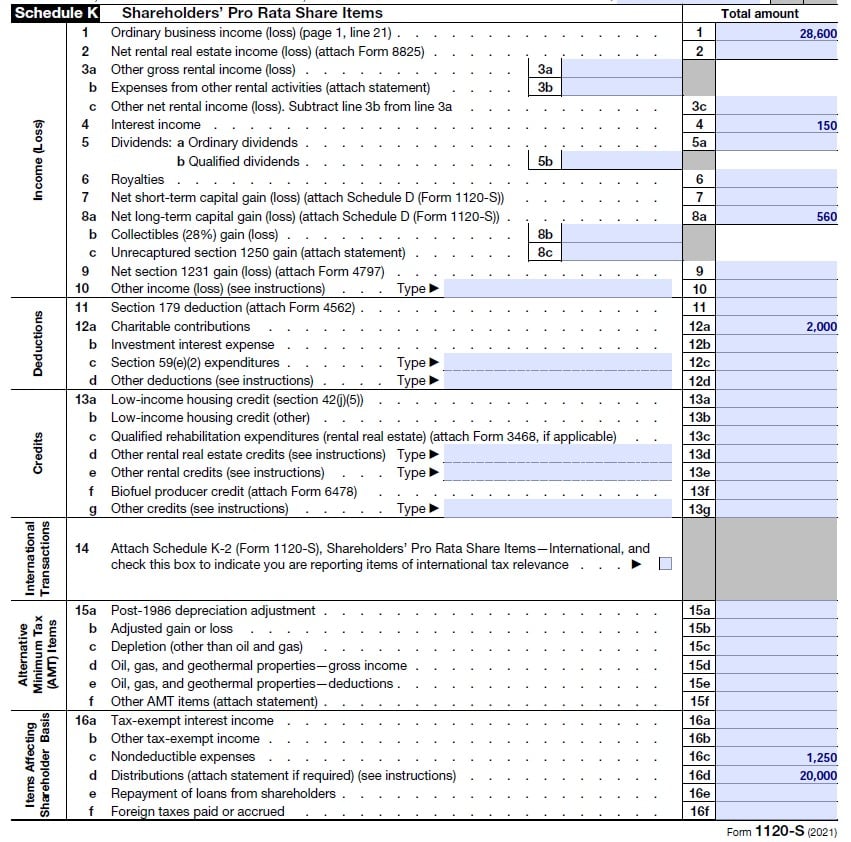

Schedule K-1 (Form 1120S) - Deductions – Support WebThe amount entered will flow to Form 8582, Worksheet 3 where, based on other passive items affecting the taxpayer, it will determine if any amount will be allowed on Schedule E (Form 1040), line 28, column (f). Any remaining deductions above the $10,000 ($5,000 if married filing separately) for each qualified timber property can be amortized. See: Publication 525 (2021), Taxable and Nontaxable Income WebContributions, other than employer contributions, are deductible on your return whether or not you itemize deductions. Contributions made by your employer aren’t included in your income. Distributions from your HSA that are used to pay qualified medical expenses aren’t included in your income. Distributions not used for qualified medical expenses are …

Schedule K-1 (Form 1120S) - Income (Loss) Items – Support WebIf the income (loss) is entered as Passive Income/Loss, it will carry to Worksheet 3 of Form 8582 – Passive Activity Loss Limitations where any losses may be limited and any income may be offset by other passive losses that the taxpayer has. If the loss is allowed, it will then flow through to Schedule E (Form 1040).

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

1120s other deductions worksheet

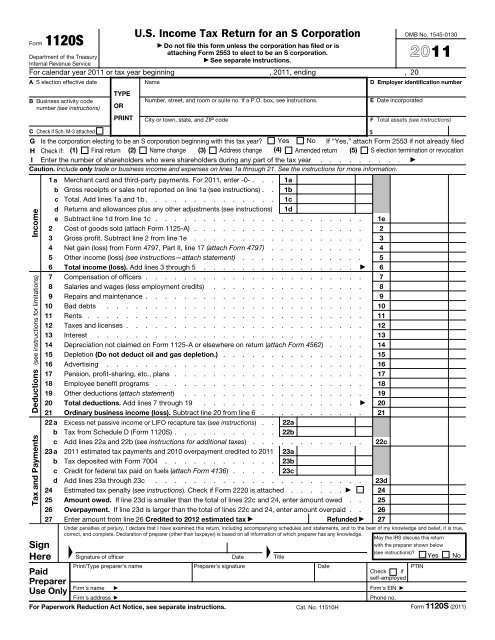

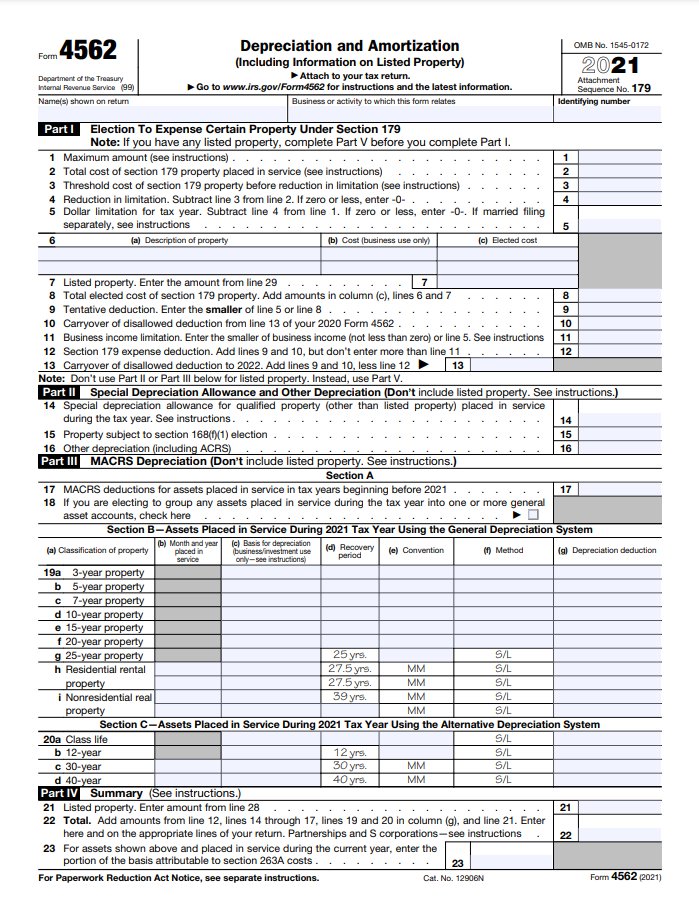

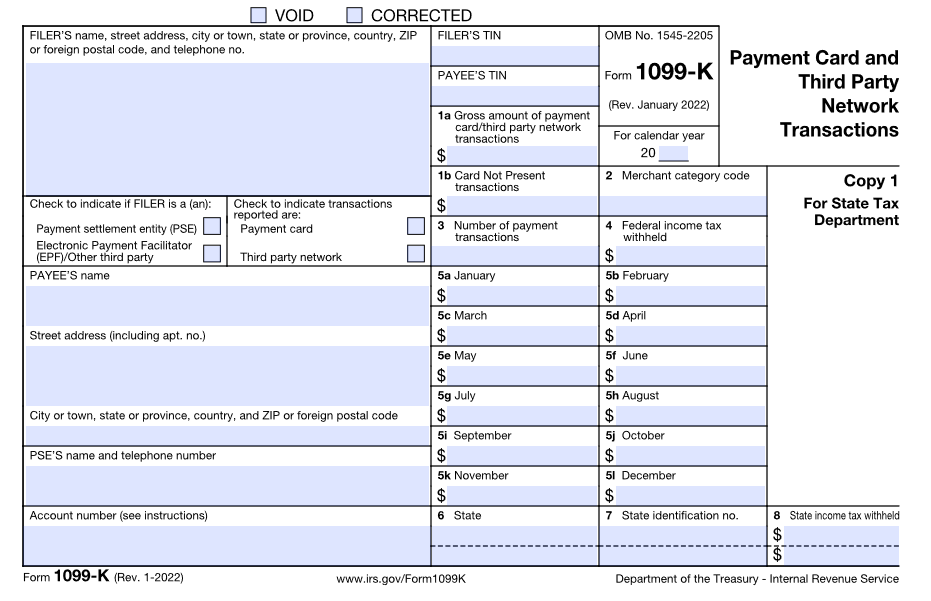

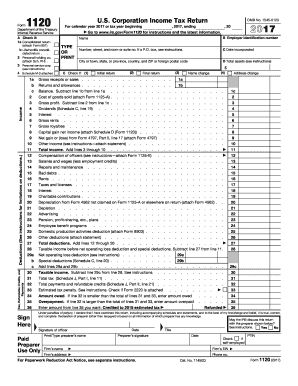

Tax Support: Answers to Tax Questions | TurboTax® US Support WebThe TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Open TurboTax; Sign In. Why sign in to Support? Get personalized help; Join the Community ; Sign in to Support or Sign in to TurboTax and start working on your taxes . Discuss; Discover. Community Basics; Connect with Others; Top … Instructions for Form 1120 (2021) | Internal Revenue Service WebUse Form 1120-W, Estimated Tax for Corporations, as a worksheet to compute estimated tax. See the Instructions for Form 1120-W. Penalties may apply if the corporation does not make required estimated tax payment deposits. See Estimated tax penalty below. If the corporation overpaid estimated tax, it may be able to get a quick refund by filing Form … Schedule K-1 (Form 1120S) - Other Information – Support WebThe K-1 1120S Edit Screen. has two distinct sections entitled ‘Heading Information’ and ‘Income, Deductions, Credits, and Other Items.’ The K-1 1120S Edit Screen in TaxSlayer Pro has an entry for each box on found on the Schedule K-1 (Form 1120S) that the taxpayer received. A description of each of the Other Information Items contained ...

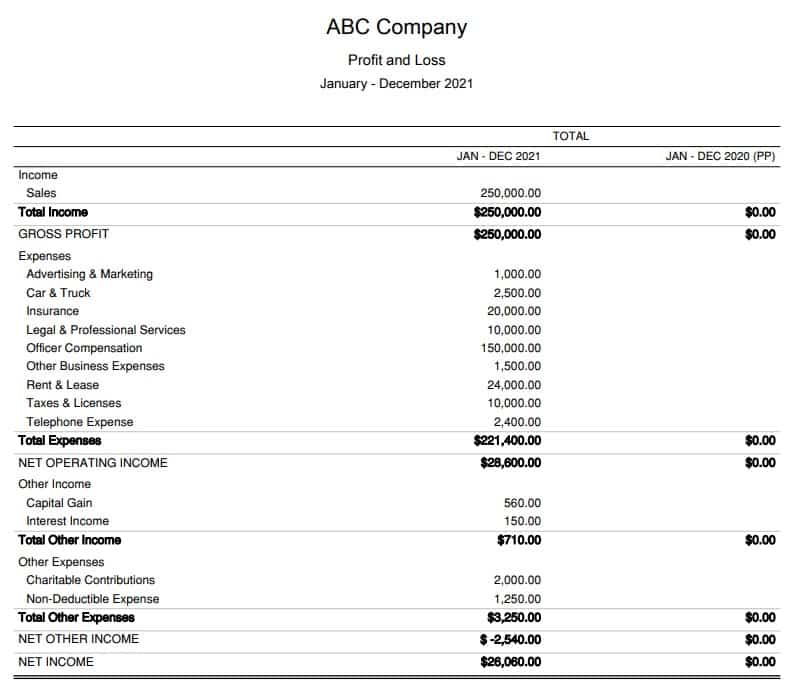

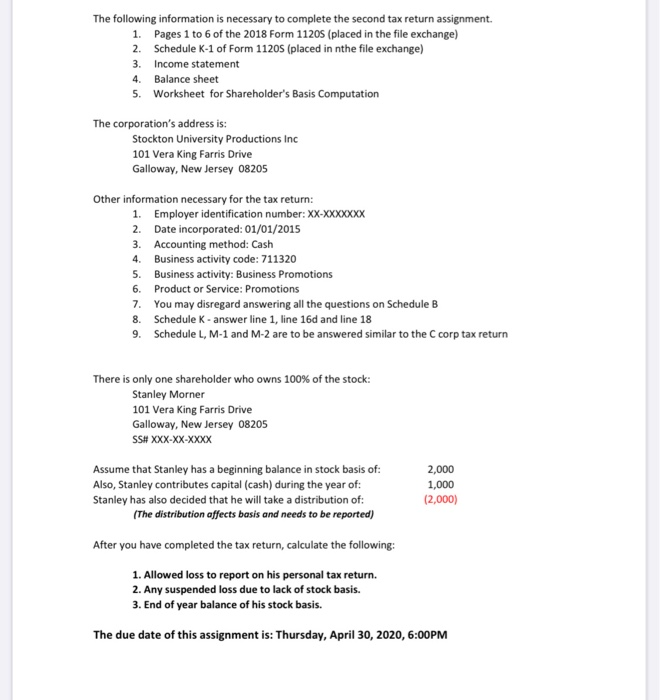

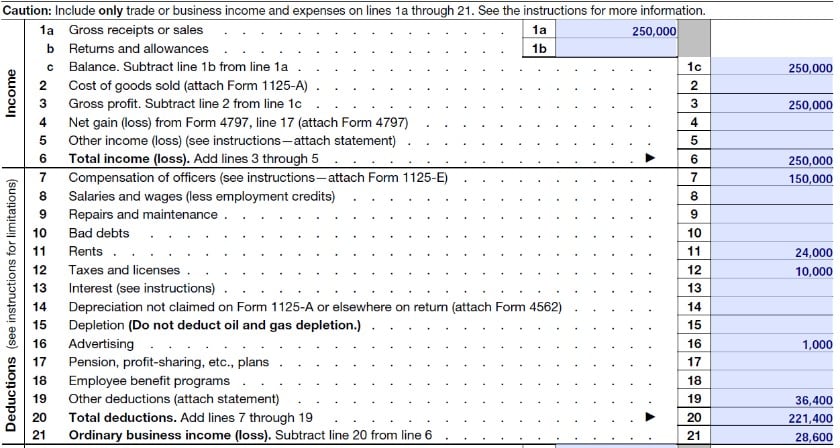

1120s other deductions worksheet. TurboTax® Premier CD/Download 2022-2023 Tax Software for ... Nov 20, 2022 · TurboTax Premier CD/Download software makes tax filing easy. It calculates investment & rental property tax deductions to maximize your tax refund. Get guidance and support with employee stock plans, rental properties, and investment info with TurboTax Premier Download. STATE OF SOUTH CAROLINA SC 1120S S CORPORATION INCOME TAX RETURN Other deductions F Amounts Allocated or Apportioned to SC E Amounts Not Allocated or Apportioned to SC D Federal Schedule K Amounts After SC Adjustments C Plus or Minus South Carolina Adjustments B Amounts From Federal Schedule K A Description Ordinary business income (loss) Dividends 1 Net rental real estate income (loss) Other net rental Shareholder's Instructions for Schedule K-1 - IRS tax forms Shareholder's Share of Current Year Income, Deductions, Credits, and Other Items. The amounts shown in boxes 1 through 17 reflect your share of income, loss, deductions, credits, and other items, from corporate business or rental activities without reference to limitations on losses, credits, or other items that may have to be adjusted because of: 1120S - Shareholders Adjusted Basis Worksheet (Basis Wks) (K1) WebThis article refers to screen Shareholder's Adjusted Basis Worksheet, in the 1120-S (S corporation) package. The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen.. Basis is tracked at both the 1120-S level and the 1040 level, however, the worksheets are not always the same between the 1120-S and 1040 returns.

Customer Support Site Form Status WebK-1 (1065) Partner's Share of Income, Deductions : Draft : Final Pending from Tax Agency : Sch K1 (1120S) K-1 Shareholder's Share of Income, Deductions, Cr. Draft : Final Pending from Tax Agency : Sch K1 (8865) K-1 Partner's Share of Income, Deductions, Credits : Not Available : 2/2/2023 : Sch K2 (1065) Partners' Distributive Share Items ... Publication 550 (2021), Investment Income and Expenses WebInterest, dividends, and other investment income you receive as a beneficiary of an estate or trust generally is taxable income. You should receive a Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions, Credits, etc., from the fiduciary. Your copy of Schedule K-1 (Form 1041) and its instructions will tell you where to report the ... Schedule K-1 (Form 1120S) - Other Information – Support WebThe K-1 1120S Edit Screen. has two distinct sections entitled ‘Heading Information’ and ‘Income, Deductions, Credits, and Other Items.’ The K-1 1120S Edit Screen in TaxSlayer Pro has an entry for each box on found on the Schedule K-1 (Form 1120S) that the taxpayer received. A description of each of the Other Information Items contained ... Instructions for Form 1120 (2021) | Internal Revenue Service WebUse Form 1120-W, Estimated Tax for Corporations, as a worksheet to compute estimated tax. See the Instructions for Form 1120-W. Penalties may apply if the corporation does not make required estimated tax payment deposits. See Estimated tax penalty below. If the corporation overpaid estimated tax, it may be able to get a quick refund by filing Form …

Tax Support: Answers to Tax Questions | TurboTax® US Support WebThe TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Open TurboTax; Sign In. Why sign in to Support? Get personalized help; Join the Community ; Sign in to Support or Sign in to TurboTax and start working on your taxes . Discuss; Discover. Community Basics; Connect with Others; Top …

0 Response to "44 1120s other deductions worksheet"

Post a Comment