45 pastor's housing allowance worksheet

U.S. appeals court says CFPB funding is unconstitutional - Protocol Web20.10.2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is … American Family News Web02.08.2022 · American Family News (formerly One News Now) offers news on current events from an evangelical Christian perspective. Our experienced journalists want to glorify God in what we do.

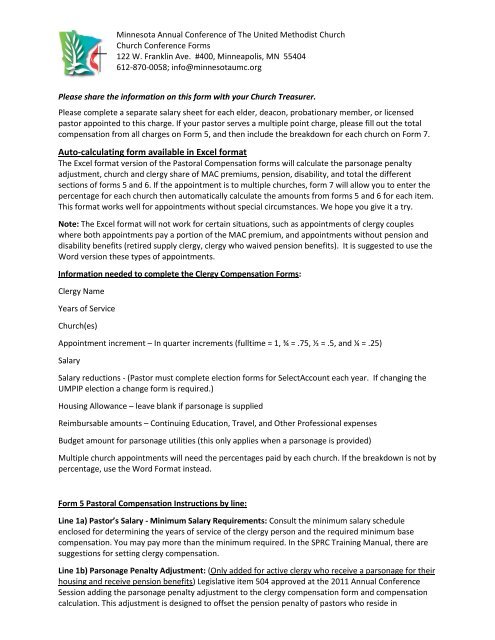

WebCash Housing Allowance Cash Salary Pastor's Continuing Education Pastor's Annual Conference Expense Pastor's Other Vouchered Travel & Expense Cash Housing Allowance or 2023 CLERGY COMPENSATION PACKAGE SSN (last four digits) DOES PASTOR LIVE IN THE PARSONAGE? Box 1 Box 2 Box 3 Pastor Annual Contribution: …

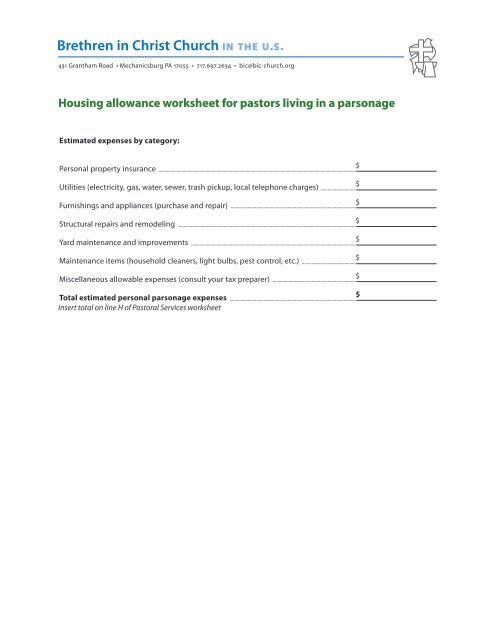

Pastor's housing allowance worksheet

› articles-tips › 2021/09/16Four Important Things to Know about Pastor’s Housing Allowance Sep 16, 2021 · The pastor’s housing allowance is one of the greatest tax benefits you will ever receive as a minister. But there are some key aspects to it that you must follow. Many miss the opportunity, and more than a few make some critical mistakes. Here are four important things that you need to know concerning the housing allowance: 1. pastorswallet.com › how-do-you-report-your-housingHow Do You Report Your Clergy Housing Allowance To The IRS? Sep 13, 2021 · The housing allowance is exempt from income and should therefore not be reported here. If it is, the IRS will think you owe more in taxes and you will have a mess on your hands. If your church accidentally includes your housing allowance in Box 1, have them correct the mistake right away by filing an amended Form W-2. Boxes 3, 4, 5, and 6 static1.squarespace.com › static › 5d38c95dfaastatic1.squarespace.com Housing Allowance P1 Church Contribution to Pastor's Compensation P1, Line 1 Equitable Compensation Cash Allowances - Total of Lines 4-9 Below Cash - insurance premiums P2 Worksheet 1, Line A Business Exp P2, Worksheet 1, Line B Housing Exclusion Expenses P2, Worksheet 1, Line E Other P2, Worksheet 1, Lines D-E Total or Gross Cash Payment

Pastor's housing allowance worksheet. Four Important Things to Know about Pastor’s Housing Allowance Web16.09.2021 · The pastor’s housing allowance is one of the greatest tax benefits you will ever receive as a minister. But there are some key aspects to it that you must follow. Many miss the opportunity, and more than a few make some critical mistakes. Here are four important things that you need to know concerning the housing allowance: 1. The … Center Street United Methodist Church WebThe following resolutions and policies support the Pastor Compensation Form for 2020 and document allowable deductions to the pastor’s cash salary or additional compensation in the form of a housing allowance and/or an accountable reimbursement policy established by the Annual Charge/Church Conference. All of the resolutions and policies are for the … › files › tableswww.holston.org Box 1 of Clergy W-2 Form = Line 2 + Line 8b - Lines 10b, 11a, 11b, 11c, 12; Box 14 on W-2 should = Line 13 with notation "Housing" 2023 PASTOR'S SUPPORT WORKSHEET 8b. Cash Housing Allowance (if answered YES above, leave blank) One time Moving Expense (not included in appointment or benefits calculations) 10b. Contribution to UMPIP (Tax Deferred) How Do You Report Your Clergy Housing Allowance To The IRS? Web13.09.2021 · Under certain circumstances, you may be able to claim a ministerial housing allowance even during retirement. The next chapter will discuss this in detail. If you take a housing allowance during retirement, you will receive a 1099-R instead of a W-2. Your housing allowance may or may not be listed on the 1099-R. The form may just say …

Microsoft takes the gloves off as it battles Sony for its Activision ... Web12.10.2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition. › 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... Clergy Compensation Calculator | Treasurer's Office WebAll clergy serving a local church appointment must complete the Clergy Compensation Worksheet on ... Skip to primary navigation; Skip to main content; Treasurer's Office. Clergy Compensation Calculator. This calculator is intended only for the purpose of performing the mathematical functions of the 2023 Clergy Compensation Worksheet. … afn.netAmerican Family News Aug 02, 2022 · American Family News (formerly One News Now) offers news on current events from an evangelical Christian perspective. Our experienced journalists want to glorify God in what we do.

Unbanked American households hit record low numbers in 2021 Web25.10.2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ... PlayStation userbase "significantly larger" than Xbox even if every … Web12.10.2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised… › story › moneyUnbanked American households hit record low numbers in 2021 Oct 25, 2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ... static1.squarespace.com › static › 5d38c95dfaastatic1.squarespace.com Housing Allowance P1 Church Contribution to Pastor's Compensation P1, Line 1 Equitable Compensation Cash Allowances - Total of Lines 4-9 Below Cash - insurance premiums P2 Worksheet 1, Line A Business Exp P2, Worksheet 1, Line B Housing Exclusion Expenses P2, Worksheet 1, Line E Other P2, Worksheet 1, Lines D-E Total or Gross Cash Payment

pastorswallet.com › how-do-you-report-your-housingHow Do You Report Your Clergy Housing Allowance To The IRS? Sep 13, 2021 · The housing allowance is exempt from income and should therefore not be reported here. If it is, the IRS will think you owe more in taxes and you will have a mess on your hands. If your church accidentally includes your housing allowance in Box 1, have them correct the mistake right away by filing an amended Form W-2. Boxes 3, 4, 5, and 6

› articles-tips › 2021/09/16Four Important Things to Know about Pastor’s Housing Allowance Sep 16, 2021 · The pastor’s housing allowance is one of the greatest tax benefits you will ever receive as a minister. But there are some key aspects to it that you must follow. Many miss the opportunity, and more than a few make some critical mistakes. Here are four important things that you need to know concerning the housing allowance: 1.

0 Response to "45 pastor's housing allowance worksheet"

Post a Comment