38 qualified dividends and capital gain tax worksheet fillable

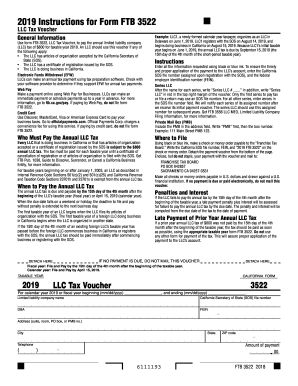

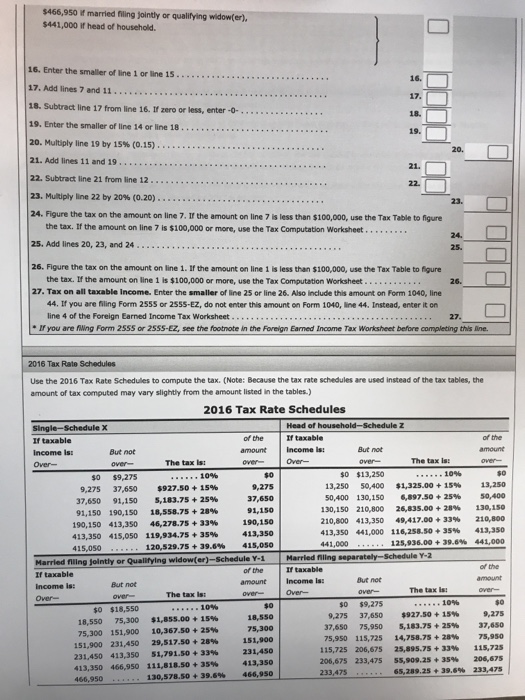

Publication 3 (2021), Armed Forces' Tax Guide Certain investment income must be $10,000 or less during the year. For most people, this investment income is taxable interest and dividends, tax-exempt interest, and capital gain net income. See Worksheet 1 in Pub. 596 for more information on the investment income includible in the amount that must meet the $10,000 limit. How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

fillable capital gain worksheet: Fill out & sign online | DocHub Edit, sign, and share qualified dividends and capital gain tax worksheet 2019 online. No need to install software, just go to DocHub, and sign up instantly and for free.

Qualified dividends and capital gain tax worksheet fillable

Qualified Dividends And Capital Gain Tax Worksheet 2021 Once you’ve finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience. Publication 334 (2021), Tax Guide for Small Business The FFCRA requirement that employers provide paid sick and family leave for reasons related to COVID-19 (the employer mandate) expired on December 31, 2020; however, the COVID-related Tax Relief Act of 2020 extends the periods for which employers providing leave that otherwise meets the requirements of the FFCRA may continue to claim tax credits for qualified sick and … Qualified Dividends Tax Worksheet PDF Form - FormsPal Step 2: You can now edit the qualified dividends and capital gains worksheet fillable 2020. You may use our multifunctional toolbar to include, erase, and adjust the text of the form. The following sections will create the PDF document that you will be filling out: Type in the requested details in the space . Step 3: Select the "Done" button.

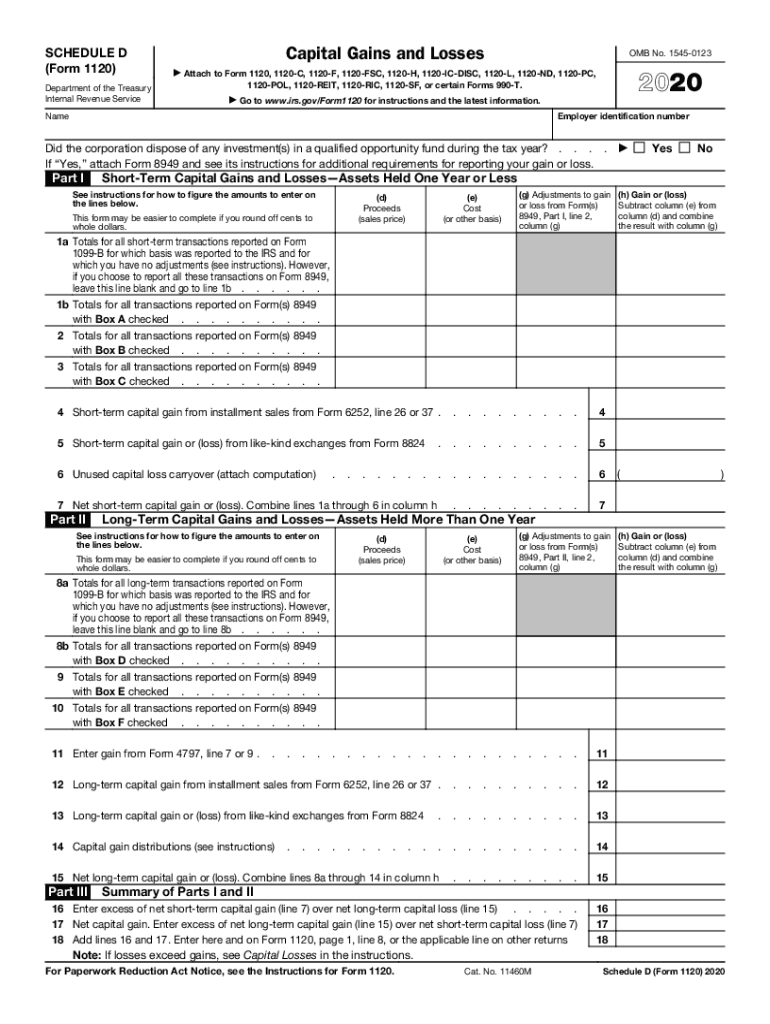

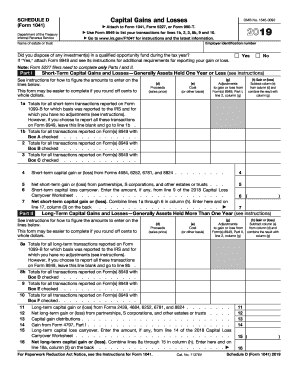

Qualified dividends and capital gain tax worksheet fillable. Publication 502 (2021), Medical and Dental Expenses 13.1.2022 · If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ... Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Fill Online, Printable, Fillable, Blank Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Form Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Yes, I am reporting qualified dividends. When I downloaded my return from Turbo Tax, Schedule D was included. The YES box was checked for line 20 which reads, "Complete Qualified Dividends and Capital Gain Tax Worksheet". Unfortunately, that worksheet was not included with my download. I would really like to have it, since I believe that is ... Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) Academic year2021/2022 Helpful? 75 Comments Please sign inor registerto post comments. Tim5 months ago 2019 - Correct Year Related Studylists ACC 330 Preview text

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2020 Qualified dividends and capital gain tax worksheet. qualified dividends and capital gain tax worksheet 2019 Fill Online from form-1040-schedule-d-instructions.com. Capital gains and losses keywords: Enter the smaller of line 25 or 26. However, if filing form 2555 (relating to foreign earned income), enter the. Source: Publication 17 (2021), Your Federal Income Tax - IRS tax forms If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return. Qualified Dividends And Capital Gain Tax Worksheet: Fillable ... - CocoDoc Qualified Dividends And Capital Gain Tax Worksheet: Fillable, Printable & Blank PDF Form for Free | CocoDoc Qualified Dividends And Capital Gain Tax Worksheet: Fill & Download for Free GET FORM Download the form How to Edit Your Qualified Dividends And Capital Gain Tax Worksheet Online Free of Hassle Click the Get Form button on this page. Publication 4681 (2021), Canceled Debts, Foreclosures ... - IRS tax … 31.12.2020 · Because Robert wasn't personally liable for the debt, the abandonment is treated as a sale or exchange of the property in tax year 2021. Robert's amount realized is $185,000 and his adjusted basis in the property is $180,000 (as a result of $20,000 of depreciation deductions on the property). Robert has a $5,000 gain in tax year 2021.

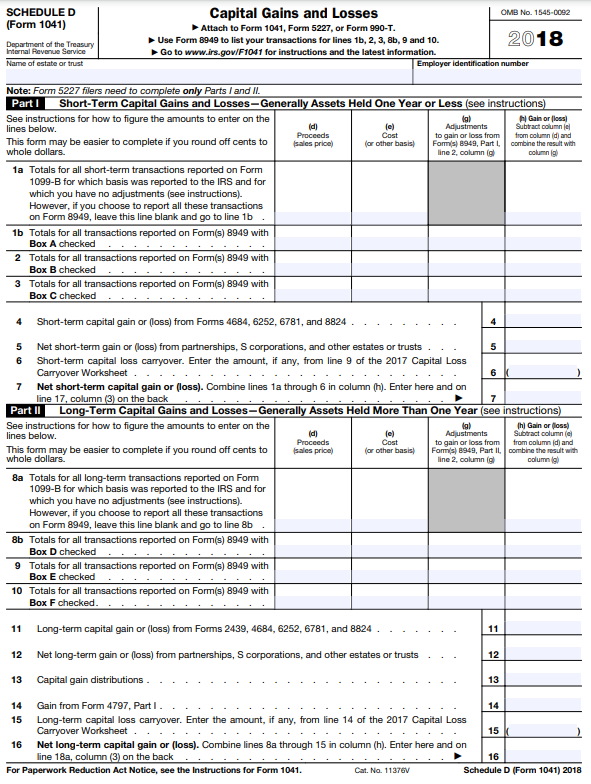

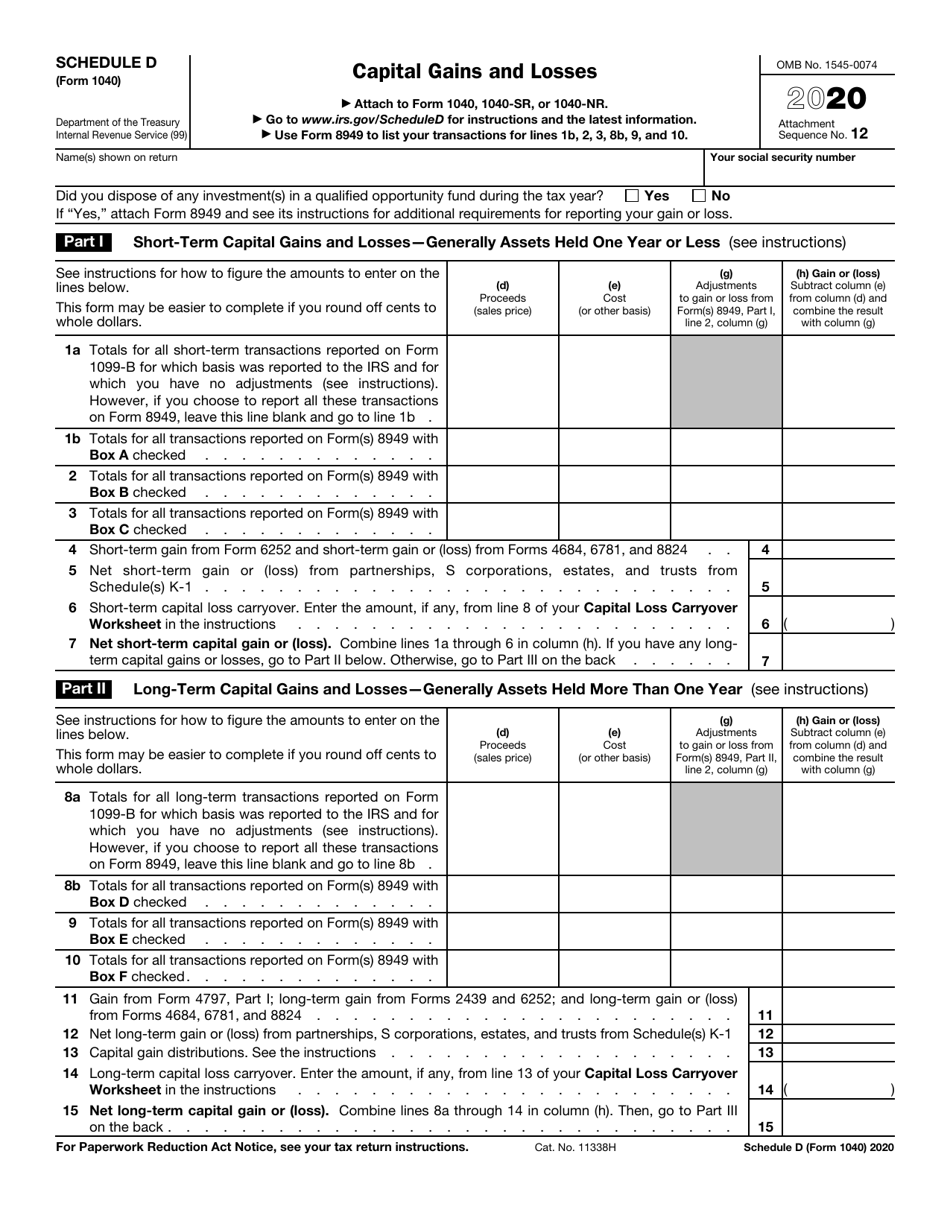

2022 Instructions for Schedule D (2022) - IRS tax forms Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment. Also, use Form 8997 to report any capital gains you are deferring by investing in a QOF during the tax year and any QOF investment you disposed of during the tax year. Capital Asset PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is ... Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

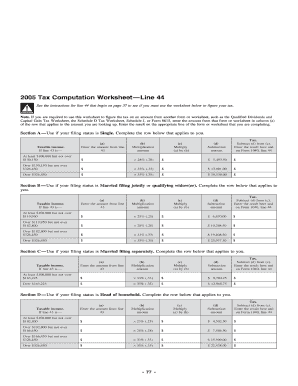

How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Your 1040 Line 43 Taxable Income actually has hidden within it your qualified dividends and long-term capital gains, which are taxed at a different rate. So lines 1-7 of this worksheet are figuring what is your total qualified income (line 6) and your total ordinary income (line 7), so they can be taxed at their different rates.

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. ... complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box ... enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a ...

'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... 'Qualified Dividends And Capital Gain Tax Worksheet' — A Basic, Simple Excel Spreadsheet For The Math. 4 Replies by Anura Guruge on February 24, 2022 Click to ENLARGE. Link to download Excel spreadsheet BELOW. Click image to download clean, very simple Excel. This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

Qualified Dividends and Capital Gains Worksheet - StuDocu See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6.

Capital Gains Tax Calculation Worksheet - The Balance These capital gains bracket thresholds increase to $80,800 and $501,600 for married couples filing jointly. There are some investments, such as collectibles, that are taxed at different capital gains rates. But most exchange-traded investments will be taxed at either 0%, 15%, or 20% if you meet long-term holding requirements. 3.

What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

Fillable 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing.

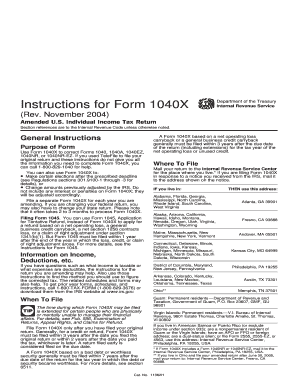

Instructions for Form 1040-SS (2021) | Internal Revenue Service An individual who was not a bona fide resident of Puerto Rico in 2021 may have to file tax returns with both Puerto Rico and the United States. For more information, see Not a Bona Fide Resident of Puerto Rico in Pub. 570. You will figure your additional child tax credit in a manner similar to how you figured this credit for 2020.

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

Qualified Dividends And Capital Gain Worksheet - Martin Lindelof Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. This document is locked as it has been sent for signing. Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, qualified dividends and. Web irs introduced the qualified dividend and capital ...

qualified dividends and capital gain tax worksheet 2019 pdf: Fill out ... Get the up-to-date 2021 qualified dividends and capital gains worksheet-2022 now Get Form 4.1 out of 5 44 votes 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users Here's how it works 02. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 03. Share your form with others

Qualified Dividends And Capital Gain Tax Worksheet 2019 - Fill and Sign ... Now, working with a Qualified Dividends And Capital Gain Tax Worksheet 2019 takes a maximum of 5 minutes. Our state web-based blanks and clear guidelines eliminate human-prone errors. Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue.

How to Figure the Qualified Dividends on a Tax Return Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use...

Publication 523 (2021), Selling Your Home - IRS tax forms Schedule B (Form 1040) Interest and Ordinary Dividends. Schedule D (Form 1040) Capital Gains and Losses. 982 Reduction of ... Section B. Determine your non-qualified use gain. ... your federal individual income tax return for free using brand-name tax-preparation-and-filing software or Free File fillable forms. However, state tax preparation ...

Publication 535 (2021), Business Expenses - IRS tax forms Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Qualified Dividend and Capital Gains Tax Worksheet? - YouTube The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, which are generally sub...

Qualified Dividends Tax Worksheet PDF Form - FormsPal Step 2: You can now edit the qualified dividends and capital gains worksheet fillable 2020. You may use our multifunctional toolbar to include, erase, and adjust the text of the form. The following sections will create the PDF document that you will be filling out: Type in the requested details in the space . Step 3: Select the "Done" button.

Publication 334 (2021), Tax Guide for Small Business The FFCRA requirement that employers provide paid sick and family leave for reasons related to COVID-19 (the employer mandate) expired on December 31, 2020; however, the COVID-related Tax Relief Act of 2020 extends the periods for which employers providing leave that otherwise meets the requirements of the FFCRA may continue to claim tax credits for qualified sick and …

Qualified Dividends And Capital Gain Tax Worksheet 2021 Once you’ve finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience.

0 Response to "38 qualified dividends and capital gain tax worksheet fillable"

Post a Comment