38 rental property expenses worksheet

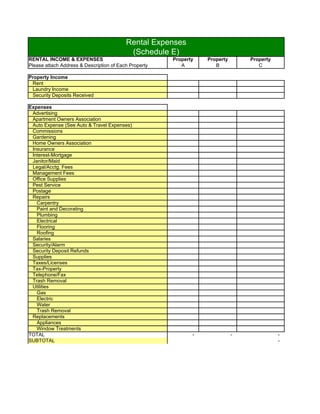

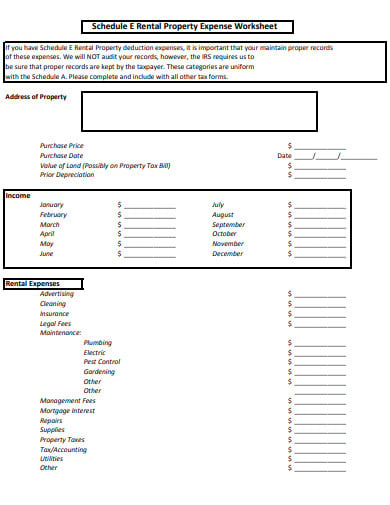

Using a Rental Property Expenses Spreadsheet? Try This Instead - Stessa Income and expenses on a rental property are reported to the IRS using two main forms: IRS Form 1040 or Form 1040-SR, Schedule E, Part I is used to report income, expenses, and rental property depreciation. Additional Schedule Es can be attached if an investor has more than three rental properties. Free Rental Property Expenses Spreadsheet Templates A rental property expenses spreadsheet is used by landlords to keep track of their monthly rental income and expenses. Tracking them is important to effectively manage your rental property and getting the most out of your investment. Rental income and expense worksheet help you stay on top of your bookkeeping.

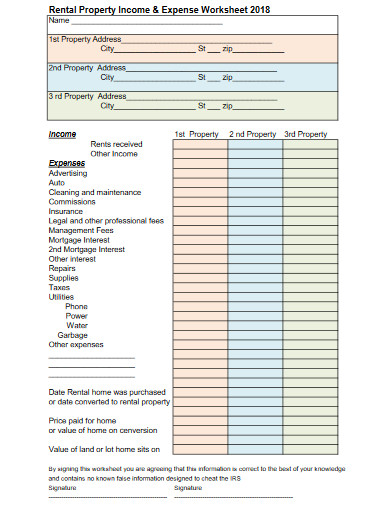

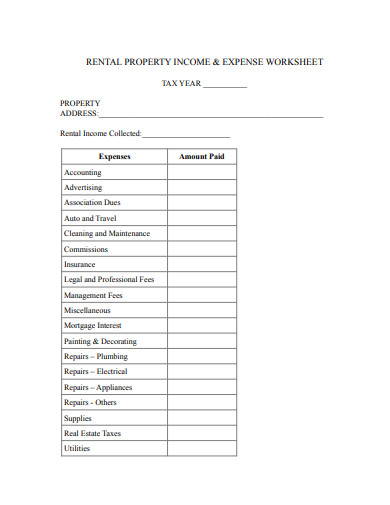

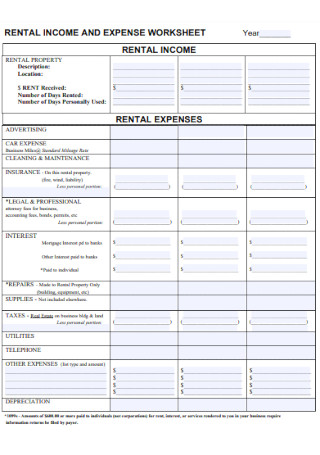

Rental Income and Expense Worksheet - PropertyManagement.com Convenient and easy to use, this worksheet is designed for property owners with one to five properties. It features sections for each category of income and spending that are associated with rental property finances. You'll start by entering the stats on your properties, and then enter the appropriate dollar amounts into each itemized category.

Rental property expenses worksheet

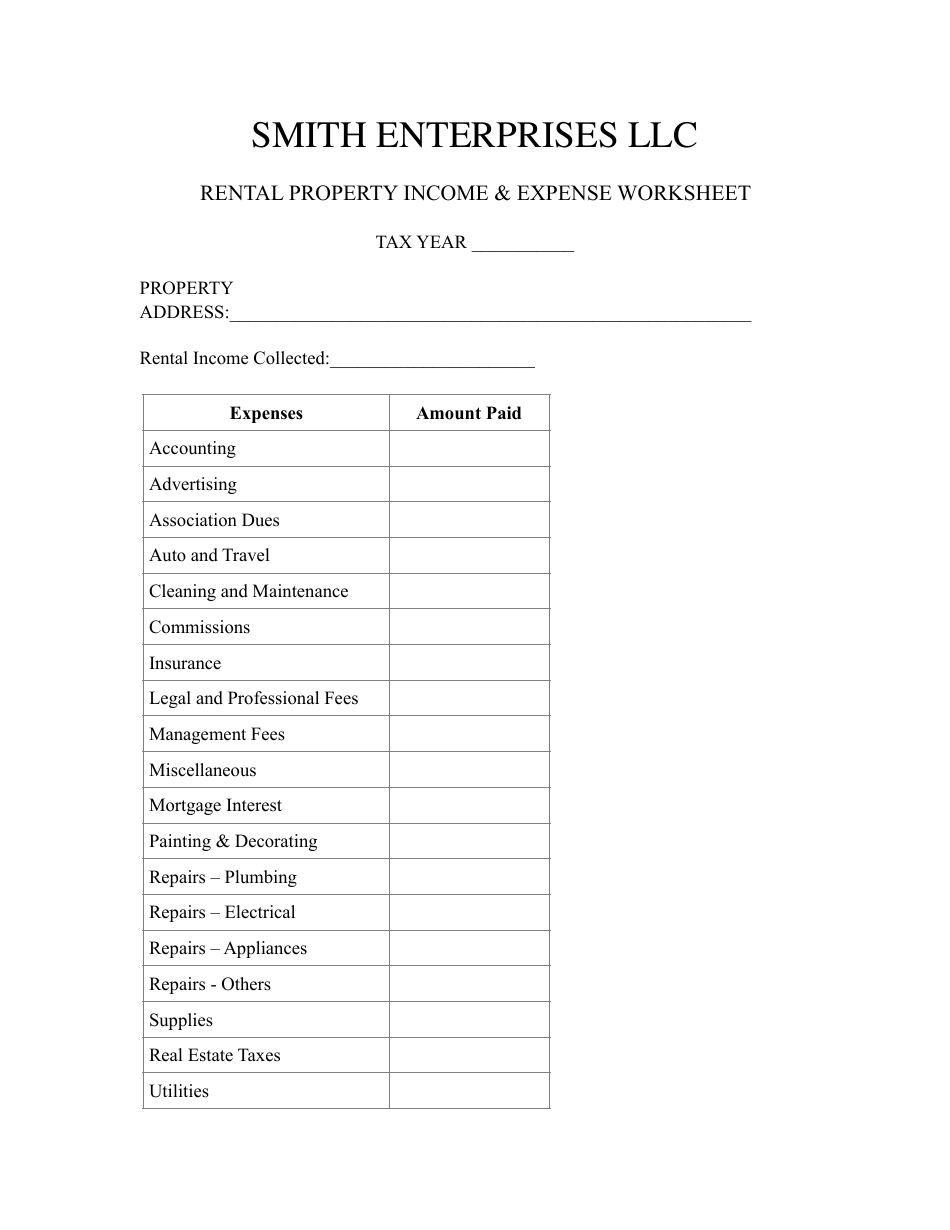

PDF Rental Income and Expenses - Tax Happens Local transportation expenses incurred to collect rent-al income or to manage, conserve, or maintain rental property are deductible. The taxpayer may deduct ei-ther actual expenses or the standard mileage rate for an auto (57¢.5 per mile for 2020). Rental Income and Expenses 2020TAX YEAR Tax Happens LLC 10018 Park Place Ave Riverview FL 33578 2022 Rental Property Analysis Spreadsheet [Free Template] - Stessa Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value. Common Rental Property Expenses & Which Ones Are Deductible - Stessa Rental expenses that can be deducted on a tax return include mortgage interest, property tax, operating expenses, depreciation, and repairs. Improvement costs paid for the betterment, restoration, or adaptation of the property to a new or different use must be recovered through depreciation.

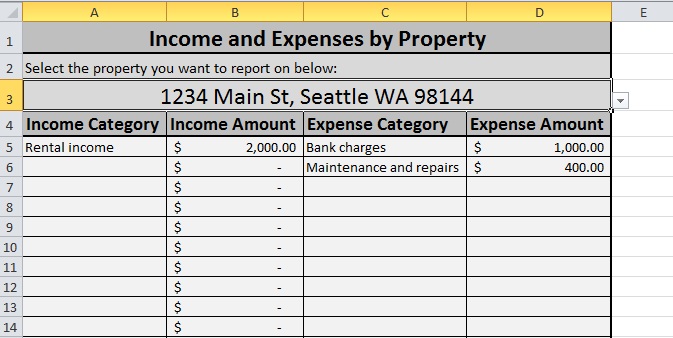

Rental property expenses worksheet. Publication 527 (2020), Residential Rental Property The room is 12 × 15 feet, or 180 square feet. Your entire house has 1,800 square feet of floor space. You can deduct as a rental expense 10% of any expense that must be divided between rental use and personal use. If your heating bill for the year for the entire house was $600, $60 ($600 × 0.10) is a rental expense. Landlords Rental Income and Expenses Tracking Spreadsheet This Landlords rental income and expenses tracking spreadsheet should be your choice to tidy up your financial transactions record. You can fill it with your tenant as well as their rental room information. Also, you can track their dues and remind it to your tenants. Furthermore, you can see profit and loss of your rental property business. Tips on Rental Real Estate Income, Deductions and Recordkeeping If you rent real estate such as buildings, rooms or apartments, you normally report your rental income and expenses on Form 1040 or 1040-SR, Schedule E, Part I. List your total income, expenses, and depreciation for each rental property on the appropriate line of Schedule E. Rental Income and Expense Worksheet - Google Sheets Property Code: Property Address/Unit # Rent Amt. Tenant Name: Phone: Move-In Date: Renewal date

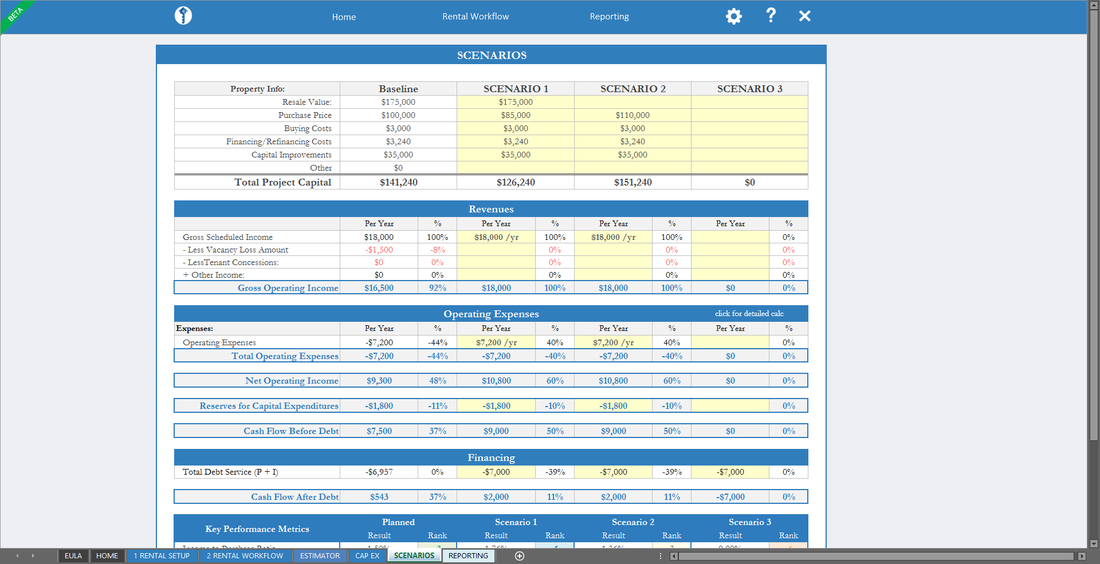

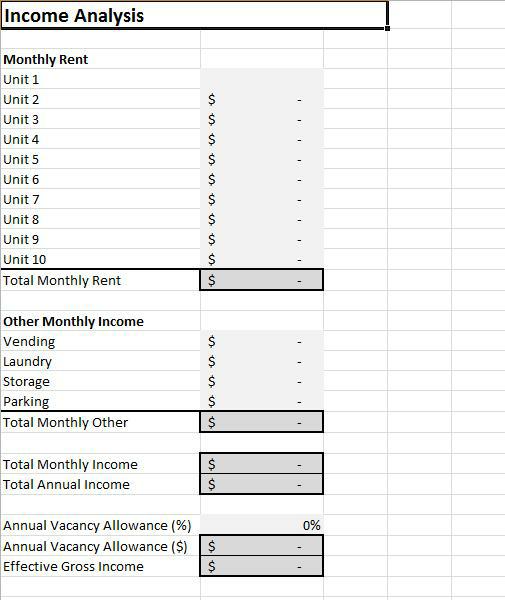

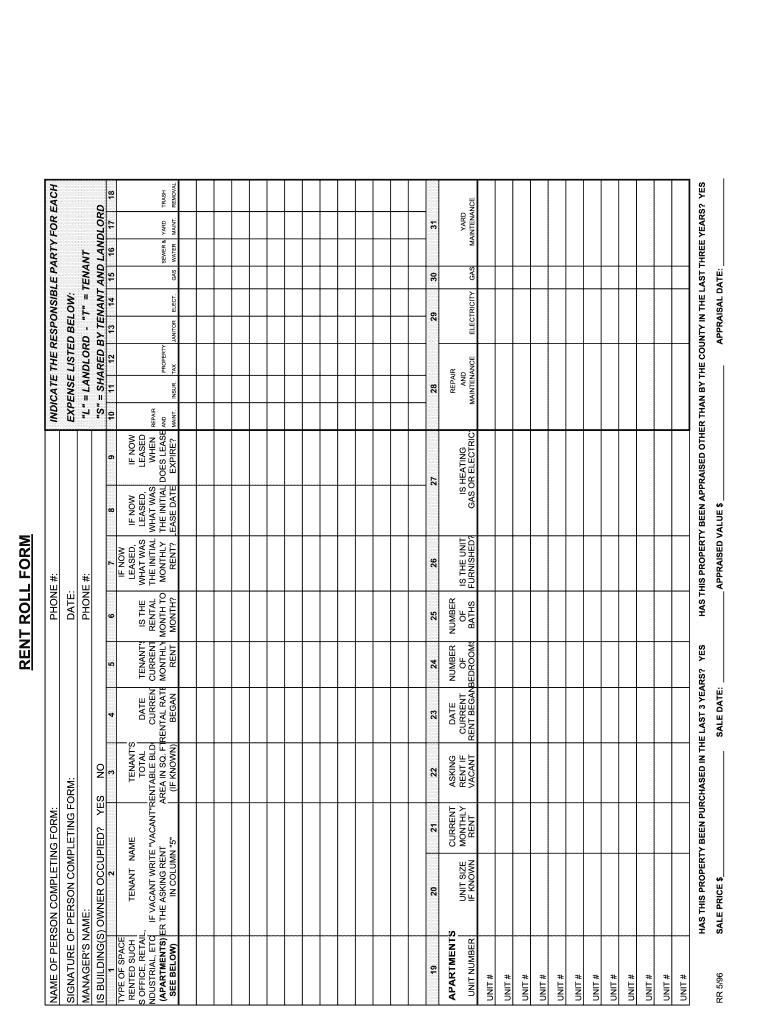

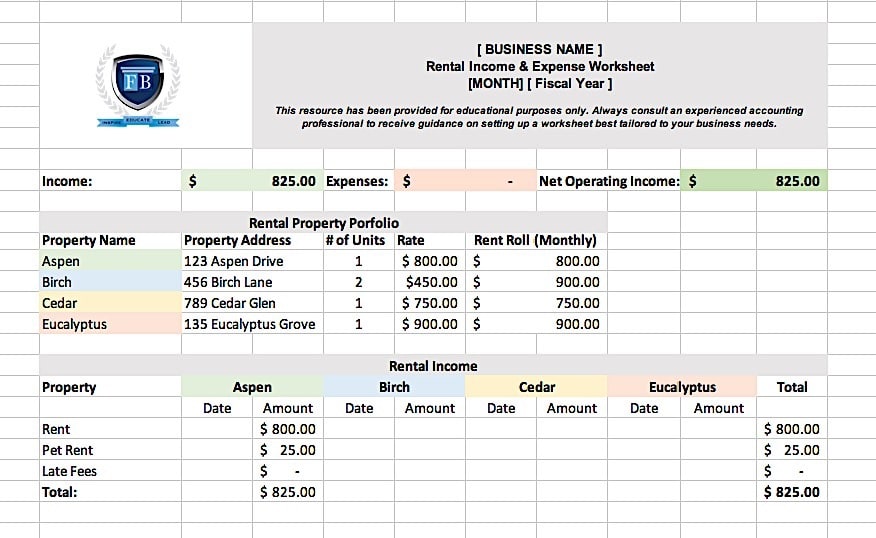

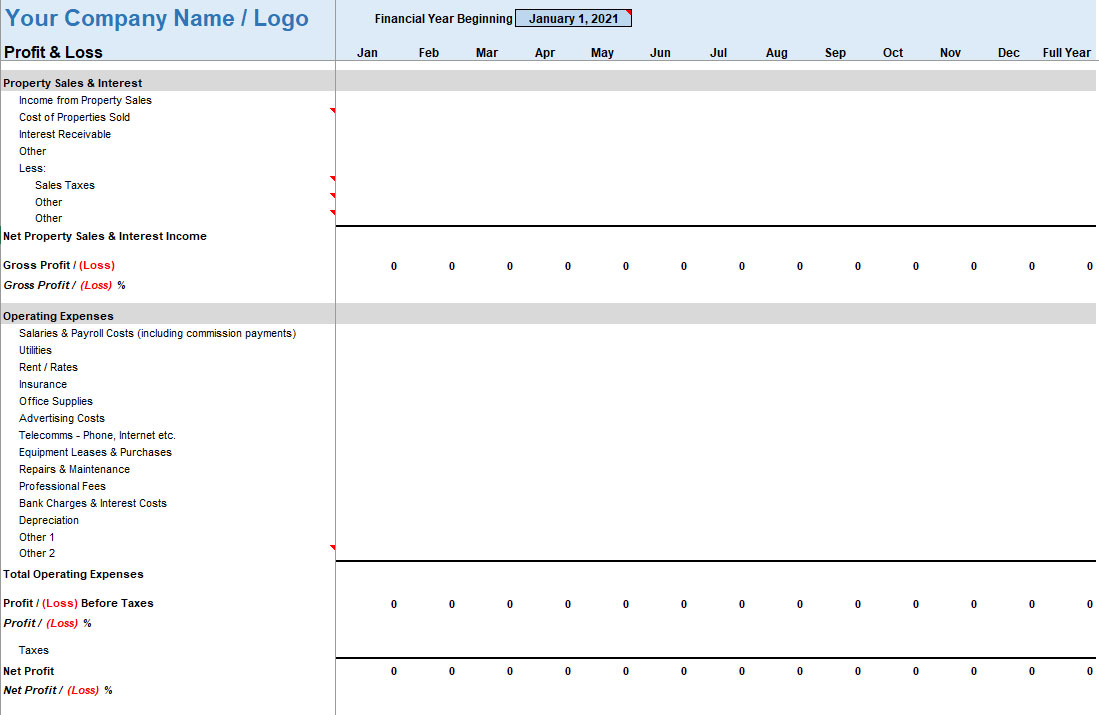

Free Rental Property Management Template (Excel, Word, PDF) The rental property management template is a document in MS Excel in different formats. It keeps the records of your property and rent collection with various reports. With the help of this template, a real estate company can easily handle up to 50 properties. Furthermore, it assists you to enlist the record of properties. Short-term Rental Expense Spreadsheet (Free Template) - Lodgify Our short term rental expense spreadsheet allows you to write in all the expenses and purchases you've made for your vacation rental on a yearly and monthly basis. The template already includes some basic costs, such as cleaning products and property management tools, but you can customize it to meet your needs. Topic No. 414 Rental Income and Expenses - IRS tax forms You can generally use Schedule E (Form 1040), Supplemental Income and Loss to report income and expenses related to real estate rentals. If you provide substantial services that are primarily for your tenant's convenience, report your income and expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship). Rental Income and Expense Worksheet: Free Resources - Stessa Use Rental Income and Expenses to Analyze Rental Property A good rental income and expense worksheet makes analyzing the current performance of property and additional investments much easier. The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including:

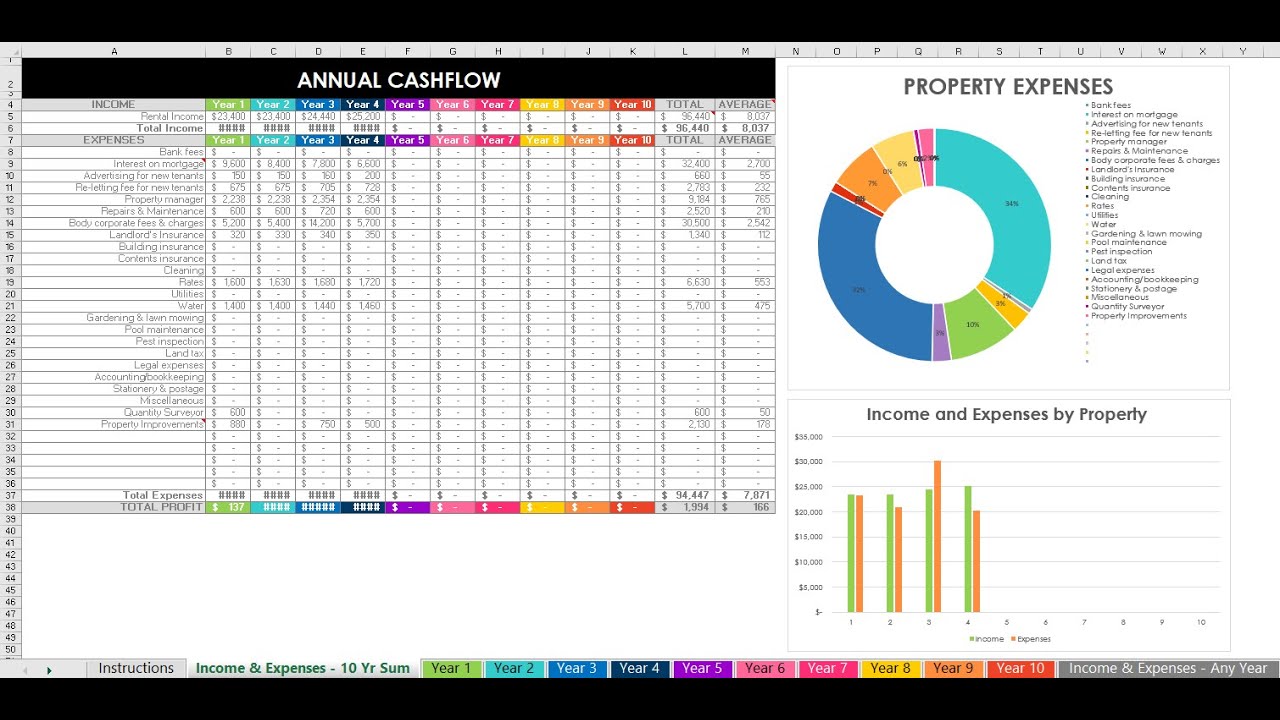

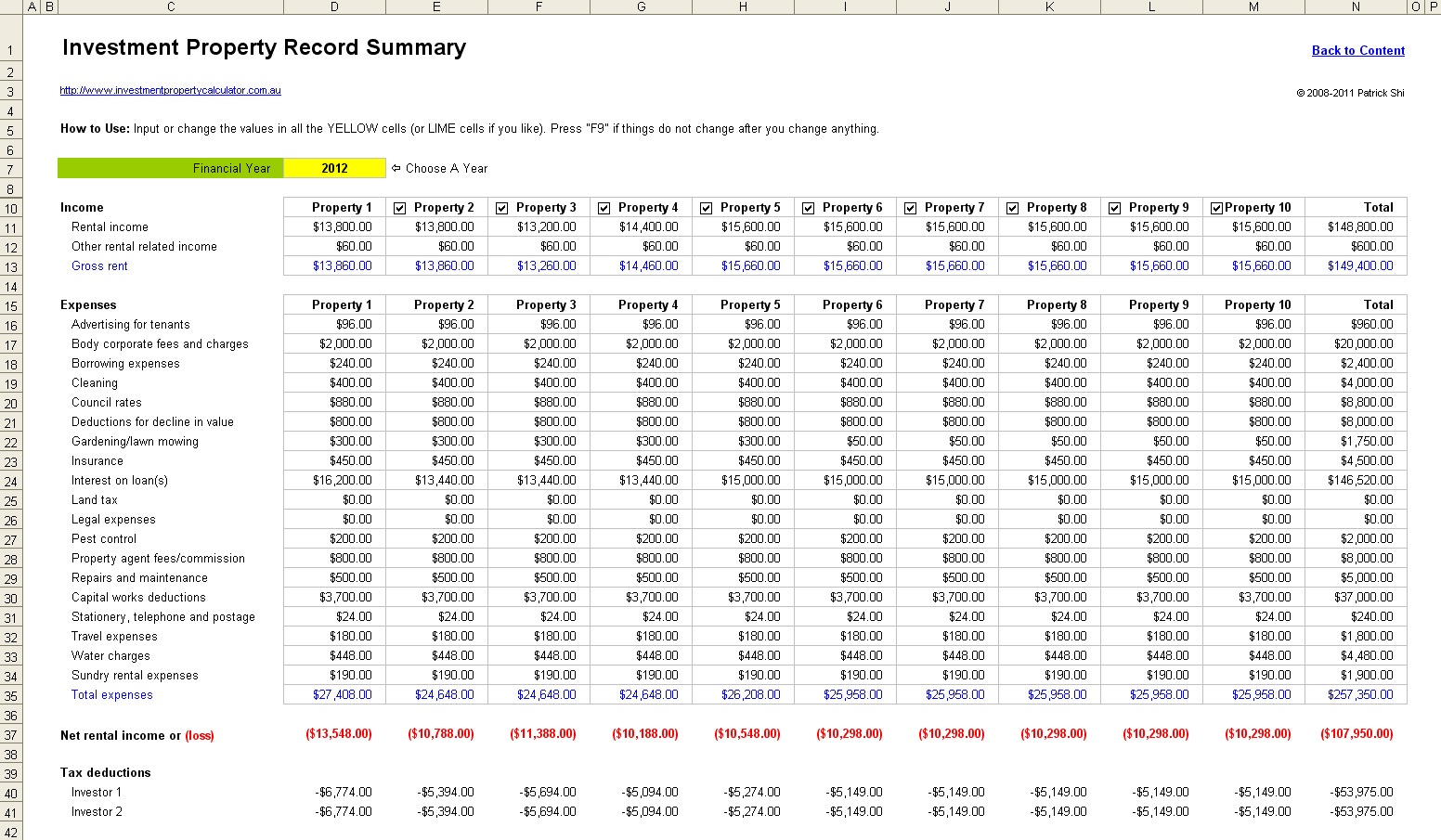

Rental Property Spreadsheet - Etsy Check out our rental property spreadsheet selection for the very best in unique or custom, handmade pieces from our templates shops. 5+ Free Rental Property Expenses Spreadsheets - Excel TMP Rental Property Excel Spreadsheet Free Details File Format Excel (xls, xlsx) Size: (364 KB) Download Rental Property Analysis Spreadsheet Details File Format Excel (xls, xlsx) Size: (162 KB) Download Free Rental Income and Expense Worksheet Details File Format PDF Size: (178 KB) Download Rental Property Record Keeping Template Details File Format 10+ free rental property Excel spreadsheet templates - Stessa There are 4 main sections of information on a rental property income statement: gross monthly rental income, operating expenses, net operating income, and pretax net income. To download the template, select the link below, select File at the top left corner of the page, select Download, and choose Microsoft Excel. Rental Property Income and Expenses Spreadsheet Template August 21, 2020 John. Rental Property Income and Expenses spreadsheet is an Excel spreadsheet to track monthly income and expenses of your rental property business. It is just a simple spreadsheet where any small business owners can use it easily. They just need to fill any transaction daily and let the Excel formulas summarize them into ...

Rental Property Expenses Spreadsheet 25+ Free Download Rental Property Spreadsheets are one of the important computerized sheets which help you in saving monthly expenses. The following spreadsheets which are given on this website are meaningful in this cause. It is easy to download and print from here. Save your total income quickly and easily

Common Rental Property Expenses & Which Ones Are Deductible - Stessa Rental expenses that can be deducted on a tax return include mortgage interest, property tax, operating expenses, depreciation, and repairs. Improvement costs paid for the betterment, restoration, or adaptation of the property to a new or different use must be recovered through depreciation.

2022 Rental Property Analysis Spreadsheet [Free Template] - Stessa Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value.

PDF Rental Income and Expenses - Tax Happens Local transportation expenses incurred to collect rent-al income or to manage, conserve, or maintain rental property are deductible. The taxpayer may deduct ei-ther actual expenses or the standard mileage rate for an auto (57¢.5 per mile for 2020). Rental Income and Expenses 2020TAX YEAR Tax Happens LLC 10018 Park Place Ave Riverview FL 33578

0 Response to "38 rental property expenses worksheet"

Post a Comment