39 1040 qualified dividends worksheet

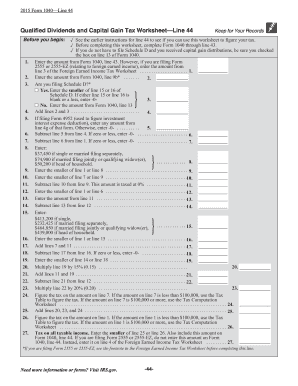

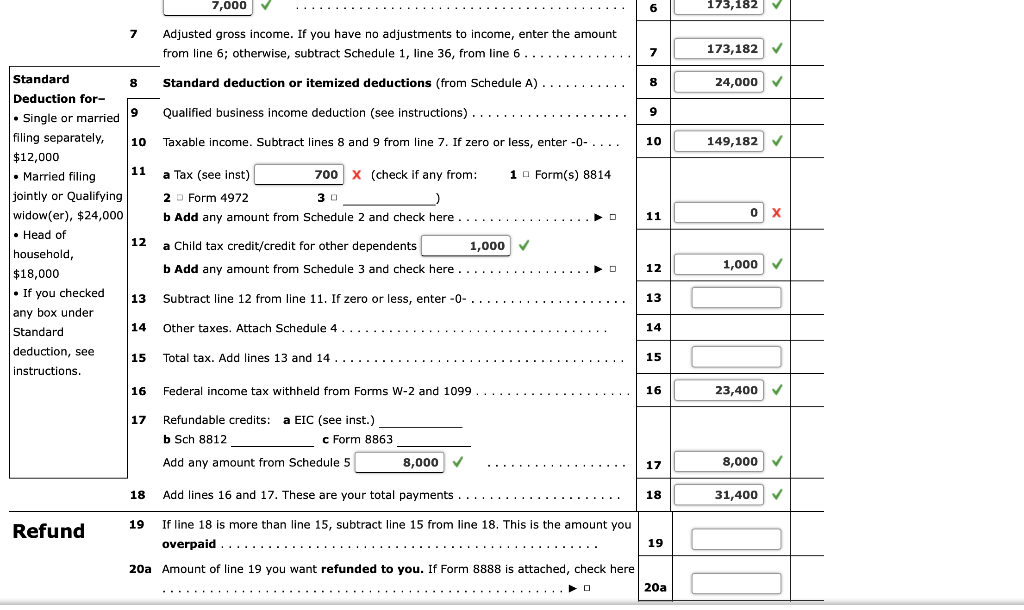

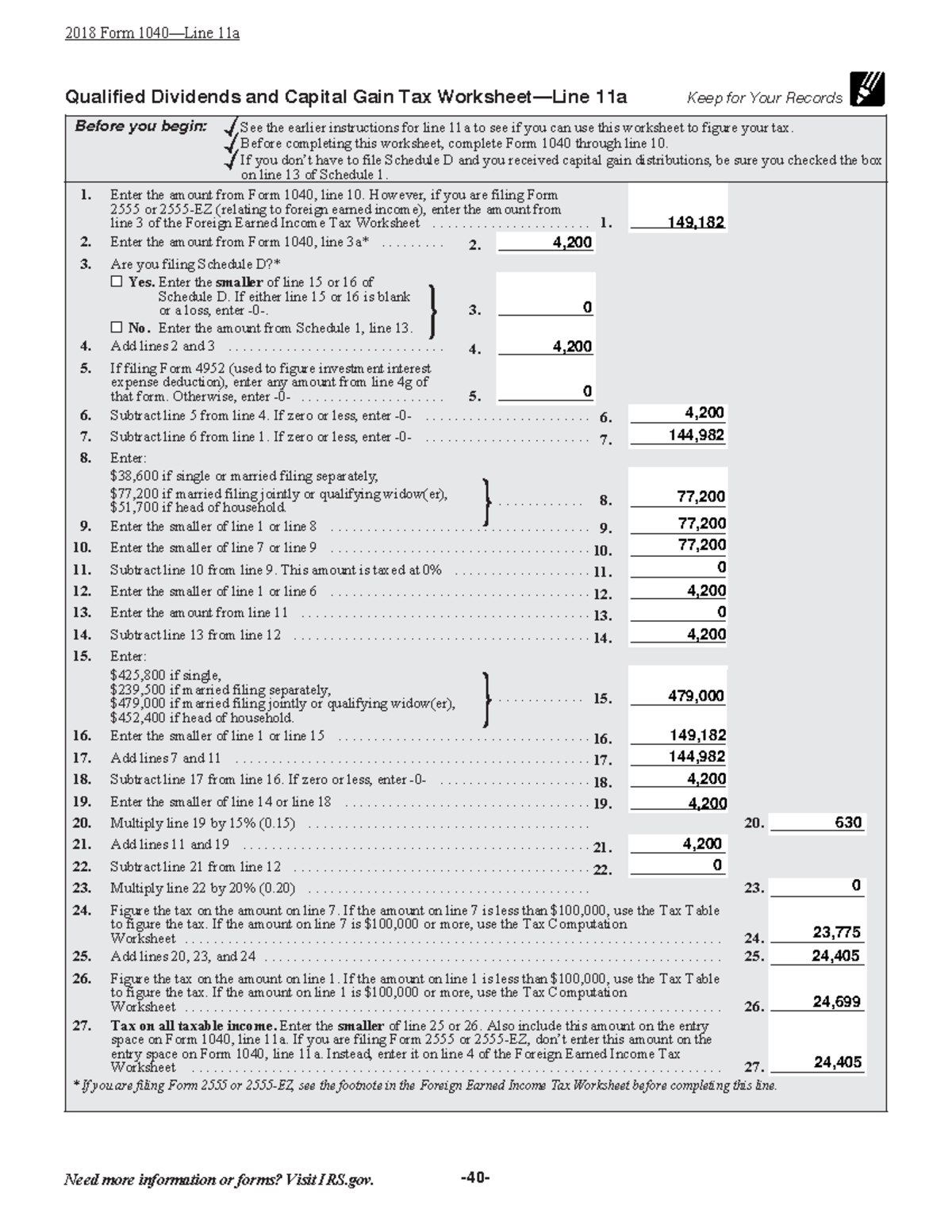

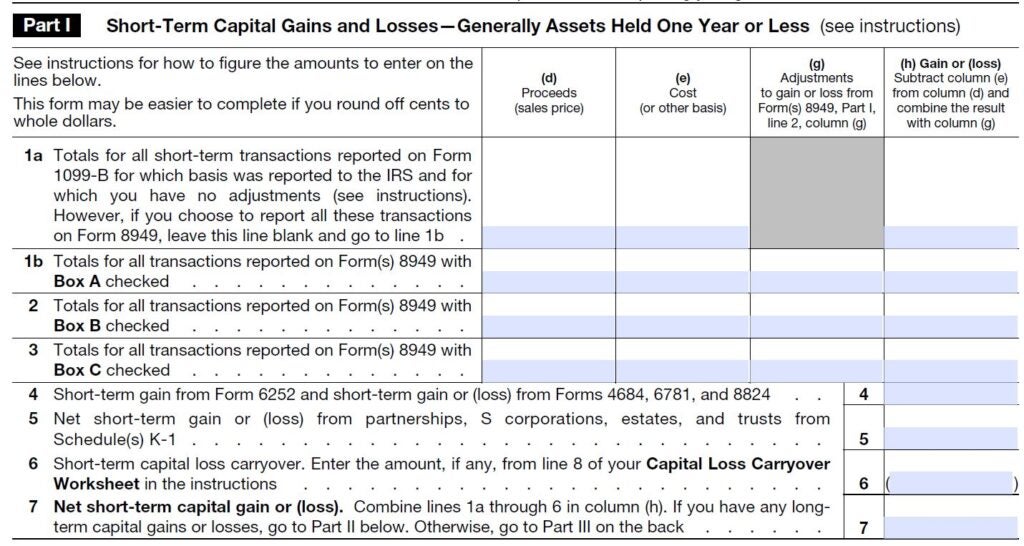

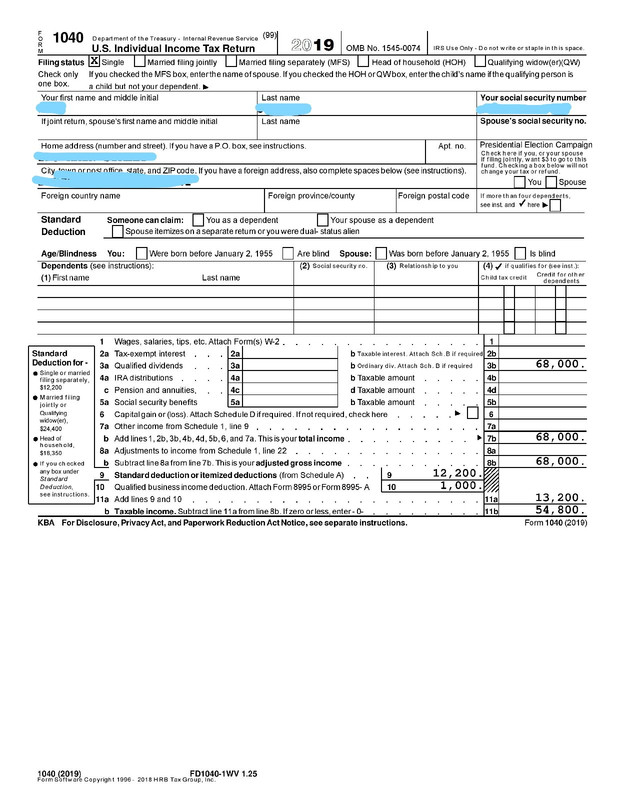

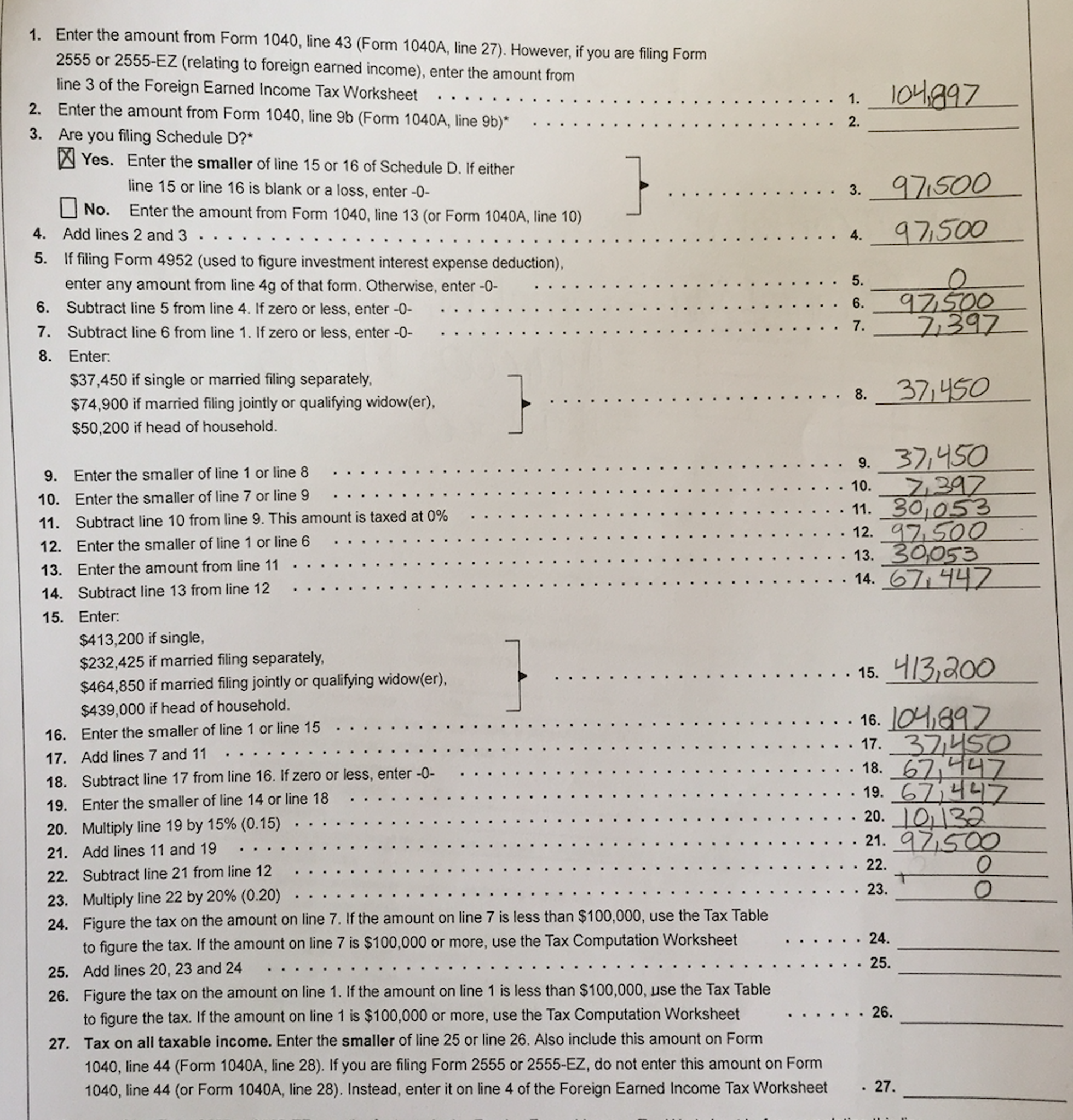

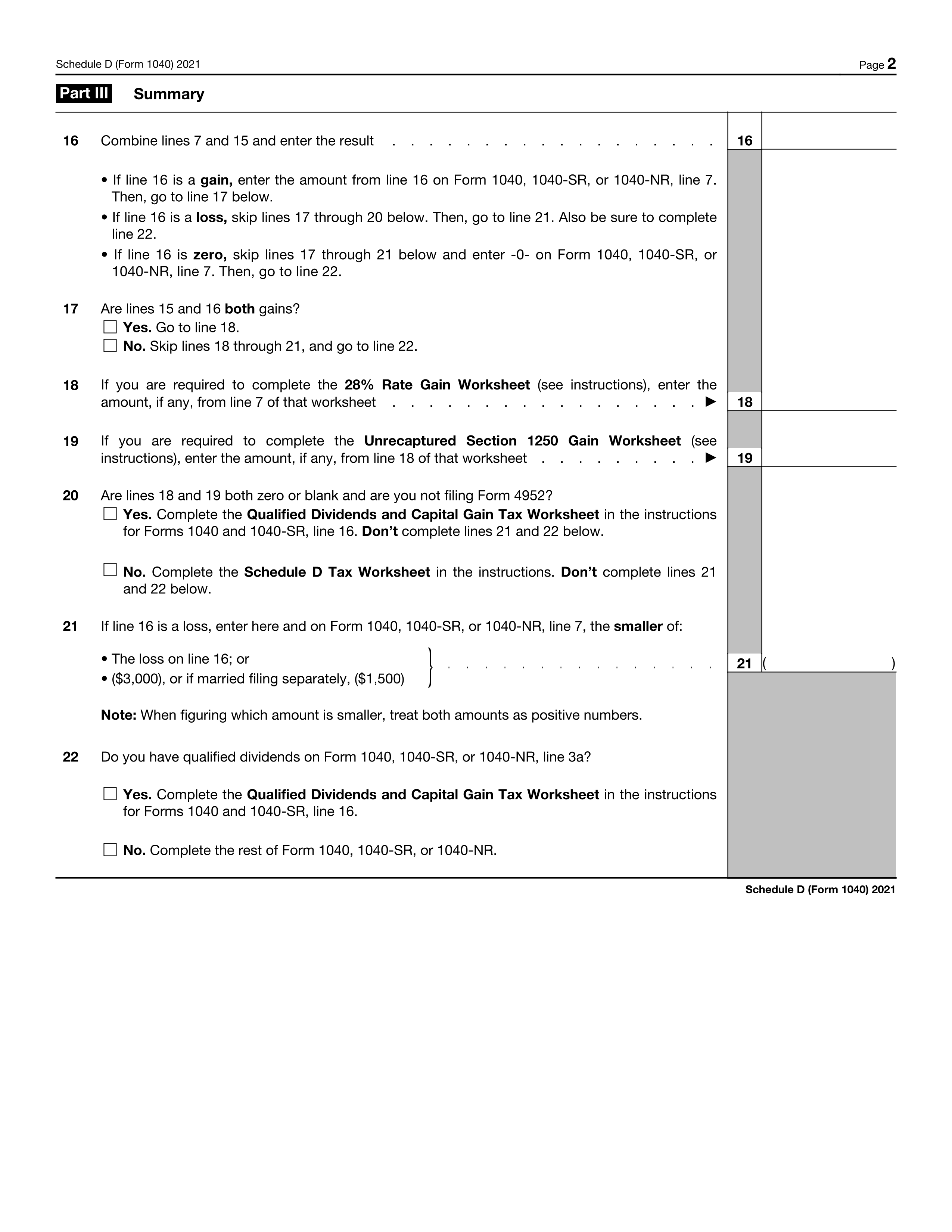

How to Figure the Qualified Dividends on a Tax Return Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax ... 2022 Instructions for Schedule D (2022) | Internal Revenue Service Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16, (or in the instructions for Form …

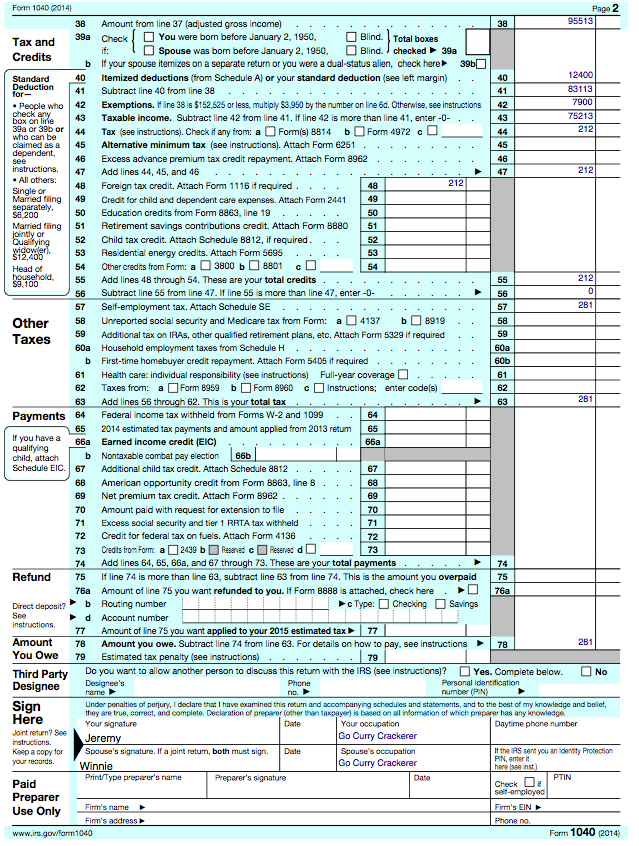

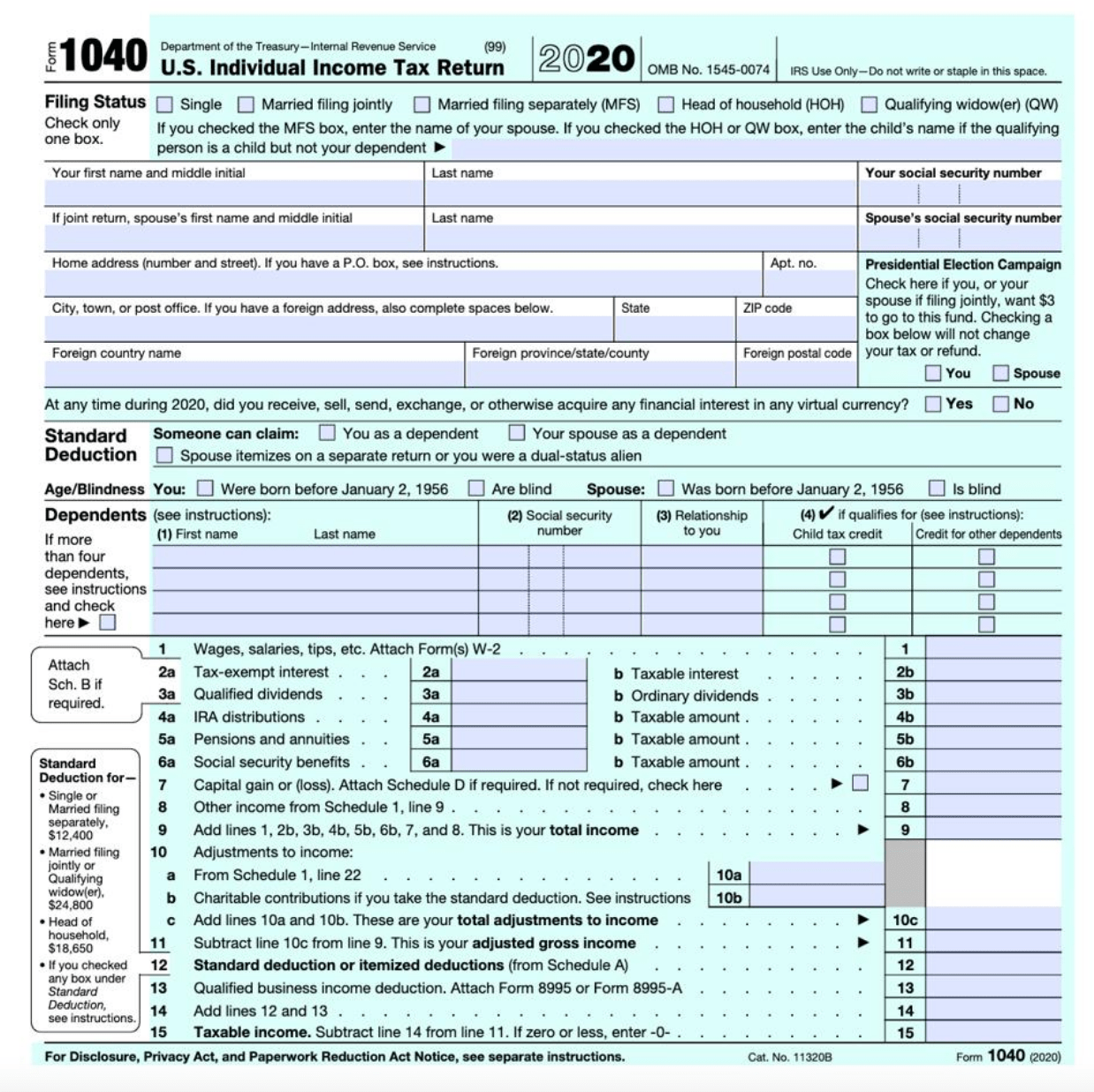

2022 Form 1040 - IRS tax forms 1040 U.S. Individual Income Tax Return 2022 Department of the Treasury—Internal Revenue Service . OMB No. 1545-0074. IRS Use Only—Do not write or staple in this space. Filing Status. Check only one box. Single. Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying surviving spouse (QSS) If you checked the MFS box, enter the …

1040 qualified dividends worksheet

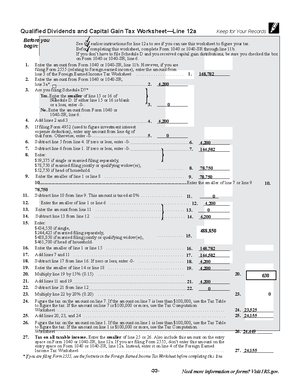

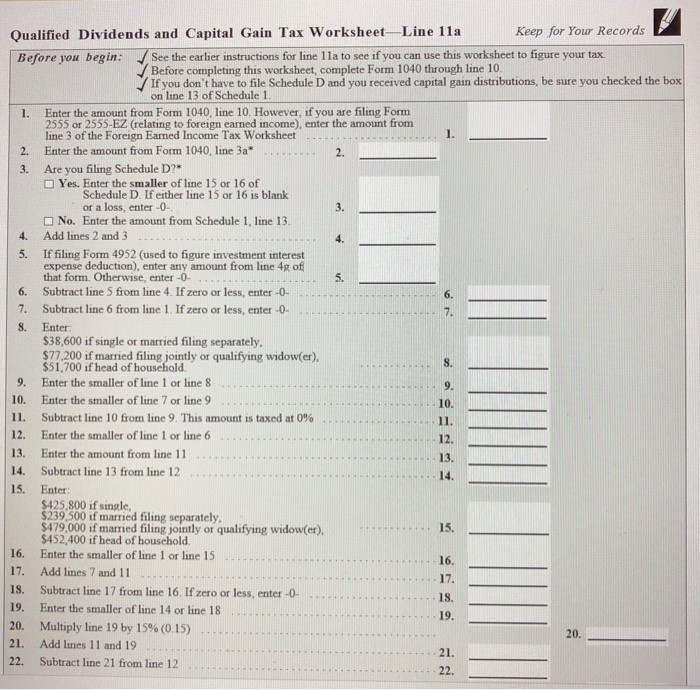

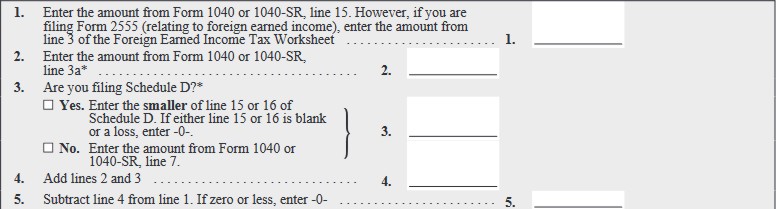

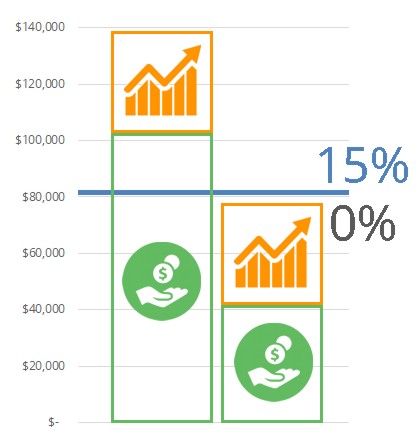

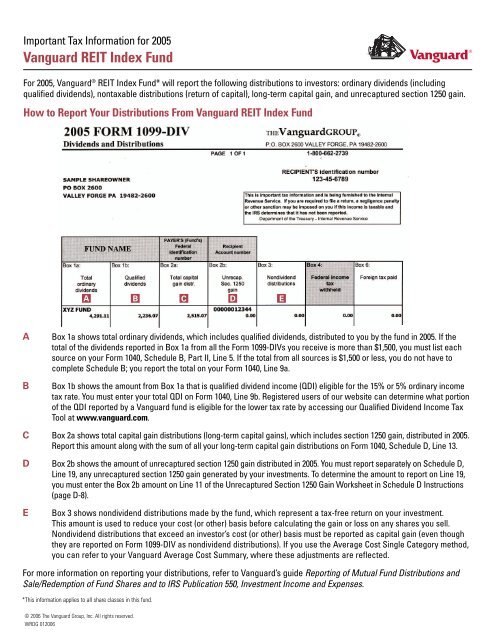

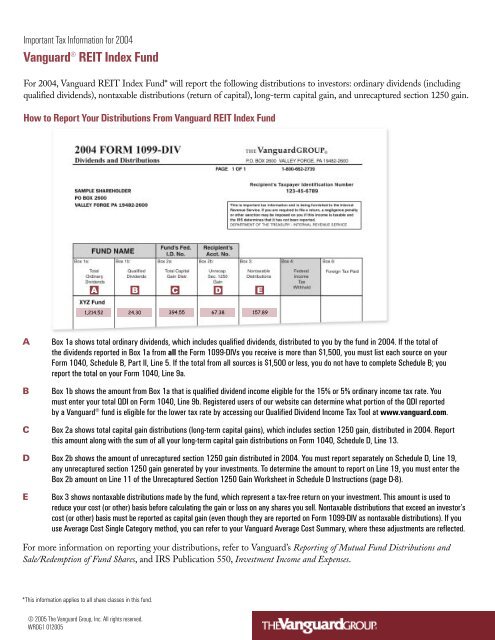

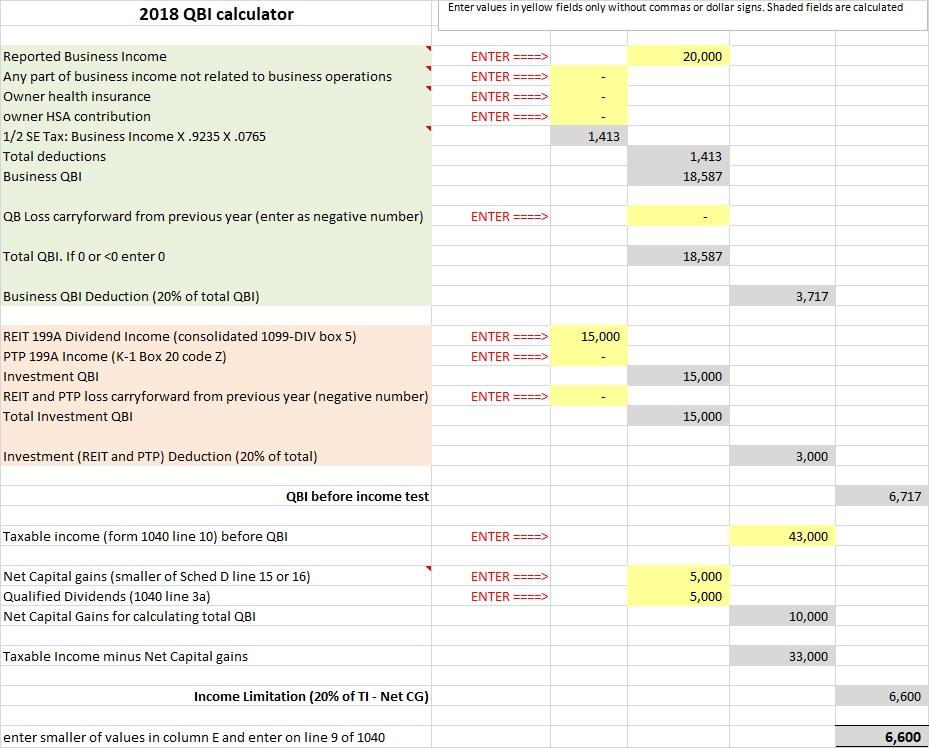

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet 24/09/2021 · Instead, 1040 Line 16 “Tax” asks you to “see instructions.” In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. So, for those of ... Qualified business income deduction (QBID) overview (1040) Individuals, trusts, and estates that have qualified business income (QBI), qualified real estate investment trust (REIT) dividends or qualified publicly traded partnership (PTP) income can qualify for the deduction. Partnerships and S Corporations can take it at partner or shareholder level on an individual return. How Dividends Are Taxed and Reported on Tax Returns - The … 15/11/2022 · Qualified dividends are reported on Line 3a of your Form 1040. You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates.

1040 qualified dividends worksheet. Publication 3 (2021), Armed Forces' Tax Guide Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live … Publication 929 (2021), Tax Rules for Children and Dependents This amount may include qualified dividends. Qualified dividends are those dividends reported on Form 1040, 1040-SR, or 1040-NR, line 3a, and are eligible for lower tax rates that apply to a net capital gain. For detailed information about qualified dividends, see Pub. 550. If your child received qualified dividends, the amount of these dividends that is added to your … 1040 (2021) | Internal Revenue Service - IRS tax forms 1040 - Introductory Material What's New Introduction Due date of Skip to main content ... Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV. See Pub. 550 for the definition of qualified dividends if you received dividends not reported on Form 1099-DIV. Exception. Some … Page 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records . See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of …

How Dividends Are Taxed and Reported on Tax Returns - The … 15/11/2022 · Qualified dividends are reported on Line 3a of your Form 1040. You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. Qualified business income deduction (QBID) overview (1040) Individuals, trusts, and estates that have qualified business income (QBI), qualified real estate investment trust (REIT) dividends or qualified publicly traded partnership (PTP) income can qualify for the deduction. Partnerships and S Corporations can take it at partner or shareholder level on an individual return. How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet 24/09/2021 · Instead, 1040 Line 16 “Tax” asks you to “see instructions.” In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. So, for those of ...

0 Response to "39 1040 qualified dividends worksheet"

Post a Comment