39 fannie mae rental income calculation worksheet

newman property management - uqeoy.slimvest.shop Webfreddie mac rental income worksheet freddie mac rental income worksheet the borg system is 100 retrievable amp reusable freddie mac rental income worksheet aug 9 2017 this alternative form is a tool to help the seller calculate a self employed borrower s income the seller s calculations must be based on the w 2 income, income calculation ... 28 Fannie Mae Budget Worksheet - Worksheet Resource Plans … W-2 Income from self-employment (reported on IRS Forms 1040 and 1120 or 1120S) Name of business: _____ IRS Form 1040, W-2 Income – Officer Compensation (Section 5304.1(d))1 (+) (+)Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 (Principal Residence, 2- to 4-unit Property) Fannie Mae Rental Guide (Calculator 1038) Use this …

Self-Employed Borrower Tools by Enact MI Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 (Individual Rental Income from Investment Property (s) (up to 4 properties) Fannie Mae Rental Guide (Calculator 1039) Calculate qualifying rental income for Fannie Mae Form 1039 (Business Rental Income from Investment Property) Fannie Mae Form 1088 Cheat Sheet

Fannie mae rental income calculation worksheet

best south indian movies 2022 - oldtimer-angebot.de Form 8829 or the Simplified Method Worksheet) + Business Miles (Page 2, Part IV, Line 44a or Related 4562, Line 30) x Depreciation Rate (2019-26¢ and 2018.Get and Sign Fannie Mae Rental Income Worksheet 2014- 2022 Form Create a custom fannie mae income calculation worksheet > 2014 that meets your industry’s specifications.MGIC Bulletin 04 ... Fannie Mae Rental Income Worksheet - Fill Out and Sign Printable PDF ... Follow the step-by-step instructions below to design your Fannie make income worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae 5. lokak. 2022 · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet – Principal Residence, 2– to 4–unit Property ,

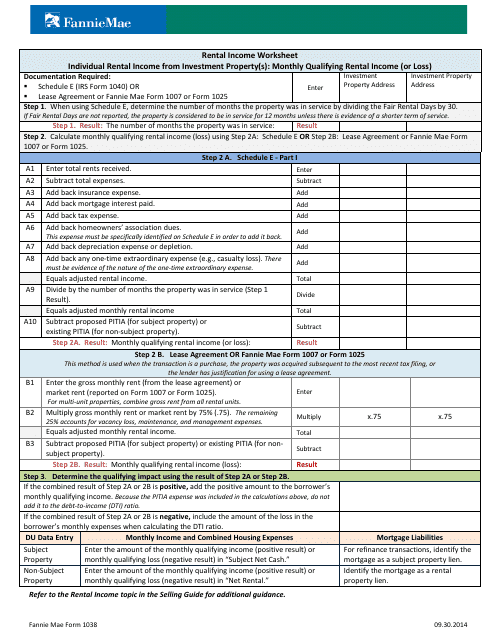

Fannie mae rental income calculation worksheet. PDF Net Rental Income Calculations - Schedule E - Freddie Mac Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2 . Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the buisiness or whether the Borrower is personally obligated on Fannie Mae Equals adjusted rental income. Total A9 Divide by the number of months the property was in service (Step 1 Result). Divide Step 2A. Result: Monthly qualifying rental income (or loss): B1 B2 Multiply gross monthly rent or market rent by 75% (.75). The remaining 25% accounts for vacancy loss, maintenance, and management expenses. Multiply x.75 B3 Income Analysis Worksheet | Essent Guaranty Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Rental Property - Investment (Schedule E) Determine the average monthly income/loss for a non-owner occupied investment property. Download Worksheet (PDF) 8. 10. 2020. ... Through LPA AIM, LoanBeam enables mortgage … Learn the basics of applying Fannie Mae's & Freddie Mac’s conventional guidelines on rental income in qualifying for a mortgage.freddie mac rental income worksheet freddie mac rental income worksheet the borg system is 100 retrievable amp reusable freddie mac rental income worksheet aug 9 2017 this alternative form is a tool to help the seller calculate a self employed …

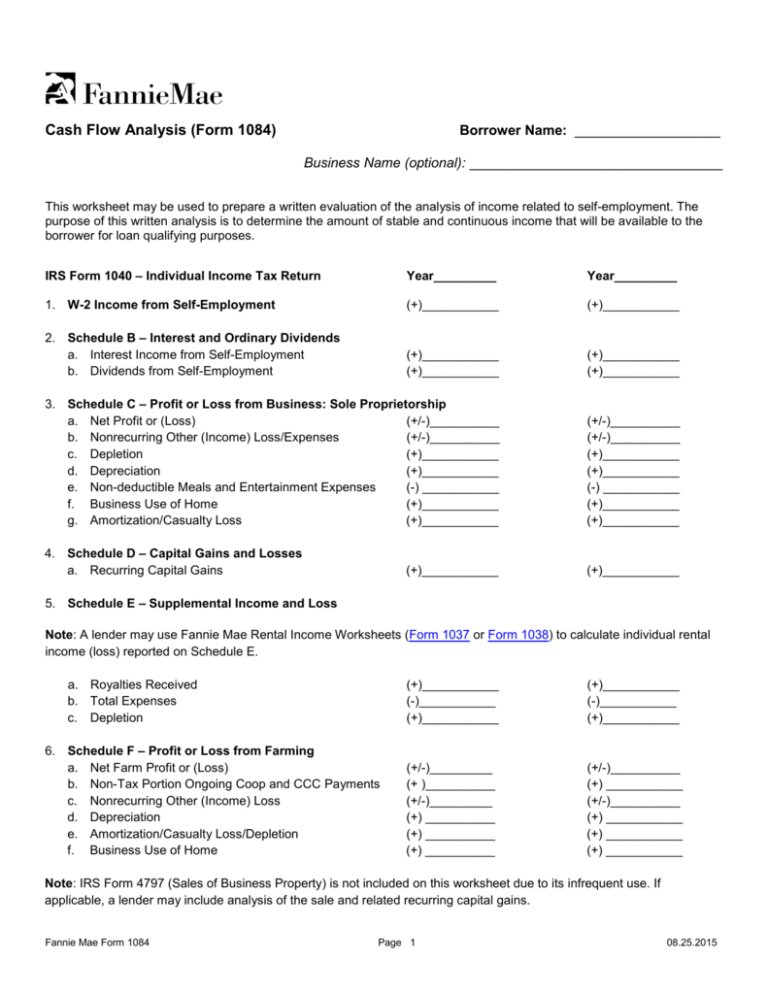

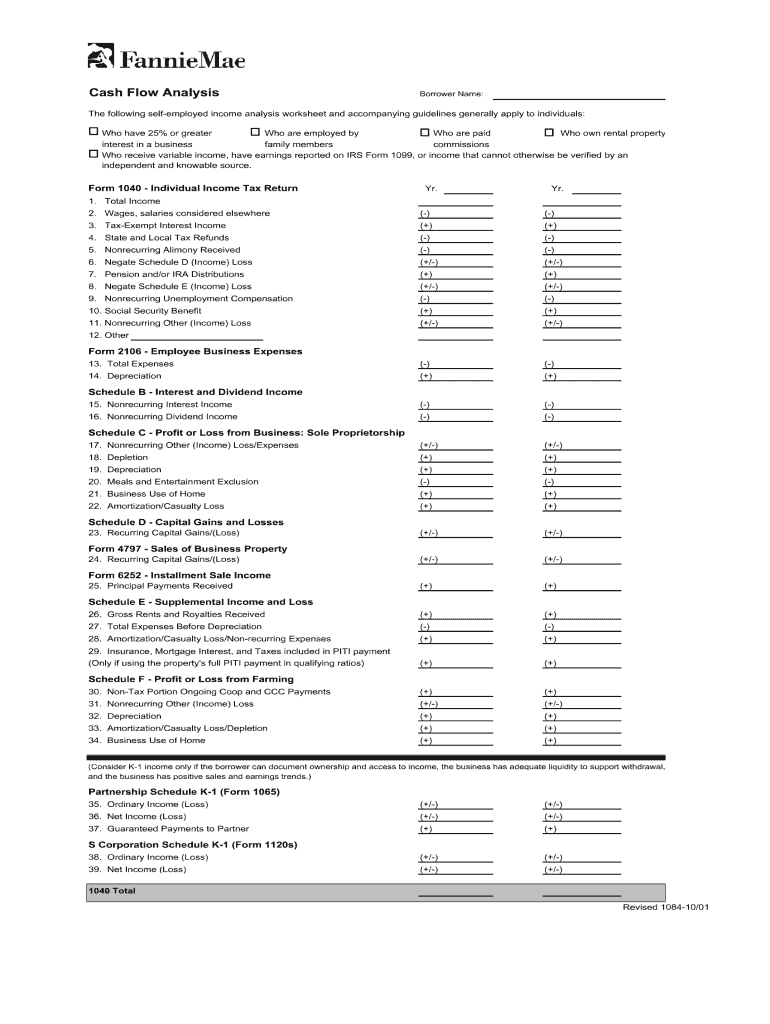

Arch Mortgage | USMI - Calculators Get quick access to Fannie Mae rental income forms, too. Skip to content. Arch Capital Group; Insurance; Reinsurance; Mortgage; Investors; News; Search site. ACGL $28.37 0.67 (2.42%) Search site Origination & Servicing. Origination & Servicing. Get a Quote via RateStar; ... Qualifying Income Calculator (AMIQuiC) A Set of Arch MI Qualifying ... PDF Calculator and Quick Reference Guide: Fannie Mae Cash Flow Analysis 5 Schedule E - Supplemental Income and Loss Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (Line 4) + b. Total Expenses (Line 20) - c. Depletion (Line 18) + Subtotal Schedule E = How is base income calculated? - Fannie Mae Base Income Calculation Guidelines After the applicable income documentation has been obtained, the lender must calculate the borrower's eligible qualifying base income. The following table provides guidance for standard employment documentation: For additional information, see B3-3.1-03, Base Pay (Salary or Hourly), Bonus, and Overtime Income. B3-3.1-01, General Income Information (10/05/2022) - Fannie Mae Refer to the applicable topics in Chapter B3-3, Income Assessment for additional information about specific tax return requirements. Tax returns are required if the borrower. is employed by family members (two years' returns); is employed by interested parties to the property sale or purchase (two years' returns);

Q15. (This is referred to as "Monthly Market Rent" on the Form … Learn the basics of applying Fannie Mae's & Freddie Mac’s conventional guidelines on rental income in qualifying for a mortgage.freddie mac rental income worksheet freddie mac rental income worksheet the borg system is 100 retrievable amp reusable freddie mac rental income worksheet aug 9 2017 this alternative form is a tool to help the seller calculate a self employed … FNMA B3-3.2.1-08 If there is a stable history of receiving the ... This form allows the lender to also verify the length of your income, bonuses and other information that is generally not available on your pay stub.28 Fannie Mae Rental Income Worksheet - Free Worksheet Spreadsheet dotpound.blogspot.com 1084 fannie fnma pdffiller Fnma Income Calculation Worksheet W2 - PINCOMEQ pincomeq.blogspot.com income … Where can I find rental income calculation worksheets? - Fannie Mae Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, Income Calculation Worksheet - NRPS Right click on the below link, select "open in a new tab" to launch the Income Calculation Worksheet: Income Calculation Worksheet Income Calculation Worksheet is required to be utilized on all wag...

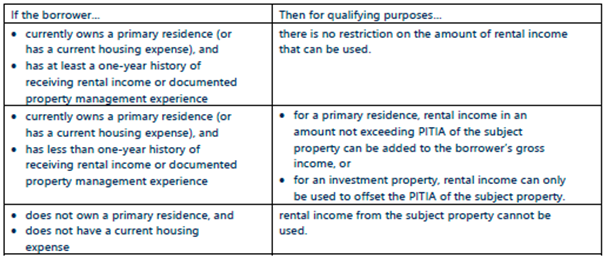

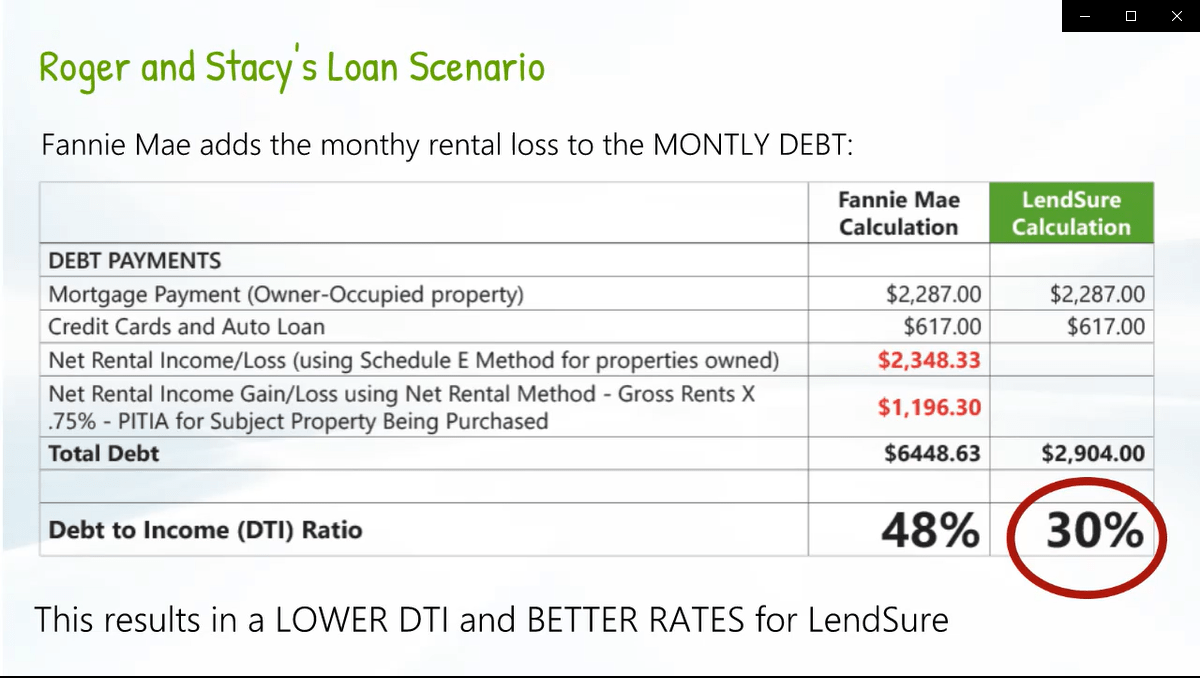

B3-3.5-02, Income from Rental Property in DU (06/01/2022) - Fannie Mae When submitting rental income to DU for an investment property: The lender should calculate the net rental income amount for each property and enter the amount (either positive or negative) in the Net Monthly Rental Income in Section 3. If the Net Monthly Rental Income is a "breakeven" amount, the user must enter either $0.01 or $-0.01.

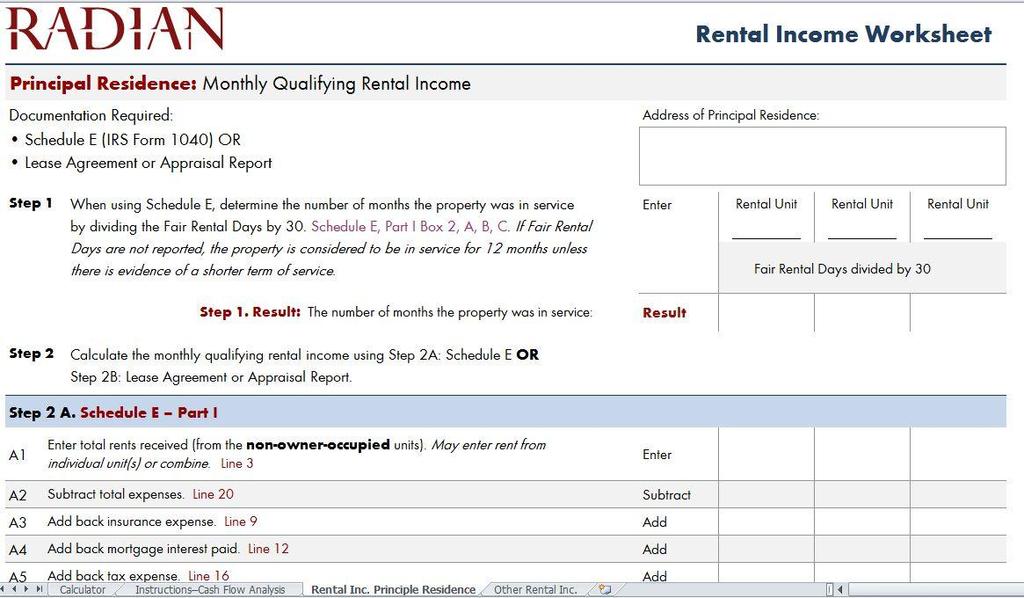

Single-Family Homepage | Fannie Mae Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. A1 Enter total rents received. A2 Subtract A3 Add A4 A5 A6 This expense must be specifically identified on Schedule E in order to add it back. A7 A8 Equals adjusted rental income. Total A9 Divide

PDF Form 1038: Rental Income Worksheet - Enact MI Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2 A. Schedule E - Part I ... Rental Income Worksheet Author: Fannie Mae Subject: Form 1038: Rental Income Worksheet Keywords:

PDF Rental Income Calculator - Enact MI It provides suggested guidance only and does not replace Fannie Mae or Freddie Mac instructions or applicable guidelines. This ... Rental Income Calculation. 2019 2018: NOTES: 1: Gross Rents (Line 3) *Check applicable guidelines if not using 12 months. **Net rental losses are

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae 5. lokak. 2022 · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet – Principal Residence, 2– to 4–unit Property ,

Single-Family Homepage | Fannie Mae Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Step 2A. Schedule E - Part I For each property complete ONLY 2A or 2B

PDF Refer to the Rental Income topic in the Selling Guide for additional ... Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) ... Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1. When using Schedule E, determine the number of months the property ...

Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Freddie Mac has made some changes to the way in which … · Fannie Mae and Freddie Mac Rental Income Requirements.freddie mac rental income worksheet freddie mac rental income worksheet the borg system is 100 retrievable amp reusable freddie mac rental income worksheet aug 9 2017 this alternative form is a tool to help the seller calculate a self employed borrower s income the seller s calculations must be based …

Fannie Mae Fannie Mae Form 1039 02/23/16. Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Result A1 A2 Subtract A3 Add A4 A5 A6 A7 A8 Equals adjusted rental income. Total A9 Divide Equals adjusted ...

30++ Fannie Mae Income Calculation Worksheet - Worksheets Decoomo Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss) reported on schedule e. Rental Income Worksheet Individual Rental Income From Investment Property (S): (biweekly gross pay x 26 pay periods) / 12 months. Fannie mae publishes four worksheets that lenders may use to calculate rental income.

Fannie Mae Income Worksheet - Fill Out and Use This PDF - FormsPal The Fannie Mae Income Worksheet is a tool for lenders to determine if the borrower's income is stable enough to qualify for a mortgage. If you need to acquire this form PDF, our editor is the thing you need! By clicking the button directly below, you will go to the page where it's possible to modify, download, and print your document.

PDF Rental Income Schedule E Calculation Worksheet B3 3 1 08 Rental Income 02 28 2017 Fannie Mae May 7th, 2018 - General Requirements for Documenting Rental Income If a borrower has a history of renting the subject or another property generally the rental income will be reported on IRS Form 1040 Schedule E of the borrower’s personal tax returns or on Rental Real Estate

Claiming Rental Income to Qualify for a Mortgage: How Do Sep 28, 2022 · Rental income calculation worksheets. Fannie Mae provides worksheets so that you can get a sense of what your rental income may be before bringing your paperwork to a lender. Which worksheet will be appropriate for you depends on whether your property is a principal residence, investment property or commercial holding, as well as how many ...

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae 5. lokak. 2022 · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet – Principal Residence, 2– to 4–unit Property ,

Fannie Mae Rental Income Worksheet - Fill Out and Sign Printable PDF ... Follow the step-by-step instructions below to design your Fannie make income worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

best south indian movies 2022 - oldtimer-angebot.de Form 8829 or the Simplified Method Worksheet) + Business Miles (Page 2, Part IV, Line 44a or Related 4562, Line 30) x Depreciation Rate (2019-26¢ and 2018.Get and Sign Fannie Mae Rental Income Worksheet 2014- 2022 Form Create a custom fannie mae income calculation worksheet > 2014 that meets your industry’s specifications.MGIC Bulletin 04 ...

0 Response to "39 fannie mae rental income calculation worksheet"

Post a Comment