40 2012 child tax credit worksheet

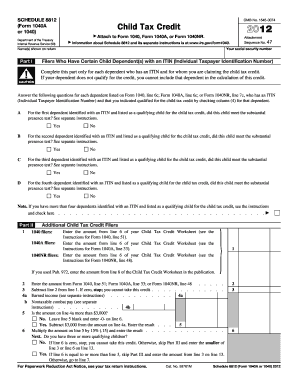

Free Child Tax Credit Worksheet and Calculator (Excel, Word, PDF) Child tax credit worksheet is a document used to provide a helpful lift to the income of parents or guardians who have dependents or children. The child tax credit received usually based on your income. It is just a tax credit not a deduction on taxes. This tax is directly subtracted from the total amount of taxes you would have to pay. Child Tax Credit Worksheet.pdf - Child Tax Credit and... View full document Child Tax Credit and Credit for Other Dependents Worksheet Figure the amount of any credits you are claiming on Schedule 3, lines 1 through 4; Form 5695, line 30; Form 8910, line 15; Form 8936, line 23; or Schedule R.Before you begin: 1. Number of qualifying children under 17 with the required social security number: 1$2,000.

Child Tax Credit Amount 2012: Child Tax Credit Worksheet - Blogger Child Tax Credit Amount 2012: Child Tax Credit Worksheet Child Tax Credit Amount 2012 If you have children who are under 17 as of the end of the tax year, you can get $1,000 from the child tax credit on your tax return. Your child must be 17 before December 31 of the year in which you claim them. Child Tax Credit Worksheet

2012 child tax credit worksheet

Child Tax Worksheet: Fillable, Printable & Blank PDF Form for Free ... Child Tax Worksheet: Fill & Download for Free GET FORM Download the form How to Edit and draw up Child Tax Worksheet Online Read the following instructions to use CocoDoc to start editing and drawing up your Child Tax Worksheet: First of all, find the "Get Form" button and tap it. Wait until Child Tax Worksheet is loaded. Child Tax Credit Worksheet - YouTube Child Tax Credit Worksheet 272 views Dec 15, 2019 2 Dislike Share Save The World Of Tax Preparation 1.18K subscribers Subscribe Child Tax Credit Worksheet Show more Passive... PDF Child Tax Credit 2012 or 1040) Attach to Form 1040, Form 1040A, or Form ... 2012. 47. Name(s) shown on return . Your social security number . Part I Filers Who Have Certain Child Dependent(s) with an ITIN (Individual Taxpayer Identification Number) ... Enter the amount from line 6 of your Child Tax Credit Worksheet (see the Instructions for Form 1040, line 51). 1040A filers:

2012 child tax credit worksheet. Publication 972 (2020), Child Tax Credit and Credit for Other ... Child Tax Credit (CTC) This credit is for individuals who claim a child as a dependent if the child meets additional conditions (described later). It is in addition to the credit for child and dependent care expenses (on Schedule 3 (Form 1040), line 2, and the earned income credit (on Form 1040 or 1040-SR, line 27)). California Earned Income Tax Credit and Young Child Tax Credit If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you might qualify for up to $1,000 through the Young Child Tax Credit. You may go back up to four years to claim CalEITC by filing or amending a state income tax return. Review the charts for past years below to see how much you could get. Forms and Instructions (PDF) - IRS tax forms Instructions for Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico) 2021. 01/28/2022. Form 14815. Supporting Documents to Prove the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) 0419. 04/08/2019. Form 14815-A. Child Tax Credit Worksheet 2015 : 25 2012 Child Tax Credit Worksheet ... It only applies to dependents who are younger than 17 as of the last day of the tax year. Figure the amount of any credits you are claiming on form 5695, part ii, line • to be a qualifying child for the child tax credit, the child must be under age 17 at the end of 2015 and meet the other requirements listed earlier.

› instructions › i5695Instructions for Form 5695 (2020) | Internal Revenue Service If you are claiming the child tax credit or the credit for other dependents for 2020, the amount you enter on line 4 of the worksheet depends on whether you are filing Form 2555. If you are filing Form 2555, enter the amount, if any, from line 16 of the Child Tax Credit and Credit for Other Dependents Worksheet in Pub. 972. › publications › p587Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ... › publications › p501Publication 501 (2021), Dependents, Standard Deduction, and ... If a child is treated as the qualifying child of the noncustodial parent under the rules described earlier for children of divorced or separated parents (or parents who live apart), only the noncustodial parent can claim the child as a dependent and claim the refundable child tax credit, nonrefundable child tax credit, additional child tax ... PDF Worksheet—Line 12a Keep for Your Records Draft as of - IRS tax forms 2018 Child Tax Credit and Credit for Other Dependents Worksheet—Line 12a Keep for Your Records 1. To be a qualifying child for the child tax credit, the child must be your dependent, under age 17 at the end of 2018, and meet all the conditions in Steps 1 through 3 under Who Quali es as Your Dependent. Make sure you checked the box in

Tax Credits | Georgia Department of Revenue Tax Credit Forms You may also need. Qualified Law Enforcement Donation Credit. Qualified Foster Child Donation Credit. Film Tax Credit. Federal Tax Changes Need Help? Help using the Georgia Tax Center. How-to Videos and Instructions for Tax Credits. Send an email (for tax credit questions: select tax, account inquiry, business tax credits) 2011 Child Tax Credit Worksheet - Printable Maths For Kids Capital Gain Transaction Worksheet Turbotax. Line 51 Child Tax Credit Worksheet. 2011 Child Tax Worksheet. Names shown on return. Get thousands of teacher-crafted activities that sync up with the school year. For more information see Form 8867. Have a qualifying child who was under age 17 on December 31 2011. Enter the amount from line 6 of ... PDF Credit Page 1 of 11 8:27 - 14-Jan-2013 Child Tax - IRS tax forms household in 2012, that child meets condition (7) above to be a qualifying child for the child tax credit. Exceptions to time lived with you. A child is consid- ered to have lived with you for more than half of 2012 if the child was born or died in 2012 and your home was this child's home for more than half the time he or she was alive. 23 Latest Child Tax Credit Worksheets [+Calculators & Froms] child tax credit worksheet 09 (295 KB) When is the Credit Amount Refundable As previously stated in the definition, child tax credit is directly deducted from your taxes and is non-refundable. This means that if your credit is actually larger than what you owe, your tax bill will be brought down to zero and any remaining credit will be gone.

PDF Child Tax Credit 2012 or 1040) Attach to Form 1040, Form 1040A, or Form ... 2012. 47. Name(s) shown on return . Your social security number . Part I Filers Who Have Certain Child Dependent(s) with an ITIN (Individual Taxpayer Identification Number) ... Enter the amount from line 6 of your Child Tax Credit Worksheet (see the Instructions for Form 1040, line 51). 1040A filers:

Child Tax Credit Worksheet - YouTube Child Tax Credit Worksheet 272 views Dec 15, 2019 2 Dislike Share Save The World Of Tax Preparation 1.18K subscribers Subscribe Child Tax Credit Worksheet Show more Passive...

Child Tax Worksheet: Fillable, Printable & Blank PDF Form for Free ... Child Tax Worksheet: Fill & Download for Free GET FORM Download the form How to Edit and draw up Child Tax Worksheet Online Read the following instructions to use CocoDoc to start editing and drawing up your Child Tax Worksheet: First of all, find the "Get Form" button and tap it. Wait until Child Tax Worksheet is loaded.

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-01.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-06.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-05.jpg)

0 Response to "40 2012 child tax credit worksheet"

Post a Comment