41 kentucky sales and use tax worksheet

Kentucky Sales And Use Tax - Printable Worksheets Showing top 8 worksheets in the category - Kentucky Sales And Use Tax. Some of the worksheets displayed are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. 51A102 Form And Instructions - Fill Out and Sign Printable PDF Template ... kentucky sales tax registration. kentucky sales and use tax worksheet instructions. Create this form in 5 minutes! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. Get Form. How to create an eSignature for the ky 51a102 form.

PDF Sales and Use Tax K - Kentucky entucky's first entry into the sales tax field occurred in 1934 when the General Assembly enacted a tax of 3 percent on general retail gross receipts. The tax was subsequently re-pealed by the 1936 General Assembly. Kentucky again enacted a sales and use tax effective on July 1, 1960. The sales tax is imposed upon all retailers for the privilege

Kentucky sales and use tax worksheet

Kentucky Accelerated Sales And Use Tax Worksheets - K12 Workbook Worksheets are Retail packet, Local option sales tax and kentucky cities, Kentucky sales and use tax work help, Kentucky sales and use tax work help voor, Kentucky tax alert, Guidelines for the accelerated sales tax payment, 2316 questions answers about paying your sales use tax, Money and sales tax work. *Click on Open button to open and print ... Sales and Use Tax in Kentucky - OnDemand Course | Lorman Education Services Learn detailed information on sales and use tax rules and regulation in Kentucky.Over the past several years, Sales and Use Tax in Kentucky has become one of the most complex areas of Kentucky's tax system given the lack of clarity or guidance on key topics, multitude of exemptions and exclusions from the tax, advancements in technologies and traditional processes, and significant ... Sales and Excise Taxes - TAXANSWERS - Kentucky KRS 138.477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents ($0.03) per kilowatt hour. There are also annual electric vehicle owner registration fees established in KRS 138.475. The effective date for the electric vehicle power tax and ...

Kentucky sales and use tax worksheet. Kentucky - Sales Tax Handbook 2022 KY Sales Tax Calculator. Printable PDF Kentucky Sales Tax Datasheet. Kentucky has a statewide sales tax rate of 6%, which has been in place since 1960. Municipal governments in Kentucky are also allowed to collect a local-option sales tax that ranges from 0% to 2.75% across the state, with an average local tax of 0.008% (for a total of 6.008% ... How Do You Fill Out a Kentucky Sales Tax Form? | Bizfluent Step 3. Calculate your tax liability. Once you have calculated your gross receipts and listed your deductions, subtract your deductions from your gross receipts. For example, if you have $1,200 in gross receipts and $200 in deductions, you owe 6 percent of $1,000 in sales taxes. Six percent of $1,000 is $60. Ky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are Retail packet, Kentucky general information use tax, Kentucky general information use tax contributions, Tax alert, 2020 kentucky individual income tax forms, Kentucky tax alert, Kentucky tax alert, Kentucky tax alert. *Click on Open button to open and print to worksheet. Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Sales And Use Tax. Worksheets are Nebraska net taxable sales and use tax work form 10, Nebraska and local sales and use tax return, Section i verify ownership of your operating business entity, 3862 monthly or quarterly sales and use tax work, 51a205 4 14 kentucky sales and department of revenue use, Work, Work for completing the sales and use tax return ...

Kentucky Sales Tax Calculator - SalesTaxHandbook You can use our Kentucky Sales Tax Calculator to look up sales tax rates in Kentucky by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Kentucky has a 6% statewide sales tax rate , but also has 211 local tax jurisdictions ... Kentucky Sales Tax Guide | Chamber of Commerce To calculate Kentucky's sales and use tax, multiply the purchase price by 6 percent (0.06). For example, an item that costs $100 will have a tax of $6, for a total of $106 (100 times .06 equals 6). If a business sells several items in one transaction, it can figure the tax on each item individually or on the total of the items. How to file a Sales Tax Return in Kentucky - SalesTaxHandbook In the state of Kentucky, all taxpayers have two options for filing their taxes.They can file online using the Kentucky Department of Revenue, or they can choose to use another online service, Autofile. Both of these online systems allow the user to remit payment online. Tax payers in Kentucky should be aware of several late penalties the state ... › us-newsU.S. News: Breaking News Photos, & Videos on the United ... Find the latest U.S. news stories, photos, and videos on NBCNews.com. Read breaking headlines covering politics, economics, pop culture, and more.

Kentucky Imposes Sales and Use Tax on 35 New Services - Dean Dorton Add services not currently subject to tax. Effective January 1, 2023, 35 more services will be to subject to sales and use tax. Here's the list: Photography and photo finishing services. Marketing services. Telemarketing services. Public opinion and research polling services. Lobbying services. Sales Tax Worksheets - Math Worksheets 4 Kids Sales Tax Worksheets. There's nothing too taxing about our printable sales tax worksheets! Teeming with exercises like finding the sales tax, calculating the original price, and solving sales tax word problems, our resources have stupendous practice in store for students in grade 6, grade 7, and grade 8. The pdf tools also let them get used to ... › newsDaily gaming news - Xfire Dec 01, 2022 · Xfire video game news covers all the biggest daily gaming headlines. PDF FAQ Sales and Use Tax - Kentucky FAQ Sales and Use Tax General Date of Issuance: June 14, 2013 1.) Where do I get an application (Form 10A100) for a sales tax account? An application may be obtained by mail, or from the DOR's website by clicking here. ... Kentucky's sales and use tax rate is six percent (6%). Kentucky does not have additional sales taxes imposed by a city ...

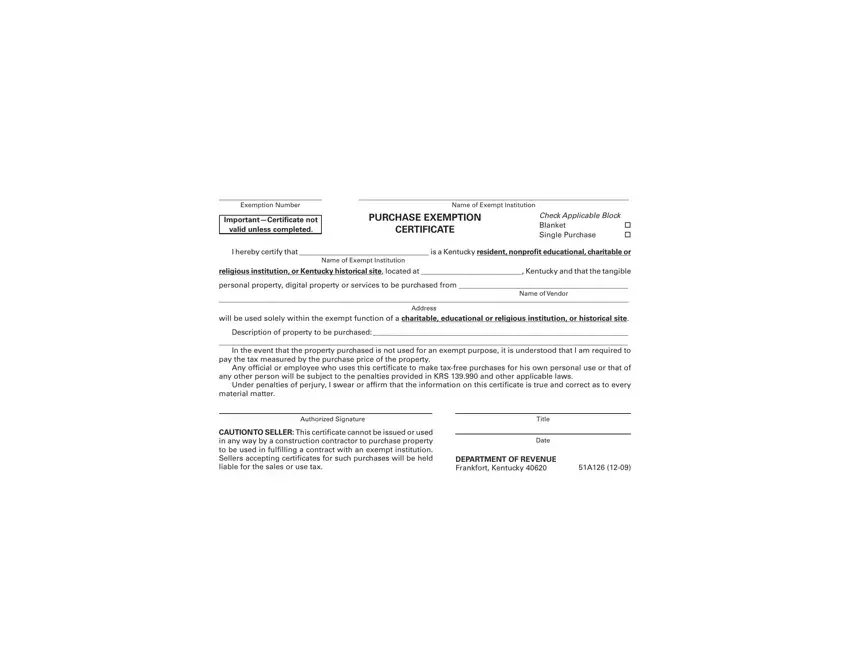

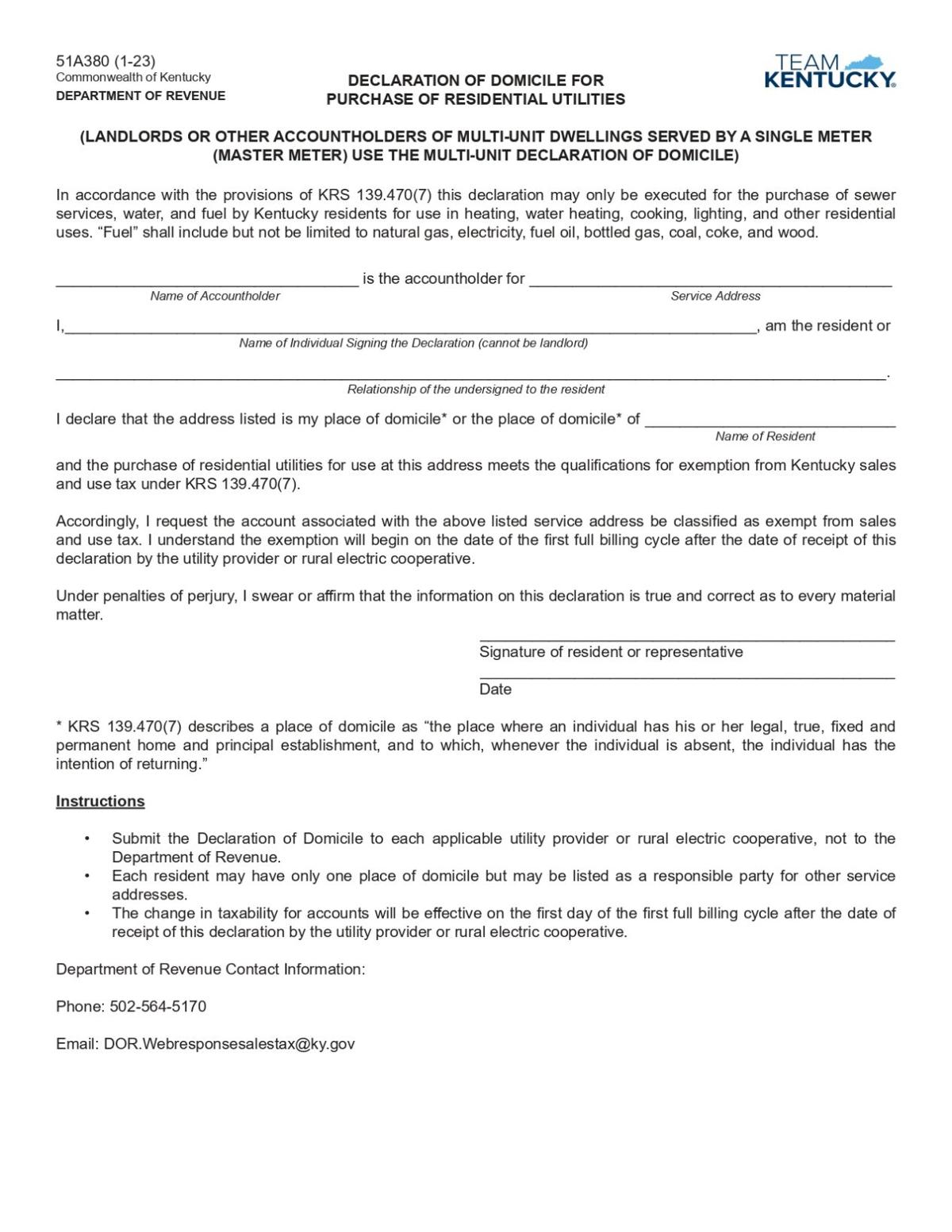

Kentucky Sales Tax Exemptions | Agile Consulting Group - sales and use tax The state of Kentucky levies a 6% state sales tax on the retail sale, lease or rental of most goods and some services. There are no local sales taxes in the state of Kentucky, and as a result, there are no direct Kentucky sales tax exemptions. Use tax is also collected on the consumption, use or storage of goods in Kentucky if sales tax was not ...

Kentucky Sales And Use Tax Form Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Form. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, 2018 kentucky individual income tax forms, Sales tax return work instructions, Sales and use tax audit manual, 01 117 texas sales and use tax return, Efo026 idaho business income tax payments work, Application for fueltax refund for use of power ...

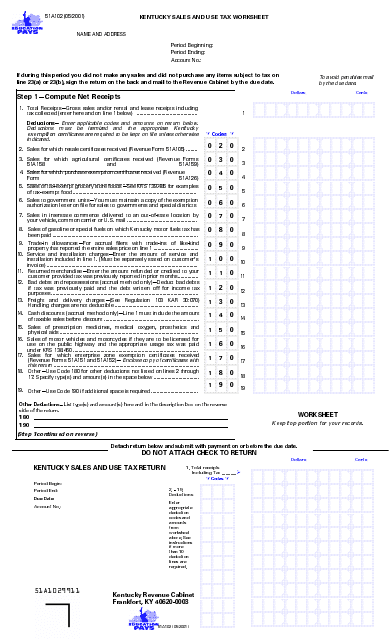

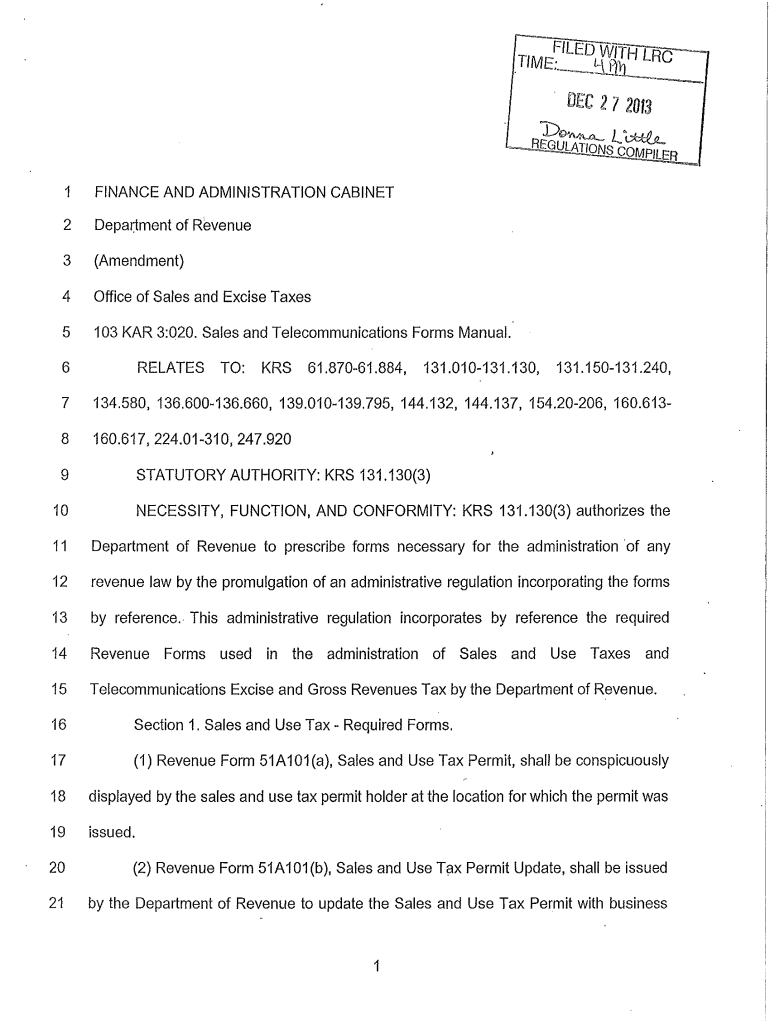

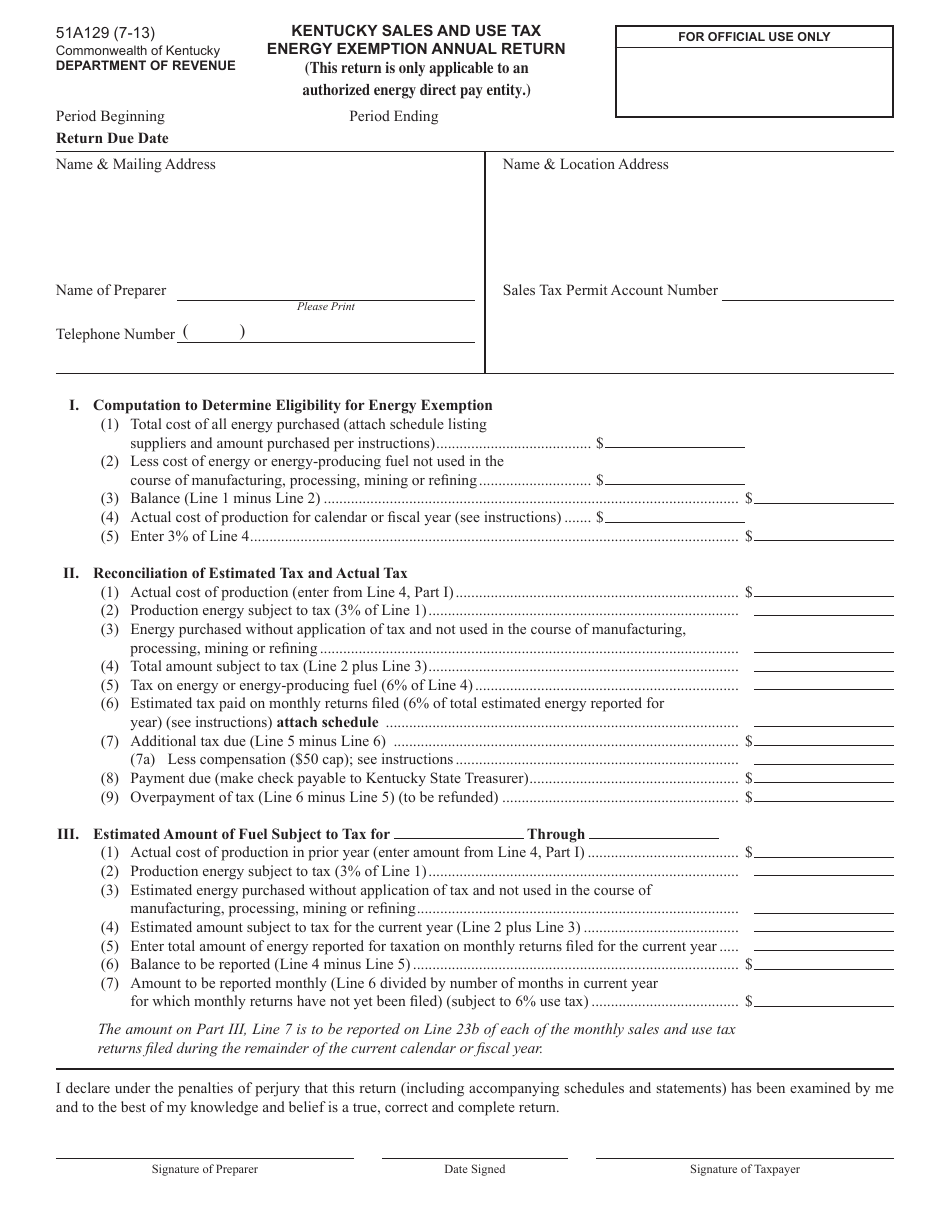

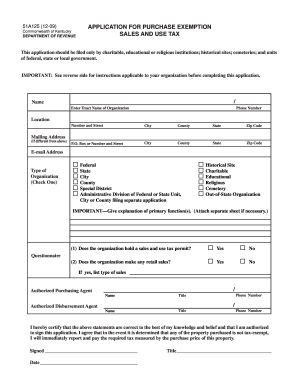

Sales & Use Tax - Department of Revenue - Kentucky The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes.

› instructions › i1040sca2021 Instructions for Schedule A (2021) | Internal Revenue ... Enter your local general sales tax rate, but omit the percentage sign. For example, if your local general sales tax rate was 2.5%, enter 2.5. If your local general sales tax rate changed or you lived in more than one locality in the same state during 2021, see the instructions for line 3 of the worksheet: 3.. 4. Did you enter -0- on line 2?

› overwatch-2-reaches-25-millionOverwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

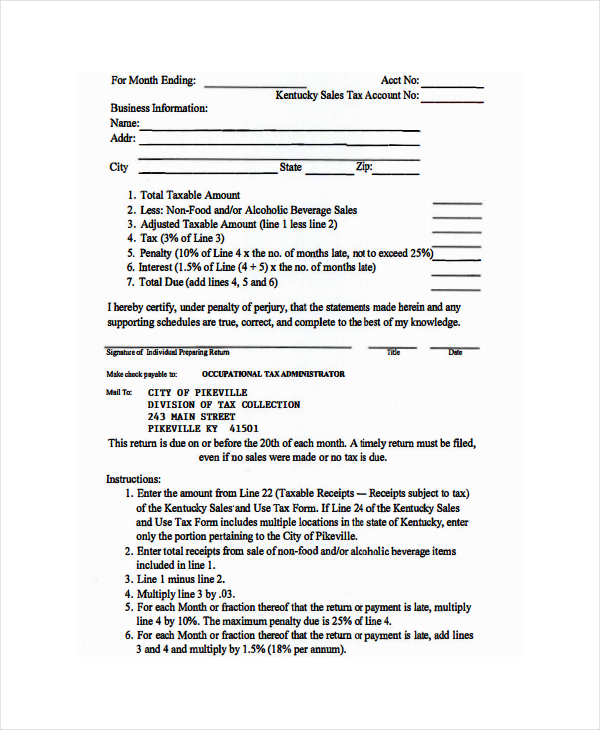

Form 51A102 "Sales and Use Tax Worksheet" - Kentucky - TemplateRoller Download Printable Form 51a102 In Pdf - The Latest Version Applicable For 2022. Fill Out The Sales And Use Tax Worksheet - Kentucky Online And Print It Out For Free. Form 51a102 Is Often Used In Kentucky Tax Forms, Kentucky Department Of Revenue, United States Tax Forms, Kentucky Legal Forms, Tax And United States Legal Forms.

PDF RETAIL PACKET - Kentucky At present the Sales and Use Tax returns and the Consumer's Use Tax form (51A113) can be filed online. Form numbers include 51A102, 51A102E, 51A103, and 51A103E.

› incometaxNorth Carolina Income Tax Rates for 2022 The North Carolina income tax has one tax bracket, with a maximum marginal income tax of 5.25% as of 2022. Detailed North Carolina state income tax rates and brackets are available on this page. Tax-Rates.org — The 2022-2023 Tax Resource

Forms - Department of Revenue - Kentucky Tax Type Tax Year (Select) Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters

Find a CERTIFIED FINANCIAL PLANNER™ Professional or Advisor ... Create Your Financial Future. Set realistic financial goals and put them into action with the help of a CERTIFIED FINANCIAL PLANNER™ professional who is a member of the Financial Planning Association.

Mortgage industry of the United States - Wikipedia Mortgage lenders. Mortgage lending is a major sector finance in the United States, and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurers.Mortgages are debt securities and can be conveyed and assigned freely to other holders. In the U.S., the Federal government created several programs, or government sponsored …

51a102 Kentucky Sales Anduse Tax Worksheets - K12 Workbook Displaying all worksheets related to - 51a102 Kentucky Sales Anduse Tax. Worksheets are Retail packet, Kentucky sales and use tax work help, Tax alert, Nebraska and local sales and use tax return form. *Click on Open button to open and print to worksheet. 1. RETAIL PACKET.

en.wikipedia.org › wiki › Incorporation_(business)Incorporation (business) - Wikipedia Lee the court ruled that there could be a corporate tax, essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom.

PDF KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.. To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars

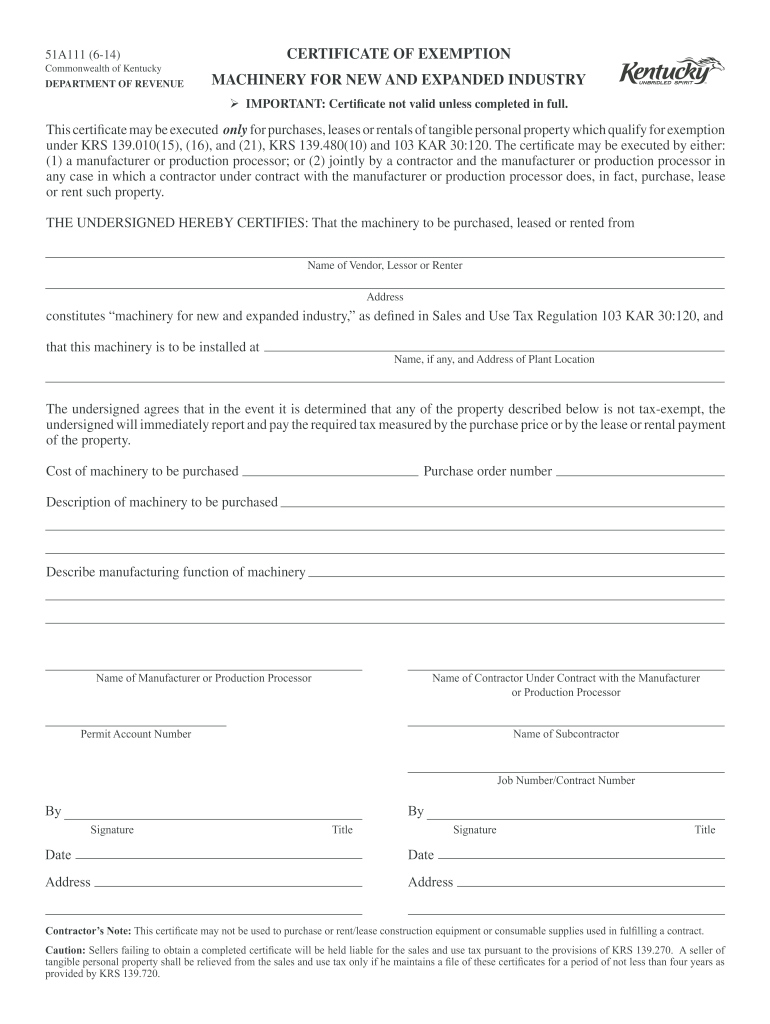

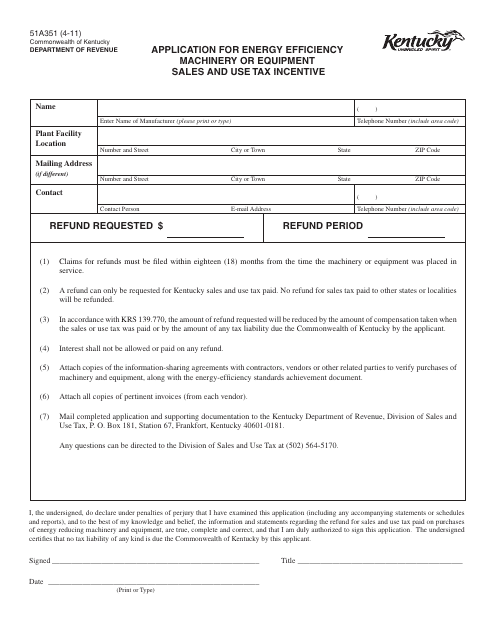

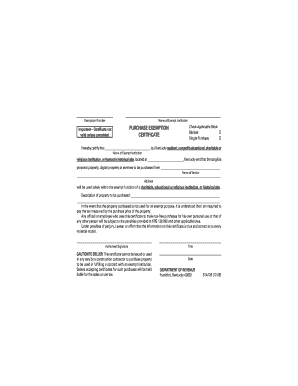

Exemptions from the Kentucky Sales Tax - SalesTaxHandbook While the Kentucky sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Kentucky. Sales Tax Exemptions in Kentucky . In Kentucky, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers.. Several exceptions to the state sales tax are goods and machinery ...

afn.netAmerican Family News Aug 02, 2022 · American Family News (formerly One News Now) offers news on current events from an evangelical Christian perspective. Our experienced journalists want to glorify God in what we do.

What transactions are subject to the sales tax in Kentucky? In the state of Kentucky, legally sales tax is required to be collected from tangible, physical products being sold to a consumer. Several exceptions to this tax are most types of farming equipment, prescription medication, and equipment used for construction. This means that someone selling furniture would be required to charge sales tax, but ...

kentucky sales and use tax worksheet 51a102: Fill out & sign online ... Add the kentucky sales and use tax worksheet 51a102 for redacting. Click on the New Document button above, then drag and drop the file to the upload area, import it from the cloud, or using a link. Alter your template. Make any adjustments needed: insert text and photos to your kentucky sales and use tax worksheet 51a102, highlight details that ...

Kentucky Sales & Use Tax Guide - Avalara - Taxrates Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. Kentucky first adopted a general state sales tax in 1960, and since that time, the rate has risen to 6 percent. In many states, localities are able to impose local sales taxes on top of the state sales tax. However, as of June 2019, there are ...

Sales and Excise Taxes - TAXANSWERS - Kentucky KRS 138.477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents ($0.03) per kilowatt hour. There are also annual electric vehicle owner registration fees established in KRS 138.475. The effective date for the electric vehicle power tax and ...

Sales and Use Tax in Kentucky - OnDemand Course | Lorman Education Services Learn detailed information on sales and use tax rules and regulation in Kentucky.Over the past several years, Sales and Use Tax in Kentucky has become one of the most complex areas of Kentucky's tax system given the lack of clarity or guidance on key topics, multitude of exemptions and exclusions from the tax, advancements in technologies and traditional processes, and significant ...

Kentucky Accelerated Sales And Use Tax Worksheets - K12 Workbook Worksheets are Retail packet, Local option sales tax and kentucky cities, Kentucky sales and use tax work help, Kentucky sales and use tax work help voor, Kentucky tax alert, Guidelines for the accelerated sales tax payment, 2316 questions answers about paying your sales use tax, Money and sales tax work. *Click on Open button to open and print ...

0 Response to "41 kentucky sales and use tax worksheet"

Post a Comment