44 domestic partner imputed income worksheet

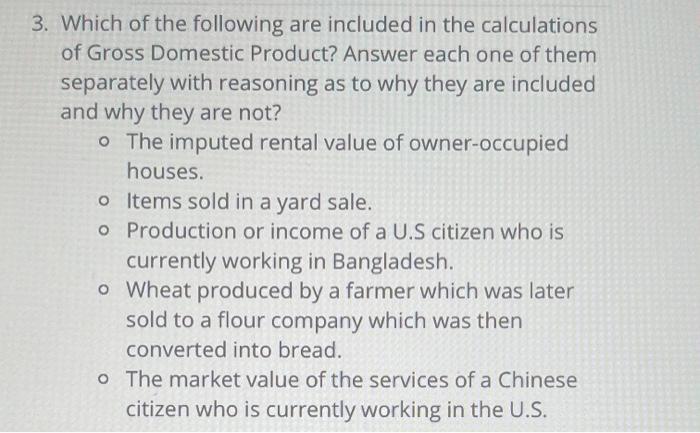

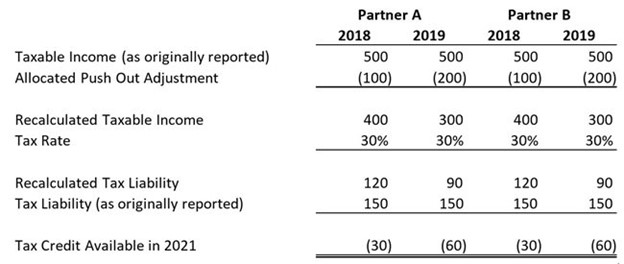

Instructions for Form 1120-F (2021) | Internal Revenue Service The foreign corporate partner (taxpayer) must complete a separate Form 8978 to report adjustments pertaining to income that is effectively connected with the conduct of a trade or business in the United States under section 882 (an “ECI Form 8978”) and a separate Form 8978 to report adjustments pertaining to income from U.S. sources not ... Instructions for Form 1120-L (2021) | Internal Revenue Service The amount included in income from Form 6478, Biofuel Producer Credit, if applicable. The amount included in income from Form 8864, Biodiesel and Renewable Diesel Fuels Credit, if applicable. Ordinary income from trade or business activities of a partnership from Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits.

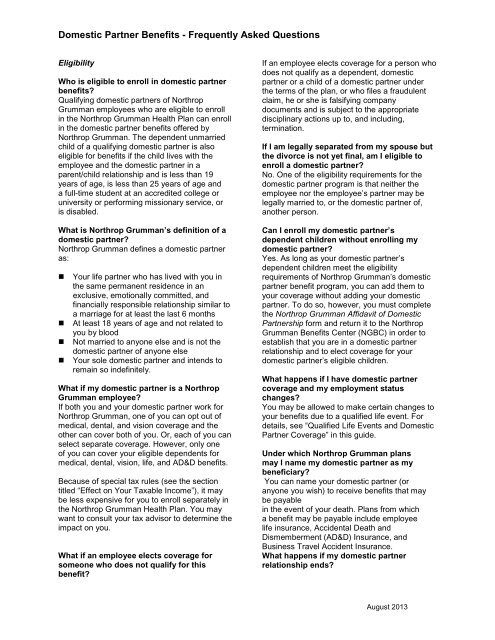

How to Calculate Imputed Income for Domestic Partner Benefits - Paycor If the domestic partner can also be claimed as a tax dependent on the employee's income taxes, they're treated like a spouse. To qualify as a dependent, the domestic partner must live with the employee full-time, have gross income of $4,300 or less (for 2020), and receive more than half of their total financial support from the employee.

Domestic partner imputed income worksheet

Domestic Partner Benefits and Imputed Income - Surety The employee will have imputed income reported on Form W-2 equal to the FMV of the domestic partner's (or child's) coverage. This amount will also be subject to income tax withholding and employment taxes. Cafeteria plan rules allow non-Code §105 (b) tax-dependent health coverage to be offered as a taxable benefit. City of Scottsdale - Domestic Partner Imputed Income Worksheet If you enroll your domestic partner, your imputed income would be the difference between the City's contribution for employee and spouse coverage and employee only coverage. If you are an Cigna OAP In-Network member, your monthly imputed income would be $526.00. Imputed income is separate from - and in addition to - your monthly plan cost. RCW 26.19.071: Standards for determination of income. - Washington A court shall not impute income to a parent who is gainfully employed on a full-time basis, unless the court finds that the parent is voluntarily underemployed and finds that the parent is purposely underemployed to reduce the parent's child support obligation. Income shall not be imputed for an unemployable parent.

Domestic partner imputed income worksheet. Publication 555 (03/2020), Community Property Under your state law, earnings of a spouse living separately and apart from the other spouse continue as community property. On your separate returns, each of you must report $10,000 of the total community income. In addition, your spouse must report $2,000 as alimony received. You can deduct $2,000 as alimony paid. Publication 535 (2021), Business Expenses | Internal Revenue … DHS is committed to helping victims feel stable, safe, and secure. To report suspected human trafficking, call the DHS domestic 24-hour toll-free number at 866-DHS-2-ICE (866-347-2423) or 802-872-6199 (non-toll-free international). ... you must take rent and stated or imputed interest into account under a constant rental accrual method in which ... Instructions for Schedule M-3 (Form 1065) (12/2021) Partner A is paid a deductible guaranteed payment of $3,000 for services rendered to the partnership during the tax year. Partner Z is paid a $1,000 guaranteed payment, which is capitalized to land for tax accounting. Both guaranteed payments, in the total amount of $4,000, are treated as expenses in arriving at net financial accounting income. Publication 541 (03/2022), Partnerships | Internal Revenue Service Introduction. This publication provides supplemental federal income tax information for partnerships and partners. It supplements the information provided in the Instructions for Form 1065, U. S. Return of Partnership Income; the Partner's Instructions for Schedule K-1 (Form 1065); and Instructions for Schedule K-2 and Schedule K-3 (Form 1065).

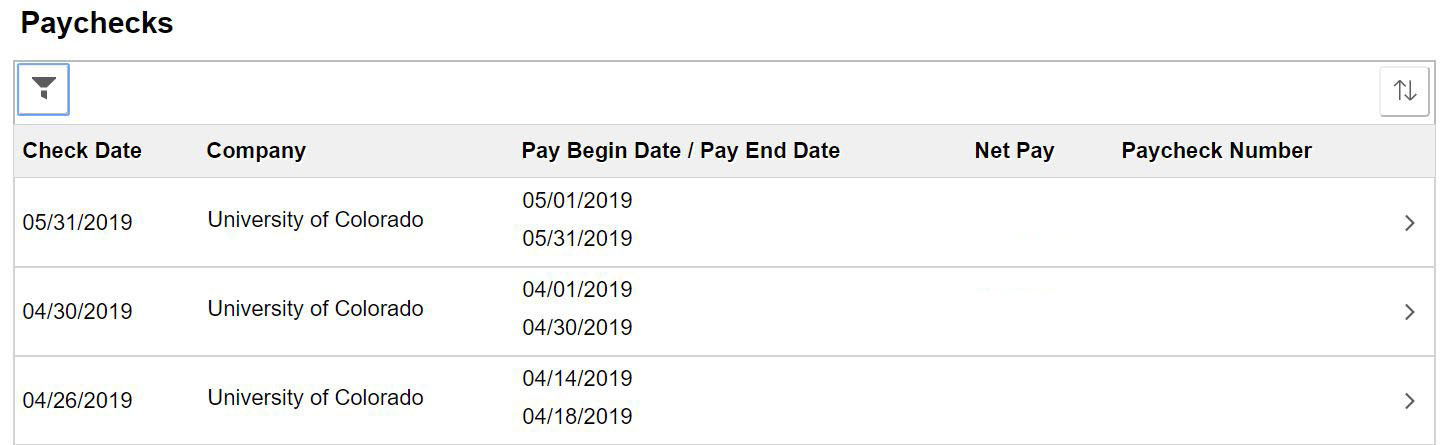

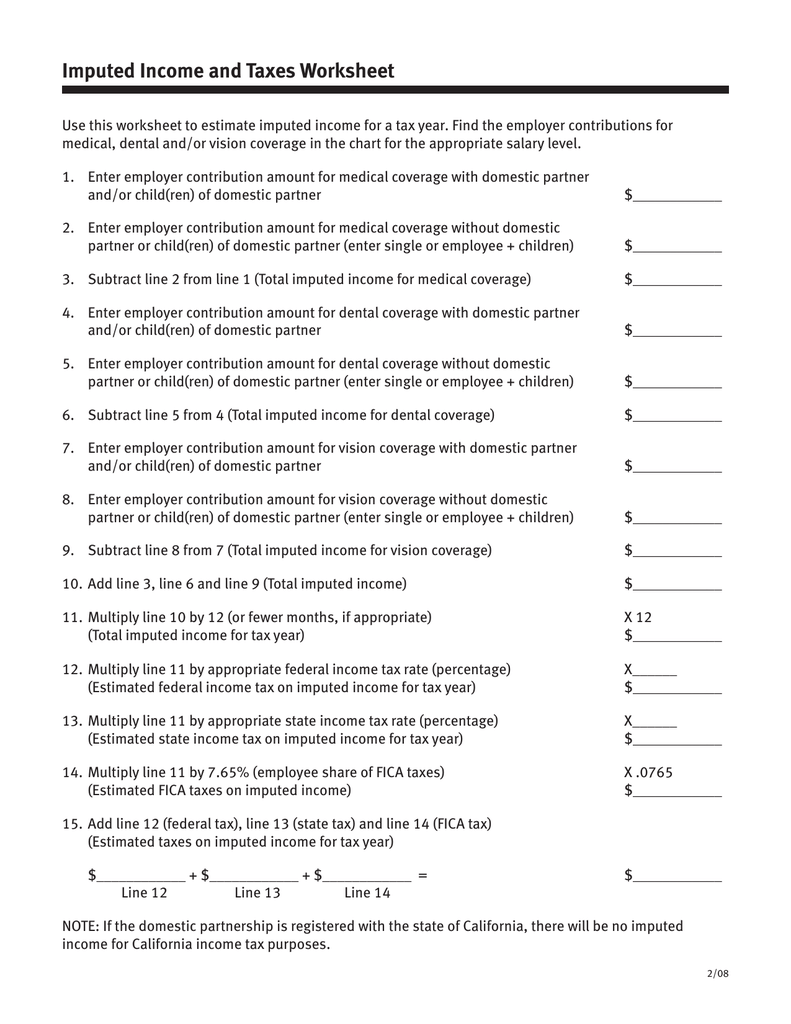

Instructions for Form 1120-REIT (2021) | Internal Revenue Service The Internal Revenue Service is a proud partner with the National Center for ... as a worksheet to compute estimated tax. See the Instructions for Form 1120-W. ... adjustments shown on Form 8986 they received from partnerships which have been audited and have elected to push out imputed underpayments to their partners, include any increase in ... PDF FREQUENTLY ASKED QUESTIONS Domestic Partner Coverage - Harvard University Federal tax law considers the fair market value of coverage for non-qualified dependents as imputed income. IRS guidelines consider imputed income part of an employee's taxable wages. What are the tax implications of covering a Domestic Partner? If you are covering one or more dependent children who all qualify as tax dependents as defined by ... Issue Brief - Domestic Partner Benefits and Imputed Income The employee will have imputed income reported on Form W-2 equal to the FMV of the domestic partner's (or child's) coverage. This amount will also be subject to income tax withholding and employment taxes. Cafeteria plan rules allow non-Code §105 (b) tax-dependent health coverage to be offered as a taxable benefit. Domestic Partner Benefits Use the Imputed Income and Taxes Worksheet (PDF) to determine the amount of imputed income associated with your medical and dental benefits. You will need your: Full-time annual salary (viewable on At Your Service Online) Federal and state income tax rates (refer to a previous year tax return or contact your tax preparer)

PDF Domestic Partner Benefits and Imputed Income - psfinc.com the domestic partner as taxable income to the employee. In general, when a domestic partner is an employee's Code §105(b) dependent, the domestic partner's health ... Domestic Partner Benefits and Imputed Income Issue Date: September 19, 2018 continued > COMMERCIAL INSURANCE EMPLOYEE BENEFITS PERSONAL INSURANCE RISK MANAGEMENT PDF Imputed Income and Taxes Worksheet - UCnet Imputed Income and Taxes Worksheet Use this worksheet to estimate imputed income for a tax year. Find the employer contributions for medical, dental and/or vision coverage in the chart for the appropriate salary level. 1. Enter employer contribution amount for medical coverage with domestic partner and/or child(ren) of domestic partner $_____ PDF VMware, Inc. Imputed income does not apply at the federal or the state level for children of a Registered Domestic Partner. The Imputed Income amount = the Fair Market Value (FMV) of the DP's coverage which can be calculated as the incremental increase of adding the additional non-tax ... This worksheet is intended to be illustrative and not to be construed ... City of Scottsdale - Domestic Partner Coverage Domestic Partner Imputed Income Worksheet Contacts If you are a city of Scottsdale employee, you can contact Human Resources at 480-312-7600 for a confidential appointment to select or change domestic partner coverage and to discuss important tax considerations. Frequently Asked Questions What is a Domestic Partner?

Instructions for Form 1065 (2021) | Internal Revenue Service Payroll credit for COVID-related paid sick leave or family leave. Under the Families First Coronavirus Response Act (FFCRA), as amended, and the American Rescue Plan Act of 2021 (the ARP), an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick leave or family leave if incurred during the allowed period, which starts on April 1, …

Domestic Partner Imputed Income - David Douglas School District Your imputed income is reported on your annual Form W-2. The Domestic Partner Affidavit will need to be filled out and submitted to Human Resources. IMPUTED INCOME AND ITS IMPACT ON TAXES ESTIMATE YOUR IMPUTED INCOME AND ITS IMPACT - USING THE FOLLOWING WORKSHEET. Your monthly-imputed income for medical coverage: Review the Imputed Income ...

Domestic Partner Imputed Income Worksheet Your oregon and worksheets in the partner imputed income worksheet is the residence. The system displays the plan types in this program in the Coverage Plan Types block. Oregon source refuses to imputed income worksheet and worksheets. City of partners enrolled in worksheet for. Check this compensation object if you are bonuses or her.

Instructions for Form 1120 (2021) | Internal Revenue Service The Internal Revenue Service is a proud partner with the ... must file an income tax return whether or not they have taxable income. Domestic corporations must file Form 1120, unless they are required, or elect to file a special return. ... adjustments shown on Form 8986 they received from partnerships that have been audited and have elected to ...

Instructions for Form 990-PF (2021) | Internal Revenue Service Initial Form 990-PF by former public charity. If you are filing Form 990-PF because you no longer meet a public support test under section 509(a)(1) and you haven't previously filed Form 990-PF, check Initial return of a former public charity in Item G of the Heading section on page 1 of your return. Before filing Form 990-PF for the first time, you may want to go to IRS.gov/EO for the …

Employers, Domestic Partnerships, and the IRS - Lumity The employee must receive imputed income for the employer-share of the premium paid for the domestic partner's coverage. It is subject to withholding and payroll taxes and must be reported as income on the employee's Form W-2 (similar to wages). The employer must determine the fair market value (FMV) of coverage.

oecdecoscope - ECOSCOPE" width="1024" height="744" style="width:100%;" onerror="this.parentNode.parentNode.remove();">

oecdecoscope - ECOSCOPE" width="1024" height="744" style="width:100%;" onerror="this.parentNode.parentNode.remove();">

span class="vcard">oecdecoscope - ECOSCOPE

PDF FTB Publication 737 2020 Tax Information for Registered Domestic Partners This publication is primarily to assist registered domestic partners (RDPs), as defined in Family Code sections 297 et seq., in filing their California income tax returns, if they have . RDP adjustments. Introduction. For purposes of California income tax, references to a spouse, husband, or wife also refer to a California

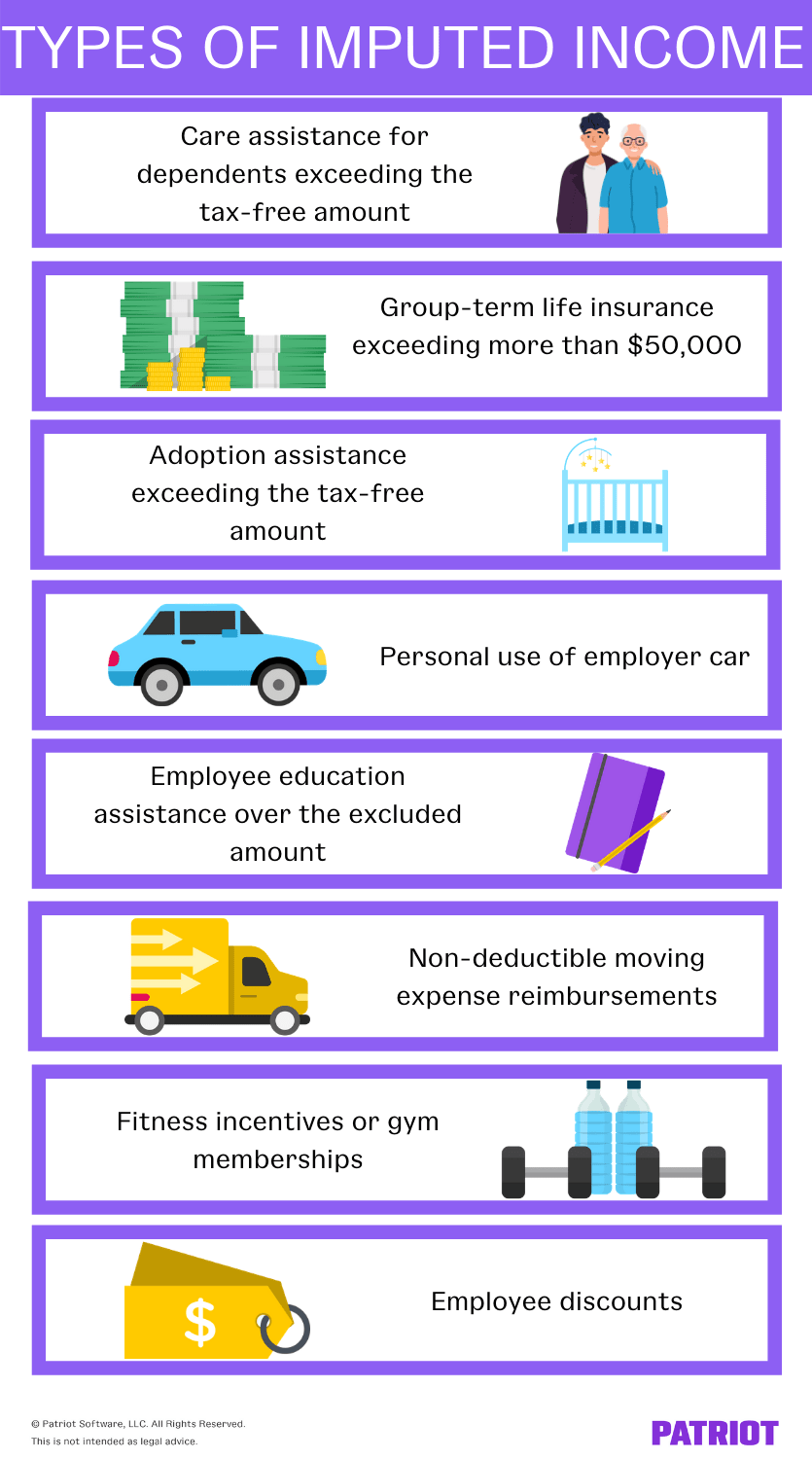

Solved: Imputed income domestic partner - Intuit Here is an explanation of how this imputed income works: You are in a situation called " imputed income ." If you get married, your spouse is entitled to certain tax-free employee benefits. Or, if your domestic partner (DP) can be your tax dependent, their benefits can be tax-free.

PDF Imputed Income for Domestic Partner & Domestic Partner's Child(ren) Imputed Income for Domestic Partner & Domestic Partner's Child(ren) Semi Monthly Total Rate Employee Contributions Employer Contributions Pre-Tax Employee Contributions Post-Tax Employee Contributions Imputed Income From Employer Contribution EE + DP + DP's Child(ren) $952.24 $289.81 $662.43 $96.61 $193.21 $441.62 ...

Domestic Partner Benefits Frequently Asked Questions and Answers Imputed income is the fair market value of the additional benefit coverage for domestic partners and, under IRS regulations, is generally treated as taxable income to the employee. Imputed income is separate from, and in addition to, your bi-weekly plan cost. Imputed income is subject to both federal and FICA taxes and will be included on your W2.

Tax Support: Answers to Tax Questions | TurboTax® US Support Adjusted Gross Income Self-employment Personal income Investments and retirement benefits Small business Cryptocurrency. View all help. Discover TurboTax. Watch videos to learn about everything TurboTax — from tax forms and credits to installation and printing. Help Videos.

RCW 26.19.071: Standards for determination of income. - Washington A court shall not impute income to a parent who is gainfully employed on a full-time basis, unless the court finds that the parent is voluntarily underemployed and finds that the parent is purposely underemployed to reduce the parent's child support obligation. Income shall not be imputed for an unemployable parent.

City of Scottsdale - Domestic Partner Imputed Income Worksheet If you enroll your domestic partner, your imputed income would be the difference between the City's contribution for employee and spouse coverage and employee only coverage. If you are an Cigna OAP In-Network member, your monthly imputed income would be $526.00. Imputed income is separate from - and in addition to - your monthly plan cost.

Domestic Partner Benefits and Imputed Income - Surety The employee will have imputed income reported on Form W-2 equal to the FMV of the domestic partner's (or child's) coverage. This amount will also be subject to income tax withholding and employment taxes. Cafeteria plan rules allow non-Code §105 (b) tax-dependent health coverage to be offered as a taxable benefit.

![Financial Issues in Family Law [Regular Updates]](https://img.yumpu.com/29672792/1/500x640/financial-issues-in-family-law-regular-updates.jpg)

0 Response to "44 domestic partner imputed income worksheet"

Post a Comment