44 gross pay vs net pay worksheet

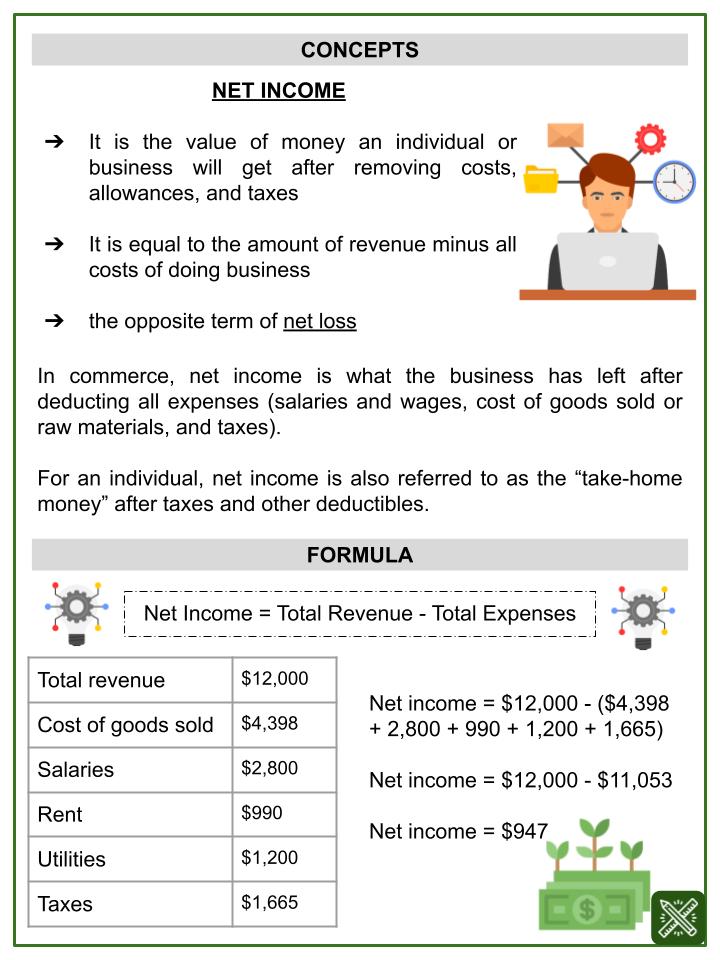

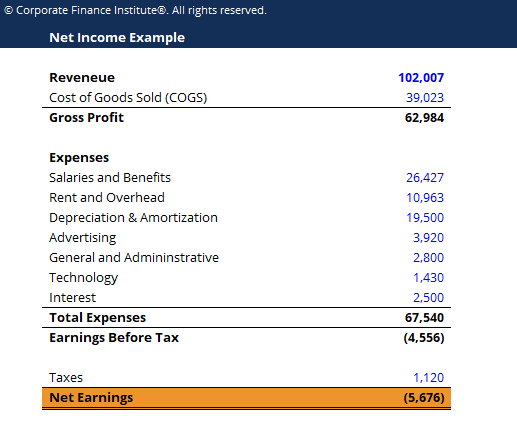

Gross Pay vs Net Pay: How to Calculate the Difference Gross pay, also called gross wages, is the amount an employee would receive before payroll taxes and other deductions. By contrast, net pay is the amount left over after deductions have been taken from an employee's gross pay. Net pay is sometimes called take-home pay. Net vs Gross Income: Key Considerations for HR and Employees Net pay is the amount of money that employees end up taking home once all payroll deductions have been calculated. This means that all the necessary payroll deductions need to be made from the gross pay in order to get the actual amount for net pay. Net pay numbers are lower than gross pay because of certain mandatory deductions that cannot be ...

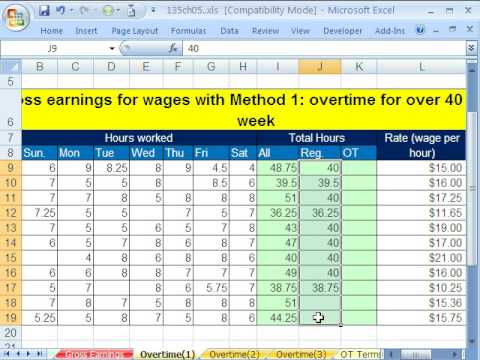

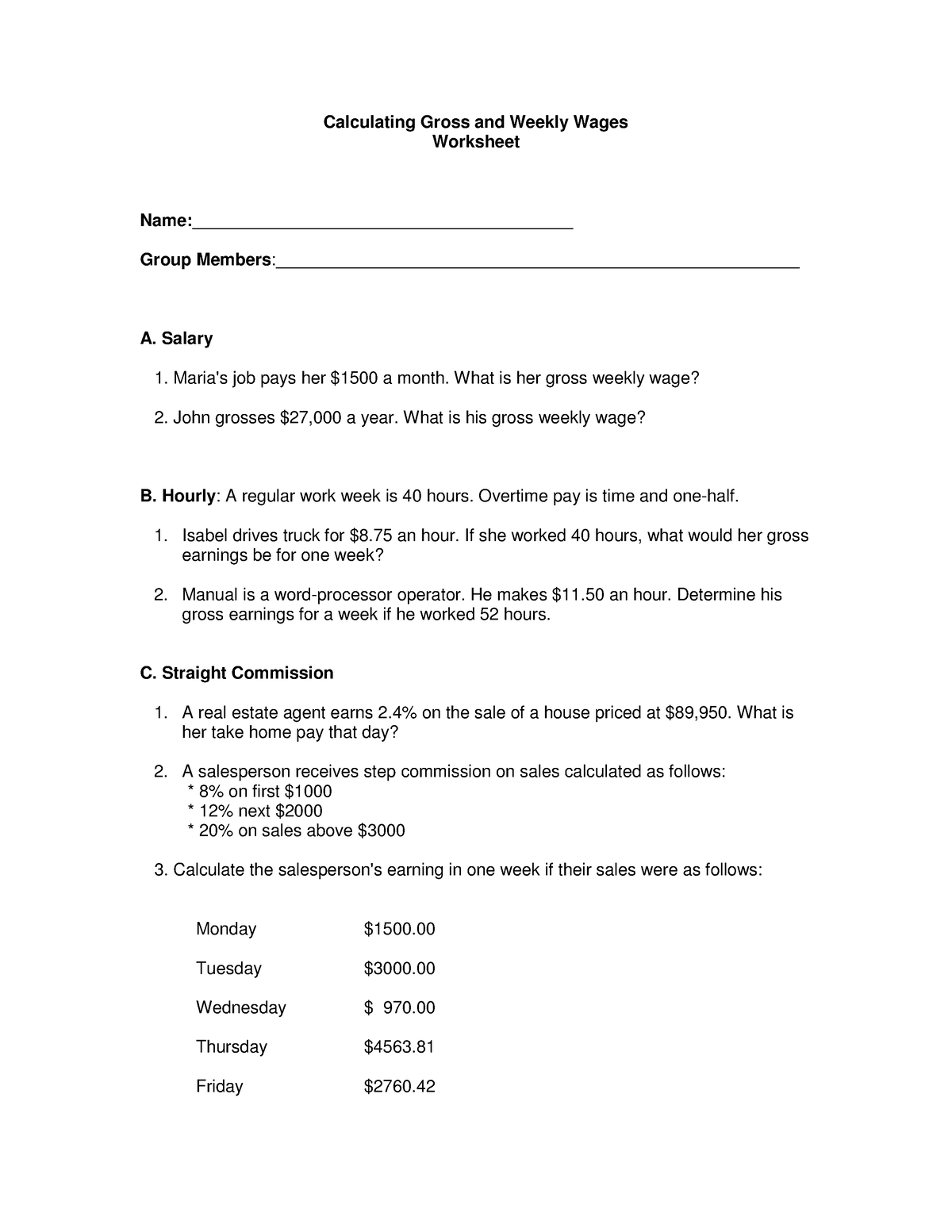

Gross Pay Worksheets - Printable Worksheets Some of the worksheets displayed are Worked, Calculating gross and weekly wages work, Work 33 calculating gross pay with overtime name, Work 34 gross pay with overtime, Gross income chapter straight time pay, Chapter 1 lesson 1 computing wages, Calculation of income work instructions, Directions using the pay check stub above answer the.

Gross pay vs net pay worksheet

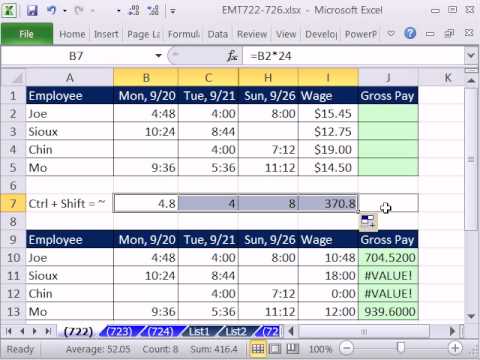

Lesson Plan: Calculating Gross and Net Pay - Scholastic So a person making $1,200 per week will have $50.40 (.042 x $1,200) deducted from his or her weekly gross pay. Step 4: Distribute the Plan, Save, Succeed! Worksheet: Where Did the Money Go? printable to students. Step 5: After students have completed the questions, use your copy of the Answer Key: Plan, Save, Succeed! Gross Pay Vs. Net Pay: What's The Difference? - Forbes Advisor The key differences between gross pay vs. net pay are the items deducted: Gross pay includes 100% of the wages, reimbursements, commissions and bonuses an employee earns in a given pay period. Net ... Career Readiness | Gross Pay vs. Net Pay What is Gross Pay? When you are hired your boss agrees to pay you an hourly rate or gross salary. ... The result of this calculation is your gross pay. What is Net Pay? ... Assignment: For this module, you will be creating a worksheet in Excel that organizes all of the information below: Employee 1: Karla Smitts has worked from 8:00-4:30 from ...

Gross pay vs net pay worksheet. Net And Gross Income Teaching Resources | Teachers Pay Teachers This activity will have students working together to determine the Net Income after Deductions have been taken out of Gross Pay. Students can work in pairs, alone, in small group or tutoring! Activity comes with-Blank Pay ChecksGross Income CardsDeduction CardsTeacher and Students InstructionsActivity also comes with an EXIT TICKET!!!! Gross And Net Pay Teaching Resources | Teachers Pay Teachers This is a worksheet for students to find gross pay and net wages. There are 10 questions that are in word problem format. Subjects: Business, Word Problems Grades: 9th - 12th Types: Printables, Worksheets Add to cart Wish List Gross & Net Pay - Labour Market - Theory & Calculations by George Frost Economics and Business Resources $4.00 Zip PDF Gross Pay and Net Pay Worksheet GROSS/NET PAY PROBLEMS CONTINUED 7. Martha Green worked 40 regular-time hours at $10.00 per hour and 4 overtime hours at $15.00 per hour. Find Martha's gross pay for the week. _____ 8. Ed Jones earns $8.00 per hour. Last week he worked 40 regular time hours and 5 ... webquest worksheet Author: Ken Bartels Created Date: Net Pay vs. Gross Pay—What's The Difference? | Capterra Net pay. Is calculated by adding all wages, commissions, tips, reimbursements, and bonuses that a worker earns in a given pay period. Is calculated by taking gross pay and subtracting any deductions, including income tax withholdings, FICA taxes, benefits, and garnishments. Net pay is what an employee actually takes home for the pay period.

Gross Pay vs Net Pay: What's the Difference and How to Calculate ... Net pay is what happens to an employee's income after all gross pay deductions have been taken out. It doesn't matter if we're talking about hourly gross vs. Gross Pay And Net Pay Teaching Resources | Teachers Pay Teachers Learning how to differentiate between gross and net pay is exactly one of those types of skills!With this purchase, your students will have a chance to practice calculating gross and net pay by using scaffolded worksheets that support them each Subjects: English Language Arts, Life Skills, Special Education Grades: 2nd - 12th Types: Gross vs Net Income - Difference, Definition, Formulas, Examples - Cuemath Example 1: If the gross salary of a person is $47500, and she has paid taxes of $1500. Calculate her net salary. Solution: By using the comparison of gross vs net income, we know that net income is the deduction of taxes from the gross income. So, net income = gross income - taxes. Net income = $47500 - $1500. Net And Gross Income Activities Worksheets - K12 Workbook Displaying all worksheets related to - Net And Gross Income Activities. Worksheets are Worked, Gross receipts work, Sga work used when gross earned income is over the, Four cornerstones of financial literacy, Personal financial workbook, Net pay work calculate the net pay for each, Its your paycheck lesson 2 w is for wages w 4 and w 2, 2015 ...

Net And Gross Income Activities - Printable Worksheets Showing top 8 worksheets in the category - Net And Gross Income Activities. Some of the worksheets displayed are Worked, Gross receipts work, Sga work used when gross earned income is over the, Four cornerstones of financial literacy, Personal financial workbook, Net pay work calculate the net pay for each, Its your paycheck lesson 2 w is for wages w 4 and w 2, 2015 instructions for form 8582. Paycheck Math - Finance in the Classroom Assume that the required income withholdings are 27% of the total. Record the Net Pay below. Hours Worked. Gross Pay. Deductions. Net Pay. Net Pay Worksheets - K12 Workbook Worksheets are Net pay work calculate the net pay for each, Net worth calculation work, Directions using the pay check stub above answer the, Its your paycheck lesson 2 w is for wages w 4 and w 2, Reading a pay stub extension activity for managing money, Personal financial workbook, Chapter 1 lesson 1 computing wages, Work. Gross Pay, Net Pay and Deductions - Maths Standard - Year 11 - NSW If you only have one source of income, your gross pay is the total amount that your employer has agreed to pay you. Your net pay is the amount that the employer ...

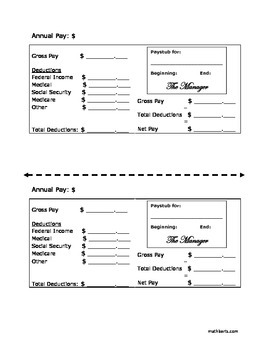

Reading a Pay Stub Extension Activity for Managing Money ... understand the difference between gross and net pay. • identify taxes and deductions taken ... Calculating Monthly Gross & Net Pay worksheet (1 per student).

Gross Pay Worksheet Teaching Resources | Teachers Pay Teachers This is a worksheet for students to find gross pay and net wages. There are 10 questions that are in word problem format. Subjects: Business, Word Problems Grades: 9th - 12th Types: Printables, Worksheets Add to cart Life Skills Practice Monthly Budget with Mock Paychecks, Bills, and Worksheets by Gregory Soave 4.7 (39) $9.50 Zip

Calculating Gross Pay, NIB Contribution and Net Pay worksheet Payroll online worksheet for 12. You can do the exercises online or download the worksheet as pdf.

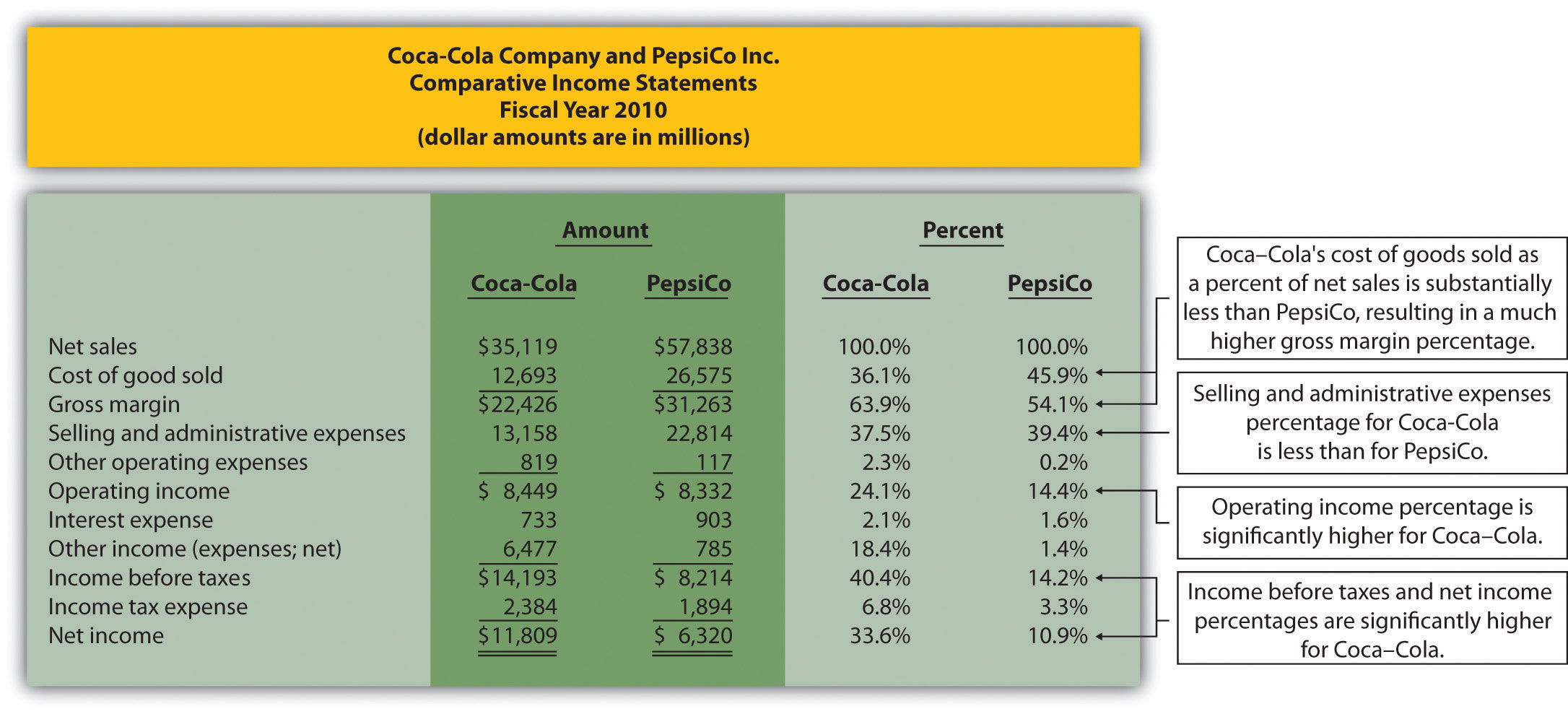

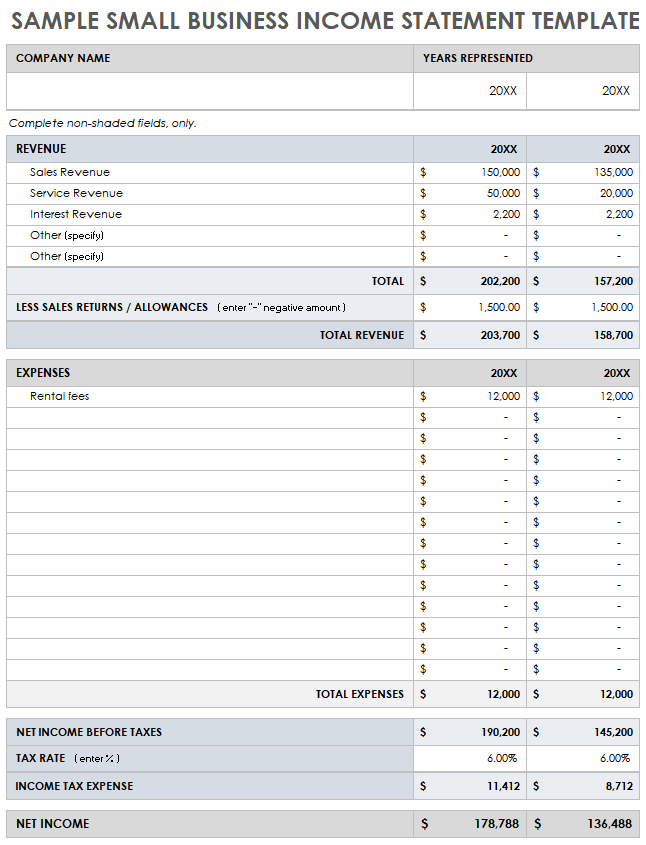

Gross Income vs. Net Income: What's the Difference? - The Balance Gross income is the total income a business earns before expenses. It's the income from sales of the business, after deducting sales returns and allowances (discounts). If your business sells products, calculate COGS and deduct it to reduce gross income. Net income, meanwhile, is the income of a business minus expenses.

Gross Pay and Net Pay: What's the Difference? - PaycheckCity Mar 13, 2020 ... The total amount earned by an employee is known as the gross pay. When "gross" is referring to a person's income, it can also be called gross ...

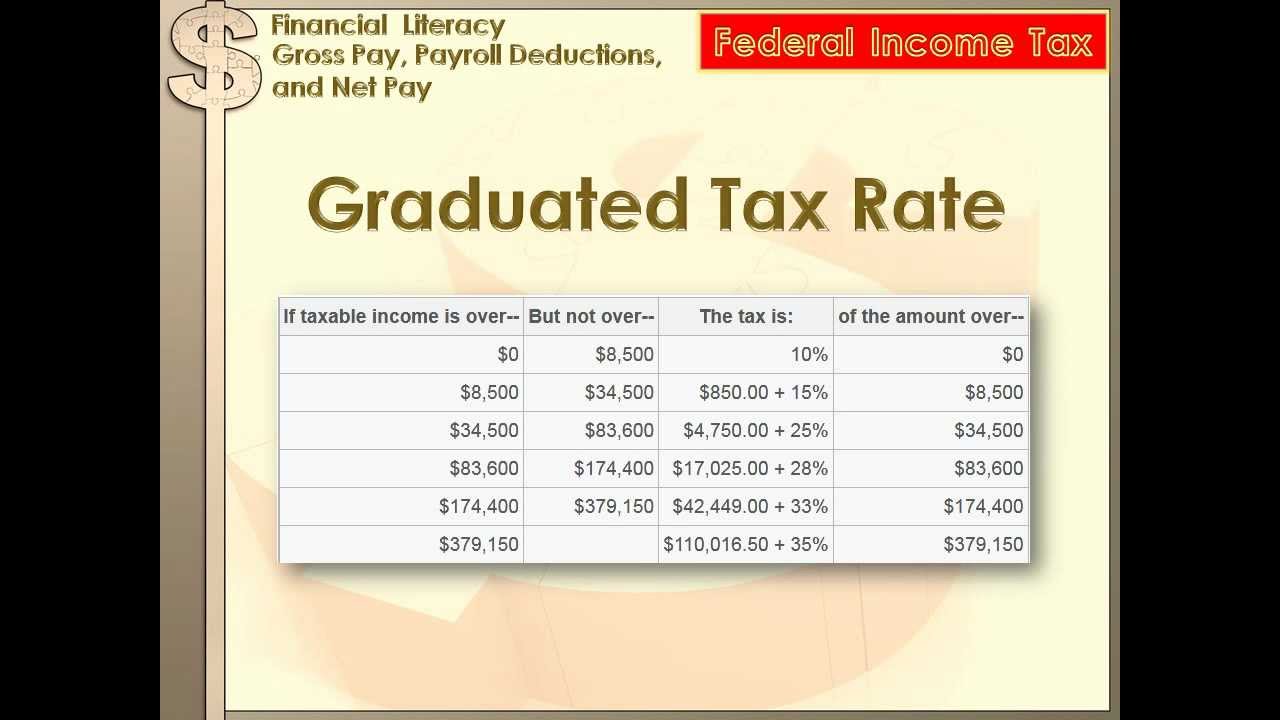

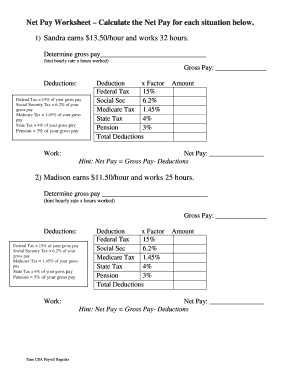

PDF Net Pay Worksheet - Calculate the Net Pay for each situation below. Teen USA Payroll Register Net Pay Worksheet - Calculate the Net Pay for each situation below. 1) Sandra earns $13.50/hour and works 32 hours. Determine gross pay_____ (hint hourly rate x hours worked) Gross Pay: _____ Deductions: Deduction x Factor Amount Federal Tax 15% Social Sec 6.2%

Gross Pay Vs Net Pay: Understanding and Calculating the Difference To sum it up, your gross pay is what you are owed by your employer, while your net pay is what you actually get when you pay all that you owe to the government and various other institutions. Calculating your net pay will be fairly simple once you know all your taxes, benefits, and other payroll deductions.

Net Pay Vs. Gross Pay Teaching Resources | Teachers Pay Teachers Net vs. Gross Pay Practice - Distance Learning by TheJoyFitTeacher 4.5 (4) $3.75 Google Slides™ This resource is meant to come after you have discussed net vs. gross pay, and social security and medicare (FICA). The first slide/worksheet is a practice pay stub, which helps students practice identifying before and after taxes amounts.

Net Gross Pay Worksheets - K12 Workbook Net Gross Pay Displaying all worksheets related to - Net Gross Pay. Worksheets are Net pay work calculate the net pay for each, Computing gross pay, Understanding your paycheck, Teacher lesson plan, Calculating payroll deductions, Worked, Work 34 gross pay with overtime, Net pay work calculate the net pay for each.

Gross vs. Net Income: What's the Difference? - The Balance The difference between gross and net income is important for many reasons, especially during tax season. Find out what you should know about both to understand your own. ... You can adjust your withholdings with your payroll manager using a W-4 form. Social Security and Medicare taxes, however, are fixed at 6.2% and 1.45%, respectively.

Gross Pay Worksheets - Lesson Worksheets Worksheets are Worked, Calculating gross and weekly wages work, Work 33 calculating gross pay with overtime name, Work 34 gross pay with overtime, Gross income chapter straight time pay, Chapter 1 lesson 1 computing wages, Calculation of income work instructions, Directions using the pay check stub above answer the.

Gross Pay vs. Net Pay: What's the Difference? | ADP To calculate gross pay for hourly workers, multiply the hourly rate by the hours worked during a pay period. For example, a part-time employee who works 35 hours at $12 per hour will have a gross pay of $420. Overtime rates must also be accounted for, if applicable. Choosing the right payroll provider for your business Download Now

Gross And Net Pay Worksheets - K12 Workbook Worksheets are Calculating the numbers in your paycheck, Teen years and adulthood whats on a pay stub, Its your paycheck lesson 2 w is for wages w 4 and w 2, My paycheck, Work 34 gross pay with overtime, Bring home the gold, Everyday math skills workbooks series, Reading a pay stub extension activity for managing money.

Calculating Pay Worksheets - K12 Workbook Worksheets are Net pay work calculate the net pay for each, Hourly and overtime pay version 2 and answer keys, Calculating gross and weekly wages work, Calculating payroll deductions, Income calculation work, Pdpm calculation work for snfs, Wage calculation work 312, Chapter 1 lesson 1 computing wages.

Gross Pay vs. Net Pay: Explanation and Examples Gross annual income is simply the sum of weekly or monthly paychecks. For instance, if an employee receives a wage of $3,000 per month, then their gross annual income is just $3,000 multiplied by 12 - the number of calendar months in the year. If their weekly income is $1,000, then their annual pay is $52,000.

Quiz & Worksheet - Gross & Net Income | Study.com Gross income is the total income after subtracting COGS, but before subtracting the cost of running the business; net income is the profit left after subtracting the cost of running the...

Net And Gross Income Activities Worksheets - Learny Kids Some of the worksheets for this concept are Worked, Gross receipts work, Sga work used when gross earned income is over the, Four cornerstones of financial literacy, Personal financial workbook, Net pay work calculate the net pay for each, Its your paycheck lesson 2 w is for wages w 4 and w 2, 2015 instructions for form 8582.

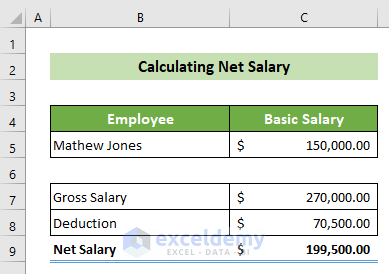

Career Readiness | Gross Pay vs. Net Pay What is Gross Pay? When you are hired your boss agrees to pay you an hourly rate or gross salary. ... The result of this calculation is your gross pay. What is Net Pay? ... Assignment: For this module, you will be creating a worksheet in Excel that organizes all of the information below: Employee 1: Karla Smitts has worked from 8:00-4:30 from ...

Gross Pay Vs. Net Pay: What's The Difference? - Forbes Advisor The key differences between gross pay vs. net pay are the items deducted: Gross pay includes 100% of the wages, reimbursements, commissions and bonuses an employee earns in a given pay period. Net ...

Lesson Plan: Calculating Gross and Net Pay - Scholastic So a person making $1,200 per week will have $50.40 (.042 x $1,200) deducted from his or her weekly gross pay. Step 4: Distribute the Plan, Save, Succeed! Worksheet: Where Did the Money Go? printable to students. Step 5: After students have completed the questions, use your copy of the Answer Key: Plan, Save, Succeed!

0 Response to "44 gross pay vs net pay worksheet"

Post a Comment