38 1040 qualified dividends worksheet

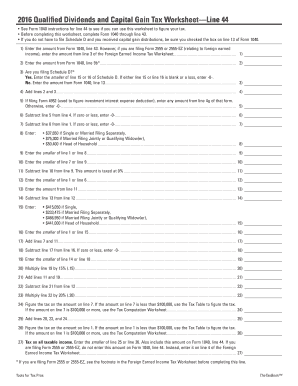

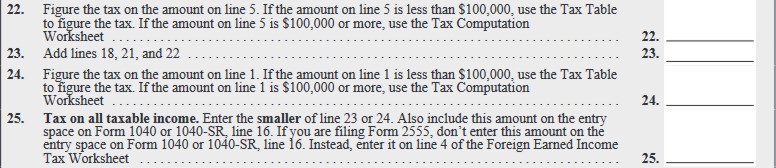

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a - IRS Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure ... Qualified Dividends and Capital Gains Worksheet - Page 33 of 108 ... Enter the amount from Form 1040 or 1040-SR, line 11b. However, if you are filing Form 2555 (relating to foreign earned income), enter the amount from line 3 of ...

Qualified Dividend and Capital Gains Tax Worksheet? - YouTube Feb 16, 2022 ... The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, ...

1040 qualified dividends worksheet

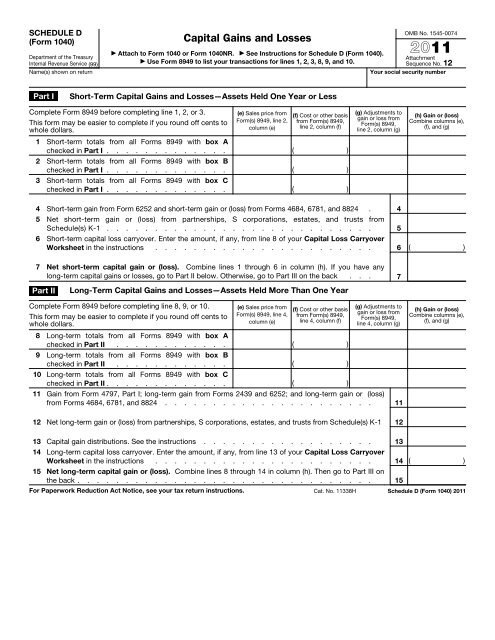

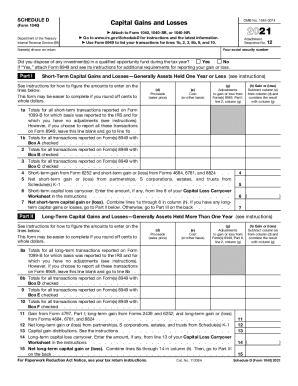

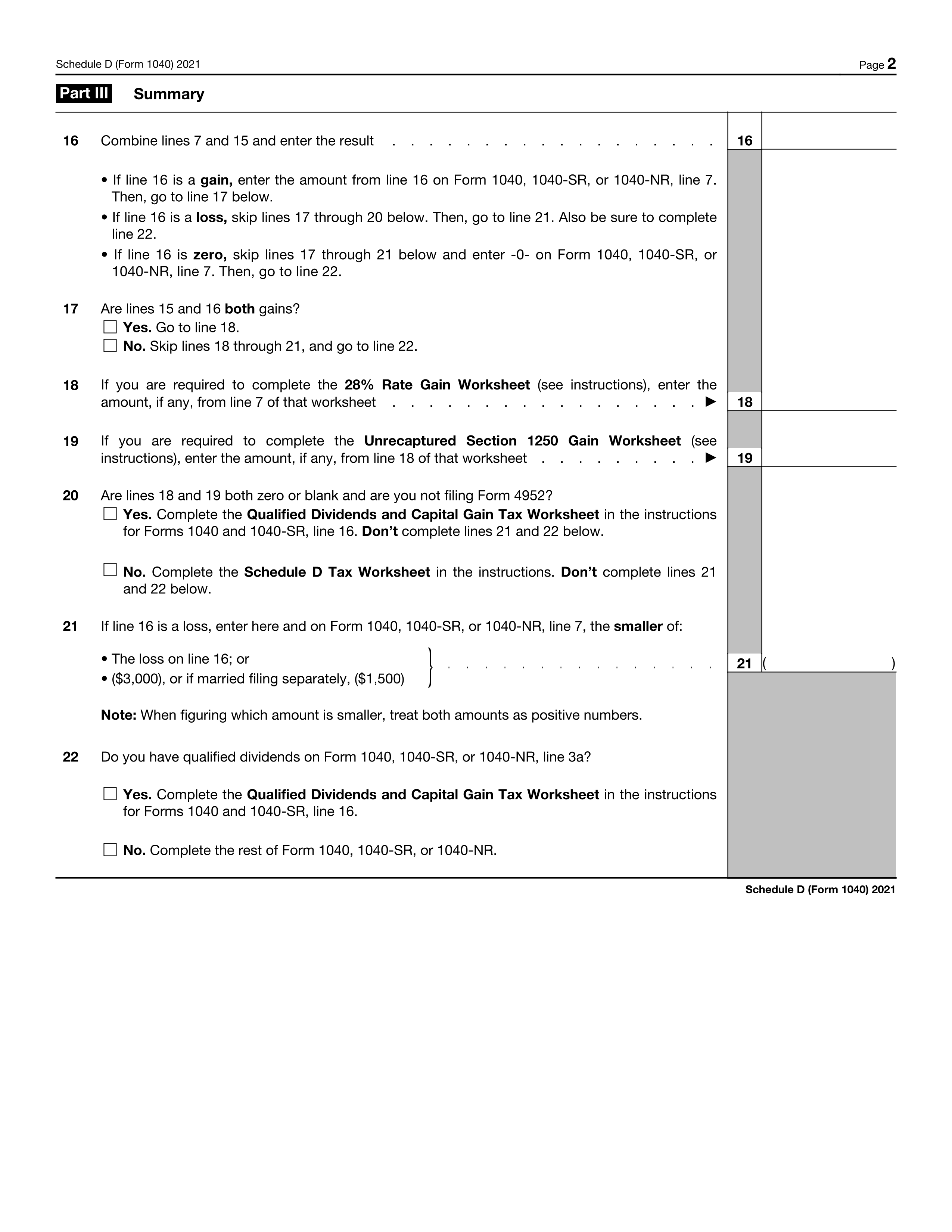

2022 Instructions for Schedule D - Capital Gains and Losses - IRS These instructions explain how to complete Schedule D (Form 1040). ... Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, ... How Your Tax Is Calculated: Qualified Dividends and Capital Gains ... Sep 24, 2021 ... On Form 1040, you add all of your taxable income and subtract all your ... Lines 1-5 of this worksheet calculate your total qualified income ... Fillable Qualified Dividends and Capital Gain Tax Worksheet This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure's 'Tax and Credits' section. It is used only if you have dividend income or long- ...

1040 qualified dividends worksheet. Qualified Dividends and Capital Gain Tax Worksheet - Drake ETC See the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. • Before completing this worksheet, complete Form 1040 or ... How Dividends Are Taxed and Reported on Tax Returns You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on ... Why doesn't the tax on my return (line 16) match the Tax Table? Instead, you will need to use the Capital Gains Worksheet to figure your tax. 1040 Instructions Line 16 , Qualified Dividends and Capital Gains Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. - CCH Support Why is form 1040 line 16 calculating tax using the Qualified Dividends & Capital Gain worksheet instead of the tax tables in ATX™.

Fillable Qualified Dividends and Capital Gain Tax Worksheet This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure's 'Tax and Credits' section. It is used only if you have dividend income or long- ... How Your Tax Is Calculated: Qualified Dividends and Capital Gains ... Sep 24, 2021 ... On Form 1040, you add all of your taxable income and subtract all your ... Lines 1-5 of this worksheet calculate your total qualified income ... 2022 Instructions for Schedule D - Capital Gains and Losses - IRS These instructions explain how to complete Schedule D (Form 1040). ... Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, ...

0 Response to "38 1040 qualified dividends worksheet"

Post a Comment