44 interest rate reduction refinance loan worksheet

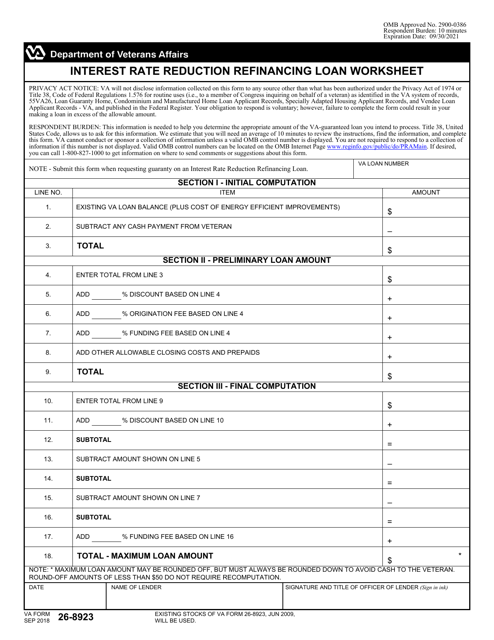

Loan analysis worksheet - templates.office.com Loan analysis worksheet. Use this accessible template to analyze various loan scenarios. Enter the interest rate, loan term, and amount, and see the monthly payment, total payments, and total interest calculated for you. Other interest rates and loan terms are provided for comparison to help you make the choice that's right for your situation. Interest Rate Reduction Refinancing Loan Worksheet - OMB 2900-0386 Interest Rate Reduction Refinancing Loan Worksheet VA Form 26-8923 (508 Conformant 3-16-21).pdf : Yes: No: Fillable Printable: Other-Online - Web LGY : 2900-0386 v2.docx Web LGY : Yes: Yes: Fillable Fileable: Other-Prior Approval : 2900-0386 Prior Approval v2.docx Web LGY : Yes: Yes: Fillable Fileable

About VA Form 26-8923 | Veterans Affairs Form name: Interest Rate Reduction Refinancing Loan Worksheet Related to: Housing assistance Form last updated: June 2022 Downloadable PDF Download VA Form 26-8923 (PDF) Helpful links Change your direct deposit information Find out how to update your direct deposit information online for disability compensation, pension, or education benefits.

Interest rate reduction refinance loan worksheet

VA Interest Rate Reduction Refinance Loans (IRRRL) IRRRL borrowers who are not exempt will need to pay the VA Funding Fee. The good news is that this fee is significantly lower for an IRRRL (0.5 percent) compared to the fee for first-time and subsequent purchase and Cash-Out refinance loans. For example, the funding fee on a typical $200,000 loan would be $1,000. Interest Rate Reduction Refinance Loan | Veterans Affairs If you have an existing VA-backed home loan and you want to reduce your monthly mortgage payments—or make your payments more stable—an interest rate reduction refinance loan (IRRRL) may be right for you. Refinancing lets you replace your current loan with a new one under different terms. Find out if you're eligible—and how to apply. PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Foundation Mortgage VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

Interest rate reduction refinance loan worksheet. Agency Information Collection Activity: Interest Rate Reduction ... Authority: 44 U.S.C. 3501-21. Title: Interest Rate Reduction Refinancing Loan Worksheet (VA Form 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision of a currently approved collection. Abstract: The major use of this form is to determine Veterans eligible for an exception to pay a funding fee in connection with a VA-guaranteed loan. Interest Rate Reduction Refinancing Loan Worksheet (VA Form 26-8923 ... Interest Rate Reduction Refinancing Loan Worksheet (VA Form 26-8923) OMB 2900-0386 OMB.report VA OMB 2900-0386 OMB 2900-0386 VA Form 22-8923 is used by lenders for completing the funding fee and maximum permissible loan amounts for interest rate reduction refinancing loans to veterans (38 U.S.C. 3729 (a), 3710 (a) (8), or 3712 (a) (1) (F)). Interest Rate Reduction Refinance Loan (IRRRL) | GovLoans Interest Rate Reduction Refinance Loan (IRRRL) can be used to refinance an existing VA loan to lower the interest rate. Program Contact 1-877-827-3702 Additional Info Regional Loan Centers Managing Agency Veterans Benefits Administration (VBA) Table of Contents Interest Rate Reduction Refinancing Loan Worksheet | DocMagic Updated to 12/2021 version. (Date of Release to Production: 04/14/22) Solutions Solutions Innovative, automated, and compliant technology solutions designed to advance every stage of your mortgage loan process

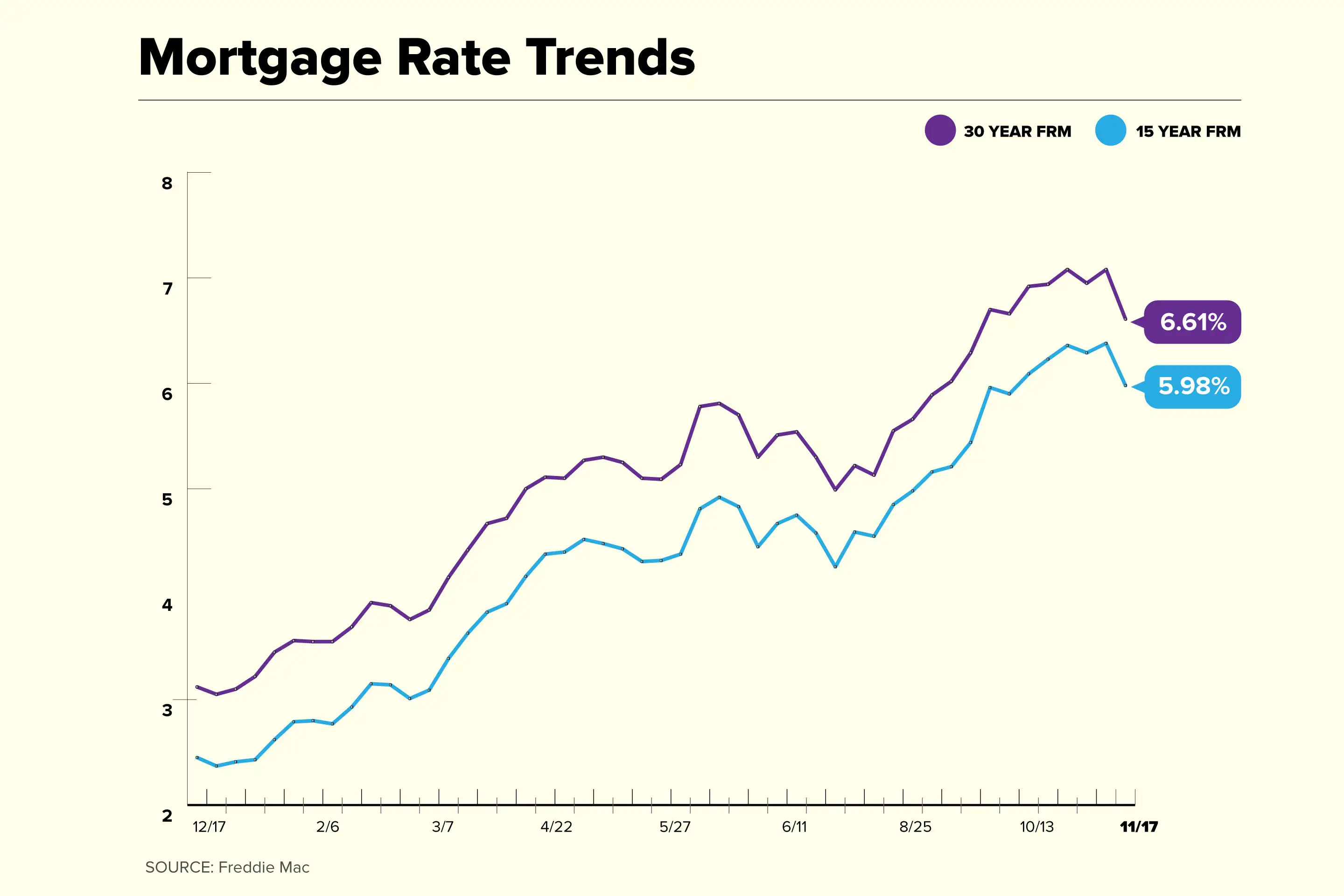

Interest Rate Reduction Refinance Loan (IRRRL): How to Lower Your ... An Interest Rate Reduction Refinance Loan, or IRRRL, is a type of refinancing that allows you to take advantage of a lower interest rate. An IRRRL can be used to refinance an existing VA loan or from a non-VA loan into a VA loan. The biggest benefit of an IRRRL is that it can help you lower your monthly payments. INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Fill All forms are printable and downloadable. INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET On average this form takes 6 minutes to complete The INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET form is 1 page long and contains: 0 signatures 0 check-boxes 25 other fields Country of origin: OTHERS File type: PDF BROWSE OTHERS FORMS Interest Rate Reduction Refinance Loan - VA Home Loans Some lenders offer IRRRLs as an opportunity to reduce the term of your loan from 30 years to 15 years. While this can save you money in interest over the life of the loan, you may see a very large increase in your monthly payment if the reduction in the interest rate is not at least one percent (two percent is better). VA IRRRL Worksheet - What is it and How Do I Use It? The IRRRL worksheet is a tool generally used by lenders and is not something the typical borrower or veteran would get much use out of completing. Many veterans want to know how long it will take them to break even or recoup their closing costs on a VA IRRRL, and this particular form, the VA IRRRL worksheet, will not tell you that.

va loan amount worksheet 23 Printable Worksheet Template Forms - Fillable Samples in PDF, Word. 17 Pictures about 23 Printable Worksheet Template Forms - Fillable Samples in PDF, Word : Va Maximum Loan Amount Worksheet 2018 | db-excel.com, Va Irrrl Worksheet : Best Va Interest Rate Reduction Refinance Loans and also Balancing Chemical Equations Practice Worksheet with Answers. Agency Information Collection Activity: Interest Rate Reduction ... Title: Interest Rate Reduction Refinancing Loan (IRRRL) Worksheet VAF 26-8923. OMB Control Number: 2900-0386. Type of Review: Extension of a currently approved collection. Abstract: The major use of this form is to determine Veterans eligible for an exception to pay a funding fee in connection with a VA-guaranteed loan. Interest Rate Reduction Refinance Loan - MortgageDepot An Interest Rate Reduction Loan through the Veterans Administration can save you thousands of dollars on your existing mortgage. The goal of the program is to refinance your existing mortgage into a new mortgage with a smaller interest rate. This reduces the monthly payment you are required to make and saves thousands on interest payments throughout the life of the loan. PDF Interest Rate Reduction Refinance Loan - Federal Deposit Insurance ... Rate Reduction Refinance Loan (IRRRL) generally lowers the interest rate by refinancing an existing VA. home loan. By obtaining a lower interest rate, the monthly mortgage payment should decrease. Eligible borrowers can also refinance an adjustable-rate mort-gage (ARM) into a fixed-rate mortgage. No additional charge is made against the veteran's entitlement because of a loan for the purpose of an interest rate reduction.

PDF Interest Rate Reduction Refinancing Loan Worksheet VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Veterans Affairs VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

PDF Interest Rate Reduction Refinance Loan Worksheet - Veterans Affairs regarding the completion of VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, effective for all Interest Rate Reduction Refinance L oan (IRRRL) applications originated (initial Fannie Mae Form 1003 application date) on or after July 2, 2017. 2. Background. VA has received many inquiries from mortgage lenders on the proper completion of the IRRRL Worksheet since the implementation of the Truth in Lending Act -

Interest Rate Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET ReloadOpenDownload 2. Calculate the Simple Interest for the Word Problems ReloadOpenDownload 3. Simple Interest Problems ReloadOpenDownload 4. Use simple interest to find the ending balance. ReloadOpenDownload 5. Compound Interest

Interest Rate Reduction Refinancing Loan Worksheet | DocMagic Interest Rate Reduction Refinancing Loan Worksheet Document Title Interest Rate Reduction Refinancing Loan Worksheet Form Name 268923.VA Agency/Statute va.gov Form Updates Updated to most recent website version. (Date of Release to Production: 09/02/21) Log in or register to post comments Wizard September 2021 SOLUTIONS THAT WORK.

PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Veterans Affairs VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

Rate Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. Write the rate and unit rate for each phrase given below ... ReloadOpenDownload 2. Write the rate and unit rate for each phrase given below ... ReloadOpenDownload 3. Related Rates Worksheet ReloadOpenDownload 4. P-7 Unit Rates ReloadOpenDownload 5. Related Rates Date Period ReloadOpenDownload

Interest Rate Reduction Refinance Loan (IRRRL) - DocsLib No Job, No Money, No Refi: Frictions to Refinancing in a Recession∗; Refinancing; Chapter 3. the VA Loan and Guaranty Overview; Understanding Strategic Defaults; ANALYSIS No 17 Mortgage Refinancing Supports Private; The Smart Consumer's Guide to Reducing Closing Costs; Interest Rate Reduction Refinance Loan (IRRRL)

VA Provides Instructions for Completion of VA Form 26-8923, Interest ... In their Circular 26-17-12 dated April 12, 2017, the Department of Veterans Affairs (VA) clarified the requirements regarding completing VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet (worksheet). According to Circular 26-17-12, there have been numerous questions regarding the correct way to complete the worksheet since the implementation of the Truth in Lending Act-Real ...

Simple loan calculator and amortization table Just enter the loan amount, interest rate, loan duration, and start date into the Excel loan calculator. It will calculate each monthly principal and interest cost through the final payment. Great for both short-term and long-term loans, the loan repayment calculator in Excel can be a good reference when considering payoff or refinancing.

Interest Rate Reduction Refinancing Loan Tips | Military.com An Interest Rate Reduction Refinancing Loan (IRRRL) can be done only when the veteran already has his or her entitlement used for a VA loan on the property to be refinanced. In other words,...

PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Foundation Mortgage VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

Interest Rate Reduction Refinance Loan | Veterans Affairs If you have an existing VA-backed home loan and you want to reduce your monthly mortgage payments—or make your payments more stable—an interest rate reduction refinance loan (IRRRL) may be right for you. Refinancing lets you replace your current loan with a new one under different terms. Find out if you're eligible—and how to apply.

VA Interest Rate Reduction Refinance Loans (IRRRL) IRRRL borrowers who are not exempt will need to pay the VA Funding Fee. The good news is that this fee is significantly lower for an IRRRL (0.5 percent) compared to the fee for first-time and subsequent purchase and Cash-Out refinance loans. For example, the funding fee on a typical $200,000 loan would be $1,000.

:max_bytes(150000):strip_icc()/dotdash-cash-out-vs-mortgage-refinancing-loans-final-53422e64e4034a31983633db51b0501f.jpg)

0 Response to "44 interest rate reduction refinance loan worksheet"

Post a Comment